HTC 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

268

269

The Company provides warranty service for its customers.

The warranty period varies by product and is generally one

year to two years. The warranties are estimated on the basis

of evaluation of the products under warranty, historical

warranty trends, and pertinent factors.

The provision for contingent loss on purchase orders is

estimated after taking into account the effects of changes

in the product market, evaluating the foregoing effects

on inventory management and adjusting the Company's

purchases.

23. RETIREMENT BENEFIT PLANS

Defined Contribution Plans

The pension plan under the Labor Pension Act (the “LPA”)

is a defined contribution plan. Based on the LPA, HTC,

Communication Global Certification Inc. (“CGC”) and Yoda

Co., Ltd. (“Yoda”) make monthly contributions to employees'

individual pension accounts at 6% of monthly salaries and

wages.

The Company has defined contribution retirement benefit

plans for all qualified employees of HTC, CGC and Yoda in

Taiwan. Besides, the employees of the Company's subsidiary

are members of a state-managed retirement benefit plan

operated by local government. The subsidiary is required to

contribute amounts calculated at a specified percentage of

payroll costs to the retirement benefit scheme to fund the

benefits. The only obligation of the Company with respect

to the retirement benefit plan is to make the specified

contributions to the fund.

The total expenses recognized in the consolidated statement

of comprehensive income were NT$623,742 thousand and

NT$787,960 thousand, representing the contributions

payable to these plans by the Company at the rates specified

in the plans for the years ended December 31, 2015 and 2014,

respectively. As of December 31, 2015 and 2014, the amounts

of contributions payable were NT$88,942 thousand and

NT$98,605 thousand, respectively, the amounts were paid

subsequent to the end of the reporting period.

Defined Benefit Plans

The defined benefit plan adopted by HTC and CGC in

accordance with the Labor Standards Law is operated by the

government. Pension benefits are calculated on the basis

of the length of service and average monthly salaries of the

six months before retirement. HTC and CGC contribute

amounts equal to 2% of total monthly salaries and wages to a

pension fund administered by the pension fund monitoring

committee. Pension contributions are deposited in the Bank

of Taiwan in the committee's name. Before the end of each

year, the Group assesses the balance in the pension fund. If

the amount of the balance in the pension fund is inadequate

to pay retirement benefits for employees who conform

to retirement requirements in the next year, the Group is

required to fund the difference in one appropriation that

should be made before the end of March of the next year.

The pension fund is managed by the Bureau of Labor Funds,

Ministry of Labor (“the Bureau”); the Group has no right to

influence the investment policy and strategy.

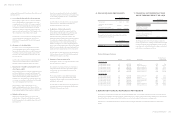

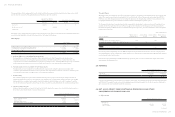

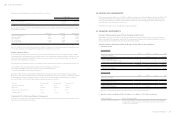

The amounts included in the consolidated balance sheets in

respect of the obligation on HTC and CGC under the defined

benefit plans were as follows:

December 31

2015 2014

Present value of defined

benefit obligation

Fair value of plan assets

$( 474,875)

554,345

$(443,642)

552,780

Net defined benefit asset $ 79,470 $ 109,138

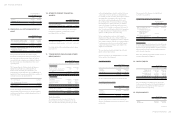

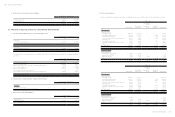

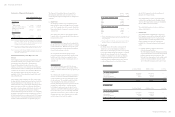

Movements in net defined benefit asset were as follows:

Present Value of Defined

Benefit Obligation

Fair Value of

Plan Assets

Net Defined

Benefit Asset

Balance at January 1, 2014 $( 413,220) $538,935 $ 125,715

Current service cost ( 9,864) - ( 9,864)

Net interest (expense) income ( 7,744) 11,017 3,273

Recognized in profit or loss ( 17,608) 11,017 ( 6,591)

Remeasurement

Return on plan assets - 1,416 1,416

Actuarial loss - changes in demographic assumptions ( 3,287) - ( 3,287)

Present Value of Defined

Benefit Obligation

Fair Value of

Plan Assets

Net Defined

Benefit Asset

Actuarial gain - changes in financial assumptions $ 7,991 $ - $ 7,991

Actuarial loss - experience adjustments ( 39,466) - ( 39,466)

Recognized in other comprehensive income ( 34,762) 1,416 ( 33,346)

Contributions from the employer - 23,360 23,360

Benefits paid 21,948 ( 21,948) -

Balance at December 31, 2014 ( 443,642) 552,780 109,138

Current service cost ( 8,017) - ( 8,017)

Net interest (expense) income ( 8,865) 11,287 2,422

Recognized in profit or loss ( 16,882) 11,287 ( 5,595)

Remeasurement

Return on plan assets - 3,761 3,761

Actuarial loss - changes in demographic assumptions ( 33,851) - ( 33,851)

Actuarial loss - changes in financial assumptions ( 16,259) - ( 16,259)

Actuarial loss - experience adjustments ( 1,868) - ( 1,868)

Recognized in other comprehensive income ( 51,978) 3,761 ( 48,217)

Contributions from the employer - 24,144 24,144

Benefits paid 37,628 ( 37,628) -

Balance at December 31, 2015 $( 474,875) $ 554,345 $ 79,470

(Concluded)

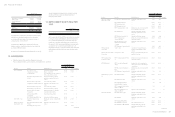

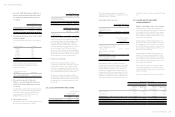

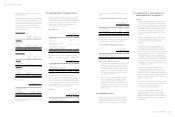

An analysis by function of the amounts recognized in profit

or loss in respect of the defined benefit plans was as follows:

December 31

2015 2014

Operating costs $ 1,124 $ 1,518

Selling and marketing expenses 458 563

General and administrative expenses 622 731

Research and development expenses 3,391 3,779

$5,595 $6,591

Through the defined benefit plans under the Labor

Standards Law, the Group is exposed to the following risks:

a. Investment risk: The plan assets are invested in

domestic/and foreign/equity and debt securities,

bank deposits, etc. The investment is conducted at

the discretion of the Bureau or under the mandated

management. However, in accordance with relevant

regulations, the return generated by plan assets should

not be below the interest rate for a 2-year time deposit

with local banks.

b. Interest risk: A decrease in the government/corporate

bond interest rate will increase the present value of the

defined benefit obligation; however, this will be partially

offset by an increase in the return on the plan's debt

investments.

c. Salary risk: The present value of the defined benefit

obligation is calculated by reference to the future

salaries of plan participants. As such, an increase in the

salary of the plan participants will increase the present

value of the defined benefit obligation.

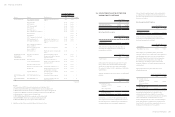

The actuarial valuations of the present value of the defined

benefit obligation were carried out by qualified actuaries.

The significant assumptions used for the purposes of the

actuarial valuations were as follows:

December 31

2015 2014

Discount rates

Expected rates of salary

increase

Mortality rates

Turnover rates

1.375%-1.750%

2.250%-4.000%

0.025%-1.640%

0.000%-30.00%

1.625%- 2.000%

2.250%- 4.000%

0.025%-1.640%

0.000%-32.00%

If possible reasonable change in each of the significant

actuarial assumptions will occur and all other assumptions

(Continued)