IHOP 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

7. Impairments and Closure Charges (Continued)

Impairment and closure charges in 2007 included the impairment of long lived assets for three

restaurants closed in 2007, and impairment losses on two restaurants in which the reacquisition values

exceeded the historical resale values. The decision to close or impair the restaurants in 2007 was a

result of a comprehensive analysis that examined restaurants not meeting minimum return on

investment thresholds and certain other operating performance criteria. The assets for these restaurants

were written down to their estimated fair value.

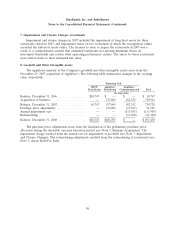

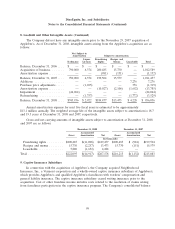

8. Goodwill and Other Intangible Assets

The significant majority of the Company’s goodwill and other intangible assets arose from the

November 29, 2007 acquisition of Applebee’s. The following table summarizes changes in the carrying

value of goodwill:

Reporting Unit

IHOP Applebee’s Applebee’s

Franchising Franchising Company-operated Total

(In thousands)

Balance, December 31, 2006 ................ $10,767 $ — $ — $ 10,767

Acquisition of business .................... — 537,609 182,352 719,961

Balance, December 31, 2007 ................ 10,767 537,609 182,352 730,728

Purchase price adjustments ................ — 149,094 (57,547) 91,547

Annual impairment test ................... — — (113,505) (113,505)

Refranchising .......................... — — (11,300) (11,300)

Balance, December 31, 2008 ................ $10,767 $686,703 $ — $ 697,470

The purchase price adjustments arose from the finalization of the preliminary purchase price

allocation during the allowable one-year allocation period (see Note 3, Business Acquisition). The

impairment charge resulted from the annual test for impairment of goodwill (see Note 7, Impairment

and Closure Charges). The refranchising adjustments resulted from the refranchising of restaurants (see

Note 5, Assets Held For Sale).

98