IHOP 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

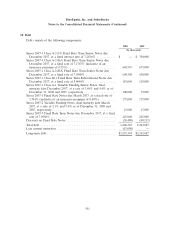

10. Debt (Continued)

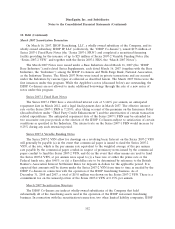

Co-Issuers, including the Series 2007-3 FRN, the March 2007 Notes or any other obligations of the

IHOP Co-Issuers incurred in connection with the issuance of the Series 2007-3 FRN or the March 2007

Notes. The Company does, however, guarantee the performance of International House of

Pancakes, LLC, as servicer for the IHOP securitization program.

All of the Series 2007-3 FRN issued in the IHOP securitization were issued under the IHOP Base

Indenture, as amended and supplemented from time to time, including by the related supplement to

the IHOP Base Indenture dated as of November 29, 2007.

Securitization Structure

The securitization structure for Series 2007-3 FRN is substantially similar to the structure for the

Series 2007-1 FRN and Series 2007-2 VFN.

Third Party Credit Enhancement

The Series 2007-3 FRN does not have any third party credit enhancement.

Covenants/Restrictions

The covenants under the Indenture and applicable to all notes were modified with the consent of

the holders of the Series 2007-1 FRN.

Weighted Average Effective Interest Rate

The weighted average effective interest rate on all of the notes issued in the November 2007

securitization transactions, exclusive of the amortization of fees and expenses associated with the

securitization transactions, is 7.1799%. Taking into account fees and expenses (excluding the interest

rate swap transaction discussed below) associated with the securitization transactions that will be

amortized as additional non-cash interest expense over a five-year period, which is the expected life of

the notes, the weighted average effective interest rate for the notes issued in November 2007

securitization transactions is 8.4571%.

Use of Proceeds

The net proceeds from the sale of the Applebee’s notes and the borrowing under the Series 2007-1

Class A-1 Variable Funding Senior Note on November 29, 2007 were $1,847.4 million, net of expenses.

The proceeds were used to deposit $66 million in various securitization accounts and to distribute

$1,794.4 million to pay the outstanding debt and other third-party obligations of Applebee’s and a

portion of the purchase price for the Applebee’s acquisition.

The IHOP Co-Issuer applied a portion of the net proceeds from the sale of the IHOP notes to

deposit $4.3 million into the Series 2007-3 interest reserve account. The remaining $238.2 million was

used to pay a portion of the purchase price related to the Applebee’s acquisition.

107