IHOP 2008 Annual Report Download - page 65

Download and view the complete annual report

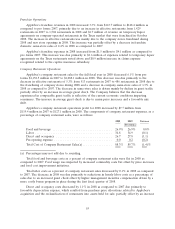

Please find page 65 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company restaurant operations loss, which is income less expenses, for IHOP company restaurants

was $2.5 million in 2007, or 23.5% higher than the loss of $2.0 million in 2006. This is primarily due to

lower sales per restaurant as well as higher salary and benefits costs.

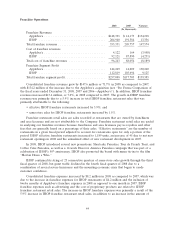

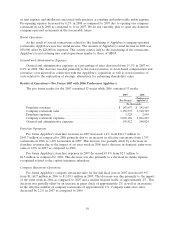

Rental Operations

Rental operations profit, which is rental income less rental expenses and exclusively IHOP,

decreased by $0.2 million or 0.5% in 2007, as compared to 2006. Rental operations profit in 2007

compared to 2006 was impacted by the write-off of deferred rent resulting from terminated subleases

on restaurants reacquired in 2006. Deferred rent on operating subleases is the difference between

straight-line rent and the actual amount received. Straight-line rent is the amount of rent over the full

lease term spread over equal monthly amounts.

Financing Operations

Financing operations profit, which is financing revenues less financing expenses, is exclusively

attributable to the IHOP business unit. In 2007 financing operations profit decreased by $1.0 million or

5.1% compared to 2006. This decrease was primarily attributable to the decrease in franchise and

equipment note interest due to the expected reduction in franchise fee note balances. These decreases

were partially offset by an increase in net profit margin on the sale of franchises and equipment

associated with company-developed and rehabilitated and refranchised restaurants. In 2007, the

Company had a net profit margin of $0.1 million associated with four refranchised restaurants,

compared to a negative margin of $0.5 million associated with nine refranchised restaurants in 2006.

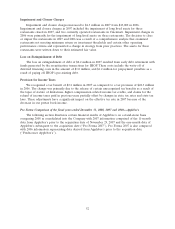

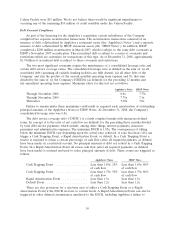

Loss on Derivative Financial Instrument

As further described under ‘‘Liquidity and Capital Resources,’’ we entered into a swap

arrangement in July 2007. Settlement of the swap resulted in additional interest expense related to the

designated portion of $62.1 million for 2007 and $1.2 million of interest expense related to the

amortization of other comprehensive loss related to the designated portion of the swap over the

expected life of the related debt, which is included in the accompanying Consolidated Statements of

Operations.

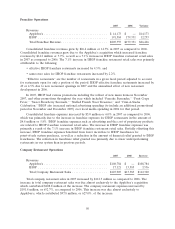

General and Administrative Expenses

General and administrative expenses increased by $18.1 million or 28.4% in 2007 compared to the

prior year, primarily due to one month of Applebee’s expenses in the amount of $12.3 million. General

and administrative expenses for IHOP as a percentage of total IHOP operating revenues increased

19.2% in 2007 compared to 18.2% in 2006, primarily due to increased professional services, and

increased expenses for equity based compensation. Professional services increased by $3.9 million in

2007 compared to 2006, primarily due to consulting fees related to the integration of Applebee’s.

Excluding the acquisition-related expenditures of $3.0 million, growth would have been 4.4%. Equity

based compensation expenses related to the issuance of additional restricted stock increased by

$1.6 million in 2007 compared to 2006. In addition, other compensation increased by $0.5 million

compared to 2006.

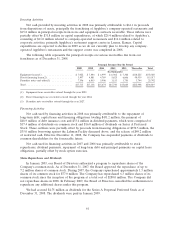

Interest Expense

Interest expense increased by $20.8 million in 2007 compared to 2006, primarily due to one month

of Applebee’s expenses in the amount of $14.6 million which is attributable to interest associated with

the securitization for the acquisition. Interest expense for IHOP increased by $6.1 million or 77.4% in

2007 compared to 2006 as a result of the higher level of debt associated with the securitizations.

51