HTC 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

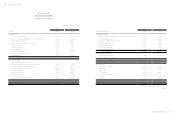

Financial information

Financial information

192

193

application of the above amendments will not have any impact on the net profit for the period, other comprehensive income for the

period (net of income tax), and total comprehensive income for the period.

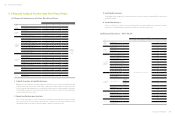

b. New IFRSs in issue but not yet endorsed by FSC

The Company has not applied the following New IFRSs issued by the IASB but not yet endorsed by the FSC. As of the date the

financial statements were authorized for issue, the FSC has not announced their effective dates.

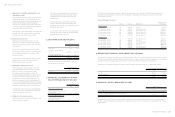

New IFRSs Effective Date Announced by IASB (Note 1)

Annual Improvements to IFRSs 2010-2012 Cycle July 1, 2014 (Note 2)

Annual Improvements to IFRSs 2011-2013 Cycle July 1, 2014

Annual Improvements to IFRSs 2012-2014 Cycle January 1, 2016 (Note 3)

IFRS 9 “Financial Instruments”January 1, 2018

Amendments to IFRS 9 and IFRS 7 “Mandatory Effective Date of IFRS 9 and Transition

Disclosures”

January 1, 2018

Amendments to IFRS 10 and IAS 28 “Sale or Contribution of Assets between an Investor and

its Associate or Joint Venture”

To be determined by IASB

Amendments to IFRS 10, IFRS 12 and IAS 28 “Investment Entities: Applying the Consolidation

Exception”

January 1, 2016

Amendment to IFRS 11 “Accounting for Acquisitions of Interests in Joint Operations”January 1, 2016

IFRS 14 “Regulatory Deferral Accounts”January 1, 2016

IFRS 15 “Revenue from Contracts with Customers”January 1, 2018

IFRS 16 “Leases”January 1, 2019

Amendment to IAS 1 “Disclosure Initiative”January 1, 2016

Amendment to IAS 7 “Disclosure Initiative”January 1, 2017

Amendments to IAS 12 “Recognition of Deferred Tax Assets for Unrealized Losses”January 1, 2017

Amendments to IAS 16 and IAS 38 “Clarification of Acceptable Methods of Depreciation and

Amortization”

January 1, 2016

Amendments to IAS 16 and IAS 41 “Agriculture: Bearer Plants”January 1, 2016

Amendment to IAS 19 “Defined Benefit Plans: Employee Contributions”July 1, 2014

Amendment to IAS 36 “Impairment of Assets: Recoverable Amount Disclosures for Non-

financial Assets”

January 1, 2014

Amendment to IAS 39 “Novation of Derivatives and Continuation of Hedge Accounting”January 1, 2014

IFRIC 21 “Levies”January 1, 2014

Note 1: Unless stated otherwise, the above New IFRSs are effective for annual periods beginning on or after their respective effective dates.

Note 2: The amendment to IFRS 2 applies to share-based payment transactions with grant date on or after July 1, 2014; the amendment to IFRS 3 applies to business

combinations with acquisition date on or after July 1, 2014; the amendment to IFRS 13 is effective immediately; the remaining amendments are effective for annual

periods beginning on or after July 1, 2014.

Note 3: The amendment to IFRS 5 is applied prospectively to changes in a method of disposal that occur in annual periods beginning on or after January 1, 2016; the remaining

amendments are effective for annual periods beginning on or after January 1, 2016.

The initial application of the above New IFRSs, whenever applied, would not have any material impact on the Company's accounting

policies, except for the following:

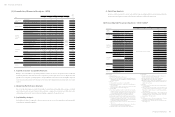

1. IFRS 9 “Financial Instruments”

Recognition and measurement of financial assets

With regards to financial assets, all recognized financial assets that are within the scope of IAS 39 “Financial Instruments:

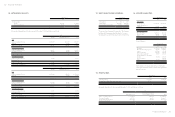

HTC CORPORATION

NOTES TO PARENT COMPANY ONLY FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014

(In Thousands of New Taiwan Dollars, Unless Stated Otherwise)

1. ORGANIZATION AND OPERATIONS

HTC Corporation (the “Company”) was incorporated on May 15, 1997 under the Company Law of the Republic of China to design,

manufacture, assemble, process, and sell smart mobile devices and provide after-sales service.

In March 2002, the Company had its stock listed on the Taiwan Stock Exchange. On November 19, 2003, the Company listed some of its

shares of stock on the Luxembourg Stock Exchange in the form of global depositary receipts.

The parent company only financial statements are presented in the Company's functional currency, New Taiwan dollars.

2. APPROVAL OF FINANCIAL STATEMENTS

The parent company only financial statements were approved by the board of directors and authorized for issue on February 29, 2016.

3. APPLICATION OF NEW, AMENDED AND REVISED STANDARDS AND

INTERPRETATIONS

a. Initial application of the amendments to the Regulations Governing the Preparation of Financial Reports

by Securities Issuers and the 2013 version of the International Financial Reporting Standards (IFRS),

International Accounting Standards (IAS), Interpretations of IFRS (IFRIC), and Interpretations of IAS (SIC)

endorsed by the Financial Supervisory Commission (FSC)

Rule No. 1030029342 and Rule No. 1030010325 issued by the FSC on April 3, 2014, stipulated that the Company should apply

the 2013 version of IFRS, IAS, IFRIC and SIC (collectively, the “IFRSs”) endorsed by the FSC and the related amendments to the

Regulations Governing the Preparation of Financial Reports by Securities Issuers starting January 1, 2015.

Except for the following, whenever applied, the initial application of the amendments to the Regulations Governing the Preparation

of Financial Reports by Securities Issuers and the 2013 IFRSs version would not have any material impact on the Company's

accounting policies:

Amendments to IAS 1 “Presentation of Items of Other Comprehensive Income”

The amendments to IAS 1 requires items of other comprehensive income to be grouped into those items that (1) will not be

reclassified subsequently to profit or loss; and (2) may be reclassified subsequently to profit or loss. Income taxes on related items of

other comprehensive income are grouped on the same basis. Under current IAS 1, there were no such requirements.

The Company retrospectively applied the above amendments starting in 2015. Items not expected to be reclassified to profit or loss

are remeasurements of the defined benefit plans. Items expected to be reclassified to profit or loss are the exchange differences

on translating foreign operations, unrealized gain (loss) on available-for-sale financial assets, and cash flow hedges. However, the