HTC 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital and shares

Capital and shares

130

131

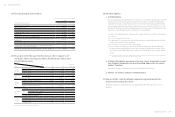

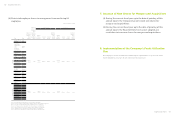

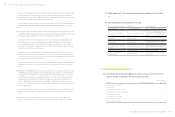

6. New Restricted Employee Shares

(1) Issuance of restricted employee shares and impact to

shareholders’ equity

2016.03.31/Unit:ShareandNT$

Restricted Employee

Shares Granted 1st Restricted employee shares 2nd Restricted employee shares 3rd Restricted employee shares

Approval Date 2014.08.19 2014.08.19 2015.08.19

Issue(Vest)Date 2014.11.02 2015.08.10 2015.12.23

Number of Restricted

EmployeeSharesIssued 4,600,000shares 400,000 shares 4,006,000shares

IssuedPriceperShare NTD 0 NTD 0 NTD 0

PercentageofShares

Exercisable to Outstand-

ing Common Shares

0.56% 0.05% 0.48%

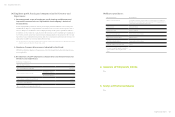

Vesting Conditions for

Exercise of Restricted

Employee Shares

1. An employee who remains employed

at HTC after 1 year has elapsed from

the time of the award of the new

restricted employee shares (i.e., the

record date of the capital increase),

and who in the then-current fiscal

year has a performance rating equal to

or higher than "Satisfactory," will be

eligible for vesting of an installment of

30%oftheshares.

2. An employee who remains employed

at HTC after 2 years have elapsed

from the time of the award of the new

restricted employee shares (i.e., the

record date of the capital increase),

and who in the then-current fiscal

year has a performance rating equal to

or higher than “Satisfactory,” will be

eligible for vesting of an installment of

30%oftheshares.

3. Anemployeewhoremainsemployed

atHTCafter3yearshaveelapsed

from the time of the award of the new

restricted employee shares (i.e., the

record date of the capital increase),

and who in the then-current fiscal

year has a performance rating equal to

or higher than “Satisfactory,” will be

eligible for vesting of an installment of

40%oftheshares.

1. An employee who remains employed

at HTC after 1 year has elapsed from

the time of the award of the new

restricted employee shares (i.e., the

record date of the capital increase),

and who in the then-current fiscal

year has a performance rating equal to

or higher than "Satisfactory," will be

eligible for vesting of an installment of

30%oftheshares.

2. An employee who remains employed

at HTC after 2 years have elapsed

from the time of the award of the new

restricted employee shares (i.e., the

record date of the capital increase),

and who in the then-current fiscal

year has a performance rating equal to

or higher than “Satisfactory,” will be

eligible for vesting of an installment of

30%oftheshares.

3. Anemployeewhoremainsemployed

atHTCafter3yearshaveelapsed

from the time of the award of the new

restricted employee shares (i.e., the

record date of the capital increase),

and who in the then-current fiscal

year has a performance rating equal to

or higher than “Satisfactory,” will be

eligible for vesting of an installment of

40%oftheshares.

1. An employee who remains employed at

HTC after 1 year has elapsed from the

time of the award of the new restricted

employee shares (i.e., the record date

of the capital increase), and who in

the then-current fiscal year has a

performance rating equal to or higher

than "Satisfactory," will be eligible for

vestingofaninstallmentof30%ofthe

shares.

2. An employee who remains employed

at HTC after 2 years have elapsed

from the time of the award of the new

restricted employee shares (i.e., the

record date of the capital increase), and

who in the then-current fiscal year has

a performance rating equal to or higher

than “Satisfactory,” will be eligible for

vestingofaninstallmentof30%ofthe

shares.

3. Anemployeewhoremainsemployed

atHTCafter3yearshaveelapsed

from the time of the award of the new

restricted employee shares (i.e., the

record date of the capital increase), and

who in the then-current fiscal year has

a performance rating equal to or higher

than “Satisfactory,” will be eligible for

vestingofaninstallmentof40%ofthe

shares.

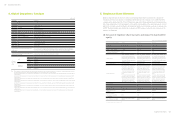

Restrictions to the Rights

of New Restricted Em-

ployee Shares

The shares to be issued and awarded to

employees in the current issue are com-

mon shares. The rights and obligations

associated with the shares are the same

as those of other issued and outstanding

common stock, except as specified as fol-

lows:

1. During the vesting period, an em-

ployee may not sell, pledge, transfer,

give to another person, create any

encumbrance on, or otherwise dispose

of, new restricted employee shares.

2. During the vesting period, the new

restricted employee shares can still

participate in stock and cash dividends

and subscription to cash rights issues.

The stock and cash dividends and cash

rights issue subscriptions so obtained

furthermore need not be placed in

trust and shall not be restricted by the

vesting period.

The shares to be issued and awarded to

employees in the current issue are com-

mon shares. The rights and obligations

associated with the shares are the same

as those of other issued and outstanding

common stock, except as specified as fol-

lows:

1. During the vesting period, an em-

ployee may not sell, pledge, transfer,

give to another person, create any

encumbrance on, or otherwise dispose

of, new restricted employee shares.

2. During the vesting period, the new

restricted employee shares can still

participate in stock and cash dividends

and subscription to cash rights issues.

The stock and cash dividends and cash

rights issue subscriptions so obtained

furthermore need not be placed in

trust and shall not be restricted by the

vesting period.

The shares to be issued and awarded to

employees in the current issue are com-

mon shares. The rights and obligations

associated with the shares are the same

as those of other issued and outstanding

common stock, except as specified as fol-

lows:

1. During the vesting period, an employee

may not sell, pledge, transfer, give to

another person, create any encum-

brance on, or otherwise dispose of, new

restricted employee shares.

2. During the vesting period, the new

restricted employee shares can still

participate in stock and cash dividends

and subscription to cash rights issues.

The stock and cash dividends and cash

rights issue subscriptions so obtained

furthermore need not be placed in

trust and shall not be restricted by the

vesting period.

Custody of Restricted

Employee Shares

1. After new restricted employee shares

are issued, if the employee to whom

shares have been awarded is an ROC

national, the shares must immediately

bedepositedintrust.Iftheemployee

to whom shares are awarded is a

foreign national, the shares must be

placed in custody with a custodian

bank. Further, before the vesting con-

ditions have been met, the employee

may not for any reason or in any man-

ner request that the trustee return the

new restricted employee shares.

2. During the period in which the new

restricted employee shares are placed

in trust, HTC shall have full discretion

to act as agent for the employee to con-

duct with the share trust institution

matters including, without limitation,

the negotiation, signing, amendment,

extension, rescission, and termination

of the trust agreement, and giving of

instructions for the delivery, utiliza-

tion, or disposition of the assets in

trust.

1. After new restricted employee shares

are issued, if the employee to whom

shares have been awarded is an ROC

national, the shares must immediately

bedepositedintrust.Iftheemployee

to whom shares are awarded is a

foreign national, the shares must be

placed in custody with a custodian

bank. Further, before the vesting con-

ditions have been met, the employee

may not for any reason or in any man-

ner request that the trustee return the

new restricted employee shares.

2. During the period in which the new

restricted employee shares are placed

in trust, HTC shall have full discretion

to act as agent for the employee to con-

duct with the share trust institution

matters including, without limitation,

the negotiation, signing, amendment,

extension, rescission, and termination

of the trust agreement, and giving of

instructions for the delivery, utiliza-

tion, or disposition of the assets in

trust.

1. After new restricted employee shares

are issued, if the employee to whom

shares have been awarded is an ROC

national, the shares must immediately

bedepositedintrust.Iftheemployeeto

whom shares are awarded is a foreign

national, the shares must be placed in

custody with a custodian bank. Further,

before the vesting conditions have been

met, the employee may not for any

reason or in any manner request that

the trustee return the new restricted

employee shares.

2. During the period in which the new

restricted employee shares are placed

in trust, HTC shall have full discretion

to act as agent for the employee to

conduct with the share trust institution

matters including, without limitation,

the negotiation, signing, amendment,

extension, rescission, and termination

of the trust agreement, and giving of in-

structions for the delivery, utilization,

or disposition of the assets in trust.

ProceduresforNon-

Compliance of the Condi-

tions

1. Ifanemployeevoluntarilyresignsor

his or her employment is terminated

or severed, then the vesting rights of

any shares previously awarded to the

employee but not yet vested shall be

lost from the date of occurrence of the

fact. HTC will withdraw and cancel

the full number of the shares without

compensation.

2. Any cash or property other than cash

received as a return of share capital

due to HTC having undergone a capital

reduction during the vesting period:

HTC will withdraw the full amount

without compensation.

1. Ifanemployeevoluntarilyresignsor

his or her employment is terminated

or severed, then the vesting rights of

any shares previously awarded to the

employee but not yet vested shall be

lost from the date of occurrence of the

fact. HTC will withdraw and cancel

the full number of the shares without

compensation.

2. Any cash or property other than cash

received as a return of share capital

due to HTC having undergone a capital

reduction during the vesting period:

HTC will withdraw the full amount

without compensation.

1. Ifanemployeevoluntarilyresignsor

his or her employment is terminated

or severed, then the vesting rights of

any shares previously awarded to the

employee but not yet vested shall be

lost from the date of occurrence of the

fact. HTC will withdraw and cancel

the full number of the shares without

compensation.

2. Any cash or property other than cash

received as a return of share capital

due to HTC having undergone a capital

reduction during the vesting period:

HTC will withdraw the full amount

without compensation.

Withdrawal of New Re-

stricted Employee Shares 786,570shares 0 shares 128,500 shares

Unrestricted New Re-

stricted Employee Shares 1,123,550shares 0 shares 13,000shares

Restricted New Re-

stricted Employee Shares 2,689,880shares 400,000 shares 3,864,500shares

PercentageofSharesUn-

restricted to Outstanding

Common Shares

0.33% 0.05% 0.47%

ImpactonShareholders’

Equity Dilution to shareholder’s equity is limited Dilution to shareholder’s equity is limited Dilution to shareholder’s equity is limited

Note:Theinformationiscalculatedbasedontheissuedshares,827,641,465.

(Continued)

2016.03.31/Unit:ShareandNT$