HTC 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

284

285

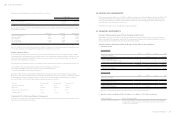

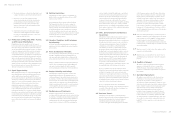

2) Liquidity and interest risk rate tables for derivative

financial instruments

The following table detailed the Company's liquidity

analysis for its derivative financial instruments. The

table was based on the undiscounted contractual net

cash inflows and outflows on derivative instruments

that settle on a net basis, and the undiscounted

gross inflows and outflows on those derivatives that

require gross settlement.

December 31, 2015

Less Than

3 Months

3 Months

to 1 Year

Over

1 Year

Gross settled

Foreign exchange

contracts

Inflows

Outflows

$ 6,658,903

( 6,611,069)

$ 7,187,186

(7,158,069)

$ -

-

$ 47,834 $ 29,117 $ -

December 31, 2014

Less Than

3 Months

3 Months

to 1 Year

Over

1 Year

Net settled

Foreign exchange

contracts $ 15,600 $ - $ -

Gross settled

Foreign exchange

contracts

Inflows

Outflows

$ 13,853,499

( 13,630,802)

$ -

-

$ -

-

$ 222,697 $ - $ -

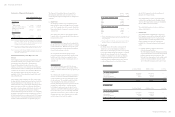

3) Bank credit limit

December 31

2015 2014

Unsecured bank general

credit limit

Amount used

Amount unused

$ 2,053,485

30,314,067

$ 1,638,476

43,623,999

$32,367,552 $ 45,262,475

Amount used includes guarantee for customs duties

and for patent litigation.

32. RELATED-PARTY TRANSACTIONS

Balance, transactions, revenue and expenses between HTC

and its subsidiaries, which are related parties of HTC, have

been eliminated on consolidation and are not disclosed in

this note. Besides as disclosed elsewhere in other notes,

details of transactions between the Company and other

related parties are disclosed below.

Operating Sales

For the Year Ended

December 31

2015 2014

Main management $ - $ 2,430

Joint venture 9,971 -

Other related parties - Employees'

Welfare Committee 20,920 22,404

Other related parties - other related

parties' chairperson or its significant

stockholder, is HTC's chairperson 6,302 10,463

$ 37,193 $ 35,297

The following balances of trade receivables from related

parties were outstanding at the end of the reporting period:

December 31

2015 2014

Joint venture $ 541 $ -

Other related parties - other related

parties' chairperson or its significant

stockholder, is HTC's chairperson 1,146 $ 925

$1,687 $ 925

The selling prices for products sold to related parties

were lower than those sold to third parties, except some

related parties have no comparison with those sold to third

parties. No guarantees had been given or received for trade

receivables from related parties. No bad debt expense had

been recognized for the years ended December 31, 2015 and

2014 for the amounts owed by related parties.

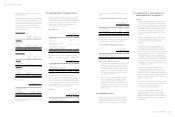

Purchase

For the Year Ended

December 31

2015 2014

Other related parties - other related

parties' chairperson or its significant

stockholder, is HTC's chairperson $ - $ 4,454

Purchase prices for related parties and third parties were

similar.

Compensation of Key Management Personnel

For the Year Ended

December 31

2015 2014

Short-term benefits

Post-employment benefits

Share-based payments

$ 247,972

2,710

85,273

$528,353

2,381

60,921

$335,955 $ 591,655

The remuneration of directors and key executives was

determined by the remuneration committee having regard

to the performance of individuals and market trends.

Property, Plant and Equipment Acquired

For the Year Ended

December 31

2015 2014

Other related parties - other related

parties' chairperson or its significant

stockholder, is HTC's chairperson $2,695 $ -

Other Related-party Transactions

a. The Company leased staff dormitory owned by a related

party under an operating lease agreement. The rental

payment is determined at the prevailing rates in the

surrounding area. The Company recognized and paid

rental expenses amounting to NT$3,285 thousand and

NT$5,209 thousand for the years ended December 31,

2015 and 2014, respectively.

b. Other related parties provide selling and marketing

service to the Company. The selling and marketing

service expenses were NT$10,300 thousand and

NT$16,150 thousand for the years ended December 31,

2015 and 2014, respectively. As of December 31, 2014,

the unpaid selling and marketing service expenses was

NT$158 thousand.

33. PLEDGED ASSETS

As of December 31, 2015 and 2014, the time of deposits

amounting to NT$623 thousand and NT$664 thousand

and were classified as other current financial assets were

provided respectively as collateral for rental deposits.

34. COMMITMENTS, CONTINGENCIES

AND SIGNIFICANT CONTRACTS

Lawsuit

a. In April 2008, IPCom GMBH & CO., KG (“IPCom”)

filed a multi-claim lawsuit against the Company with

the District Court of Mannheim, Germany, alleging that

the Company infringed IPCom's patents. In November

2008, the Company filed declaratory judgment action

for non-infringement and invalidity against three of

IPCom's patents with the Washington Court, District of

Columbia.

In October 2010, IPCom filed a new complaint against

the Company alleging patent infringement of patent

owned by IPCom in District Court of Dusseldorf,

Germany.

In June 2011, IPCom filed a new complaint against

the Company alleging patent infringement of patent

owned by IPCom with the High Court in London, the

United Kingdom. In September 2011, the Company filed

declaratory judgment action for non-infringement and

invalidity in Milan, Italy. Legal proceedings in above-

mentioned courts in Germany and the United Kingdom

are still ongoing. The Company evaluated the lawsuits

and considered the risk of patents-in-suits are low. Also,

preliminary injunction and summary judgment against

the Company are very unlikely.

In March 2012, Washington Court granted on the

Company's summary judgment motion and ruled on

non-infringement of two of patents-in-suit. As for the

third patents-in-suit, the Washington Court has granted

a stay on case pending appeal decision. In January 2014,

the Court of Appeal for the Federal Circuit affirmed the

Washington Court's decision.

As of the date that the board of directors approved and

authorized for issuing consolidated financial statements,

there had been no critical hearing, nor had a court

decision been made, except for the above.

b. In July 2014, US patent holding company Acacia

Research Corporation (“Acacia”) has enforced its 6

AMR-WB standard essential patent portfolio against

Deutsche Telekom and Vodafone separately in Germany

through its subsidiary Saint Lawrence Communications

GmbH (“SLC”).