HTC 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

224

225

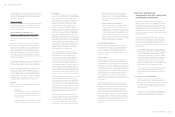

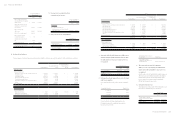

For the Year Ended December 31

2015

(Expected)

2014

(Actual)

Creditable ratio for

distribution of earning

34.37%

21.92%

Under the Income Tax Law, for distribution of earnings

generated after January 1, 1998, the imputation credits

allocated to ROC resident shareholders of the Company

was calculated based on the creditable ratio as of the

date of dividend distribution. The actual imputation

credits allocated to shareholders of the Company was

based on the balance of the ICA as of the date of dividend

distribution. Therefore, the expected creditable ratio

for the earnings may differ from the actual creditable

ratio to be used in allocating imputation credits to the

shareholders.

i. Income tax assessments

The Company's income tax returns through 2013 had

been assessed by the tax authorities. The Company

disagreed with the tax authorities' assessment of its

2013 tax return and applied for a re-examination.

Nevertheless, under the conservatism guideline, the

Company adjusted its income tax for the tax shortfall

stated in the tax assessment notices.

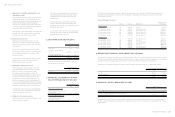

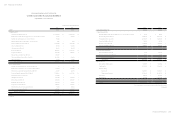

25. (LOSS) EARNINGS PER SHARE

Unit: NT$ Per Share

For the Year Ended

December 31

2015 2014

Basic (loss) earnings per share $(18.79) $1.80

Diluted (loss) earnings per

share $(18.79) $1.80

The (loss) earnings and weighted average number of

ordinary shares outstanding for the computation of (loss)

earnings per share were as follows:

Net (Loss) Profit for the Years

For the Year Ended December 31

2015 2014

(Loss) profit for the year $(15,533,068) $1,483,046

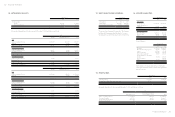

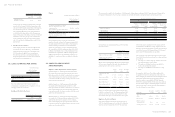

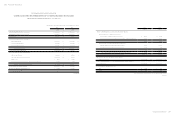

The exercise price equals to the closing price of the Company's ordinary shares on the grant date. For any subsequent changes in the

Company's ordinary shares, the exercise price is adjusted accordingly. Information on employee share options was as follows:

For the Year Ended December 31

2015 2014

Number of

Options

(In Thousands)

Weighted-average

Exercise Price

(NT$)

Number of

Options

(In Thousands)

Weighted-average

Exercise Price

(NT$)

Balance at January 1

Options granted

Options forfeited

31,908

1,000

( 7,944)

$140.37

54.50

15,000

19,000

( 2,092)

$149.00

134.50

Balance at December 31 24,964 137.20 31,908 140.37

Options exercisable, end of the year 5,905 -

Weighted-average fair value of options granted per unit (NT$) $ 15.00 $ 31.231

Shares

Unit: In Thousands of Shares

For the Year Ended

December 31

2015 2014

Weighted average number of ordinary

shares in computation of basic (loss)

earnings per share

Effect of dilutive potential ordinary shares:

Bonus issue to employees

826,784

-

824,194

622

Weighted average number of ordinary

shares in computation of diluted (loss)

earnings per share 826,784 824,816

If the Company was able to settle the bonuses paid to

employees by cash or shares, the Company presumed that

the entire amount of the bonus would be settled in shares

and the resulting potential shares were included in the

weighted average number of shares outstanding used in

the computation of diluted earnings per share, if the effect

is dilutive. Such dilutive effect of the potential shares was

included in the computation of diluted earnings per share

until the shareholders resolve the number of shares to be

distributed to employees at their meeting in the following

year.

26. SHARE-BASED PAYMENT

ARRANGEMENTS

Employee Share Option Plan of the Company

Qualified employees of the Company and its subsidiaries

were granted 15,000 thousand options in November 2013.

Each option entitles the holder to subscribe for one common

share of the Company. The options granted are valid for 7

years and exercisable at certain percentages after the second

anniversary from the grant date.

Qualified employees of the Company and its subsidiaries

were granted 19,000 thousand options in October 2014.

Each option entitles the holder to subscribe for one common

share of the Company. The options granted are valid for 10

years and exercisable at certain percentages after the second

anniversary from the grant date.

Qualified employees of the Company and its subsidiaries

were granted 1,000 thousand options in August 2015. Each

option entitles the holder to subscribe for one ordinary

share of the Company. The options granted are valid for 10

years and exercisable at certain percentages after the second

anniversary from the grant date.

Information about outstanding options as of the reporting

date was as follows:

December 31

2015 2014

Range of exercise price (NT$) $54.5-$149 $134.5-$149

Weighted-average remaining

contractual life (years)

7.30 years 8.22 years

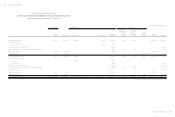

Options granted in August 2015, October 2014 and November

2013 were priced using the trinomial option pricing model

and the inputs to the model were as follows:

August

2015

October

2014

November

2013

Grant-date share price

(NT$) $ 54.50 $ 134.50 $ 149.00

Exercise price (NT$) $ 54.50 $ 134.50 $ 149.00

Expected volatility 39.26% 33.46% 45.83%

Expected life (years) 10 years 10 years 7 years

Expected dividend yield 4.04% 4.40% 5.00%

Risk-free interest rate 1.3965% 1.7021% 1.63%

Expected volatility was based on the historical share price

volatility over the past 1 year. The Company assumed that

employees would exercise their options after the vesting

date when the share price was 1.63 times the exercise price.

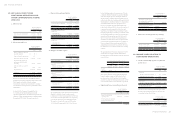

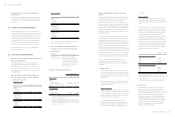

Employee Restricted Shares

In the shareholder meeting on June 19, 2014 and June 2,

2015, the shareholders approved a restricted stock plan for

employees with a total amount of $50,000 thousand and

$75,000 thousand, consisting of 5,000 thousand and 7,500

thousand shares. On October 31, 2014, August 6, 2015, and

September 16, 2015, the Company's board of directors passed

a resolution to issue 4,600 thousand shares, 400 thousand

shares, and 4,006 thousand shares respectively.

The restrictions on the rights of the employees who acquire

the restricted shares but have not met the vesting conditions

are as follows:

a. The employees cannot sell, pledge, transfer, donate or in

any other way dispose of these shares.

b. The employees holding these shares are entitled to

receive cash and dividends in share.

c. The employees holding these shares have no voting

rights.

If an employee fails to meet the vesting conditions, the

Company will recall or buy back and cancel the restricted

shares. In April, July and October 2015, the Company retired

49 thousand, 117 thousand and 409 thousand restricted

shares for employees amounting to NT$492 thousand,

NT$1,167 thousand and NT$4,087 thousand. As a result, the

amount of the Company's outstanding employee restricted

shares as of December 31, 2015 was 7,243 thousand shares,

the other information was as follows:

Grant-date

December

23, 2015

August 10,

2015

November

2, 2014

Grant-date fair value

(NT$) $76.20 $57.50 $134.50

Exercise price Gratuitous Gratuitous Gratuitous

Numbers of shares

(thousand shares) 4,006 400 4,600

Vesting period (years) 1-3 years 1-3 years 1-3 years