HTC 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

274

275

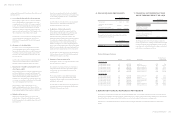

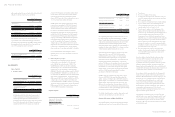

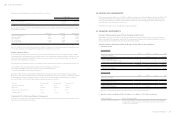

For the Year Ended December 31

2015 2014

$ 419,969 $403,155

Dividends

Others

352,074

155,993

26,381

404,588

$928,036 $834,124

(Concluded)

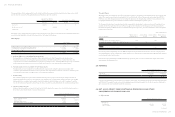

b. Other gains and losses

For the Year Ended December 31

2015 2014

Net gain (loss) on disposal of property, plant and equipment

Gains on disposal of investments

Net foreign exchange gains

Net gains arising on financial instruments classified as held for trading

Ineffective portion of cash flow hedge

Impairment losses

Other losses

$ 8,385

327

629,074

58,949

1,258

( 2,919,890)

(64,762)

$(153,493)

157,995

855,412

240,120

1,939

(547,510)

( 48,269)

$(2,286,659) $ 506,194

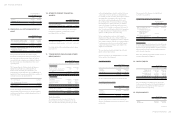

Gain or loss on financial assets and liabilities held for trading was derived from forward exchange transactions. The Company

entered into forward exchange transactions to manage exposures related to exchange rate fluctuations of foreign currency

denominated assets and liabilities.

In June 2015, the Company determined that the recoverable amount of partial prepayments and operation equipment were

less than its carrying amount, and thus recognized an impairment loss of NT$2,395,643 thousand and NT$524,247 thousand,

respectively.

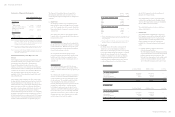

c. Impairment losses on financial assets

For the Year Ended December 31

2015 2014

Trade receivables (included in operating expenses)

Financial assets measured at cost (included in other gains and losses)

$ -

-

$ 3,875

373,257

$ - $ 377,132

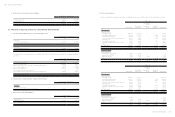

d. Depreciation and amortization

For the Year Ended December 31

2015 2014

Property, plant and equipment

Investment properties

Intangible assets

$ 2,525,191

13,855

1,956,533

$2,952,892

-

1,868,817

$4,495,579 $ 4,821,709

An analysis of depreciation - by function

Operating costs

Operating expenses

Other losses

$ 1,339,250

1,185,941

13,855

$ 1,610,472

1,342,420

-

$2,539,046 $2,952,892

An analysis of amortization - by function

Operating costs

Operating expenses

$ 6,988

1,949,545

$ 19,788

1,849,029

$1,956,533 $ 1,868,817

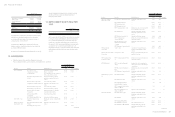

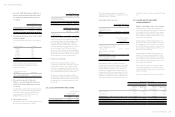

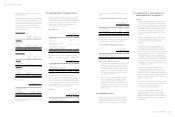

e. Employee benefits expense

For the Year Ended December 31

2015 2014

Short-term benefits $14,601,086 $16,422,150

Post-employment benefits (Note 23)

Defined contribution plans

Defined benefit plans

623,742

5,595

787,960

6,591

629,337 794,551

Share-based payments (Note 29)

Equity-settled share-based payments 550,688 269,013

Total employee benefits expense $ 15,781,111 $ 17,485,714

An analysis of employee benefits expense- by function

Operating costs

Operating expenses

$ 3,738,378

12,042,733

$ 5,771,740

11,713,974

$ 15,781,111 $ 17,485,714

The existing Articles of Incorporation of HTC stipulate to distribute bonus to employees and remuneration to directors and

supervisors at the rates no less than 5% and no higher than 0.3%, respectively, of net income (net of the bonus and remuneration).

The employee bonus for the year ended December 31, 2014 should be appropriated at 5% of net income before deducting employee

bonus expenses. To be in compliance with the Company Act as amended in May 2015, the Company expects to modify the Articles

of Incorporation according to laws and regulations above on the board of directors' meeting on February 29, 2016, which stipulate

to distribute employees' compensation and remuneration to directors and supervisors at the rates no less than 4% and no higher

than 0.25%, respectively, of net profit before income tax, employees' compensation, and remuneration to directors and supervisors.

No employee bonus was estimated as the Company reported net loss for the year ended December 31, 2015. Material differences

between such estimated amounts and the amounts proposed by the board of directors on or before the date the annual consolidated

financial statements are authorized for issue are adjusted in the year the bonus and remuneration were recognized. If there is a

change in the proposed amounts after the annual consolidated financial statements were authorized for issue, the differences are

recorded as a change in accounting estimate.

The appropriations of bonuses to employees for 2014 and 2013 have been approved in the shareholders' meetings on June 2, 2015

and June 19, 2014, respectively, were as follows:

For the Year Ended December 31

2014 2013

Cash Dividends Share Dividends Cash Dividends Share Dividends

Bonus to employees $88,334 $ - $ - $ -

There was no difference between the amounts of the bonus to employees approved in the shareholders' meetings on June 2,

2015 and June 19, 2014 and the amounts recognized in the financial statements for the years ended December 31, 2014 and 2013,

respectively.

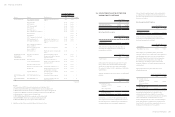

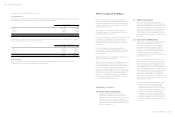

f. Impairment losses on non-financial assets

For the Year Ended December 31

2015 2014

Inventories (included in operating costs)

Property, plant and equipment (included in other gains and losses)

Intangible assets (including goodwill) (included in other gains and losses)

Prepayments (included in other gains and losses)

$ 1,939,446

524,247

-

2,395,643

$ 521,692

-

174,253

-

$4,859,336 $695,945