IHOP 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Calyon Facility were $15 million. We do not believe there would be significant impediments to

accessing any of the remaining $10 million of credit available under the Calyon Facility.

Debt Covenant Compliance

As part of the financing for the Applebee’s acquisition, certain subsidiaries of the Company

completed two separate securitization transactions. The securitization transactions consisted of an

issuance of debt collateralized by Applebee’s restaurant assets (the ‘‘Applebee’s Notes’’) and a separate

issuance of debt collateralized by IHOP restaurant assets (the ‘‘IHOP Notes’’). In addition, IHOP

completed a $200 million securitization in March 2007, which is subject to the same debt covenants as

IHOP’s November 2007 securitization. This securitized debt is subject to a series of covenants and

restrictions which are customary for transactions of this type. As of December 31, 2008, approximately

$1.9 billion of securitized debt is subject to these covenants and restrictions.

The two most significant covenants require the maintenance of a consolidated leverage ratio and

certain debt service coverage ratios. The consolidated leverage ratio is defined as the sum of: (i) all

securitized debt (assuming all variable funding facilities are fully drawn); (ii) all other debt of the

Company; and (iii) the product of the current monthly operating lease expense and 96, that sum

divided by the sum of: (i) the Company’s EBITDA (as defined) for the preceding 12 months and

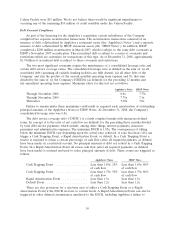

(ii) annualized operating lease expense. Maximum ratios for this test are as follows:

Applebee’s Notes IHOP Notes

Through November 2008 .............................. 8.0x 7.75x

Through November 2009 .............................. 7.75x 7.5x

Thereafter ........................................ 7.25x 7.0x

Failure to remain under these maximums could result in required early amortization of outstanding

principal amounts of the Applebee’s Notes or IHOP Notes. At December 31, 2008, the Company’s

consolidated leverage ratio was 6.8x.

The debt service coverage ratio (‘‘DSCR’’) is a fairly complex formula with numerous defined

terms. In concept, it is the ratio of net cash flow (as defined) for the preceding three months divided

by total debt service payments, which include, among other things, interest payments, insurance

premiums and administrative expenses. The minimum DSCR is 1.85x. The consequences of falling

below the minimum DSCR vary depending upon the actual ratio achieved. A ratio less than 1.85x can

trigger a Cash Trapping Event, a Rapid Amortization Event, or default. In a Cash Trapping Event a

trustee is required to retain a certain percentage of cash flow (after all required payments, as defined,

have been made) in a restricted account. No principal amounts of debt are retired in a Cash Trapping

Event. In a Rapid Amortization Event all excess cash flow (after all required payments, as defined,

have been made) is retained and used to retire principal amounts of debt. These events are triggered as

follows:

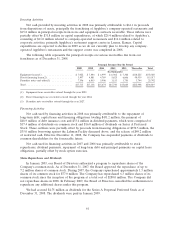

Applebee’s Notes IHOP Notes

Cash Trapping Event ................... Less than 1.85x: 25% Less than 1.85x: 40%

of cash flow of cash flow

Cash Trapping Event ................... Less than 1.75x: 50% Less than 1.75x: 80%

of cash flow of cash flow

Rapid Amortization Event ............... Less than 1.5x Less than 1.5x

Default Event ........................ Less than 1.2x Less than 1.2x

There are also provisions for a one-time cure of either a Cash Trapping Event or a Rapid

Amortization Event if the DSCR recovers to certain levels. A Rapid Amortization Event can also be

triggered in other defined circumstances unrelated to the DSCR, including Applebee’s failure to

59