IHOP 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

12. Leases (Continued)

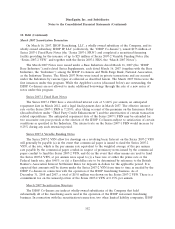

The minimum future lease payments shown above have not been reduced by the following future

minimum rents to be received on noncancelable subleases and leases of owned property at

December 31, 2008:

Direct

Financing Operating

Leases Leases

(In thousands)

2009 ......................................... $ 18,392 $ 94,232

2010 ......................................... 18,479 95,414

2011 ......................................... 18,539 95,738

2012 ......................................... 18,656 96,223

2013 ......................................... 18,815 97,041

Thereafter ..................................... 148,743 1,165,923

Total minimum rents receivable ...................... $241,624 $1,644,571

The Company has noncancelable leases, expiring at various dates through 2032, which require

payment of contingent rents based upon a percentage of sales of the related restaurant as well as

property taxes, insurance and other charges. Subleases to franchisees of properties under such leases

are generally for the full term of the lease obligation at rents that include the Company’s obligations

for property taxes, insurance, contingent rents and other charges. Generally, the noncancelable leases

include renewal options. Contingent rent expense for all noncancelable leases for the years ended

December 31, 2008, 2007 and 2006 was $4.5 million, $3.4 million and $3.3 million, respectively.

Minimum rent expense for all noncancelable operating leases for the years ended December 31, 2008,

2007 and 2006 was $91.2 million, $67.6 million and $63.8 million, respectively.

13. Fair Value Measurements

The Company adopted FAS No. 157 on January 1, 2008. FAS No. 157 defines fair value as the

price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date (an exit price). The Company has one financial

instrument we must measure under FAS No. 157, investments held by Applebee’s captive insurance

subsidiary. None of the current non-financial assets or non-financial liabilities must be measured at fair

value on a recurring basis. The fair value of the investments held by the captive insurance company at

December 31, 2008 was $5.6 million and was determined based on Level 3 inputs using a risk-adjusted

discounted cash flow model under the income approach.

14. Fair Value of Financial Instruments

We believe the fair values of cash equivalents, accounts receivable, accounts payable and the

current portion of long-term debt approximate their carrying amounts due to their short duration.

112