HTC 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

264

265

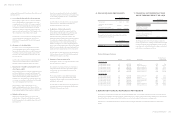

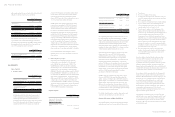

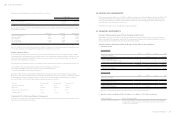

17. PROPERTY, PLANT AND EQUIPMENT

December 31

2015 2014

Carrying amounts

Land

Buildings

Property in construction

Machinery and equipment

Other equipment

$ 6,470,507

5,771,213

-

2,320,672

869,738

$ 7,622,683

10,364,729

1,089

4,437,725

1,009,330

$15,432,130 $ 23,435,556

Movement of property, plant and equipment for the years ended December 31, 2015 and 2014 were as follows:

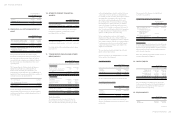

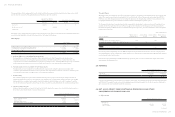

2015

Land Buildings

Property in

Construction

Machinery and

Equipment

Other

Equipment Total

Cost

Balance, beginning of the year

Additions

Disposals

Transfer to expense

Reclassification

Effect of foreign currency exchange

differences

$ 7,622,683

-

-

-

( 1,151,354)

( 822)

$ 12,508,315

142,865

( 378,465)

-

( 4,889,015)

( 22,332)

$ 1,089

1,475

(2,556)

-

-

( 8)

$ 15,181,539

361,273

( 1,735,045)

( 8,577)

-

( 44,785)

$ 2,656,990

415,936

( 446,392)

-

( 120,162)

966

$ 37,970,616

921,549

( 2,562,458)

( 8,577)

( 6,160,531)

( 66,981)

Balance, end of the year 6,470,507 7,361,368 - 13,754,405 2,507,338 30,093,618

Accumulated depreciation

Balance, beginning of the year

Depreciation expenses

Disposals

Transfer to expense

Reclassification

Effect of foreign currency exchange

differences

-

-

-

-

-

-

2,143,586

406,210

( 373,693)

-

( 583,994)

( 1,954)

-

-

-

-

-

-

10,743,814

1,685,763

( 1,487,187)

( 238)

-

( 29,382)

1,647,660

433,218

( 364,499)

-

( 81,848)

( 215)

14,535,060

2,525,191

( 2,225,379)

( 238)

( 665,842)

( 31,551)

Balance, end of the year - 1,590,155 - 10,912,770 1,634,316 14,137,241

Accumulated impairment

Balance, beginning of the year

Impairment losses

-

-

-

-

-

-

-

520,963

-

3,284

-

524,247

Balance, end of the year - - - 520,963 3,284 524,247

Net book value, end of the year $ 6,470,507 $ 5,771,213 $ - $ 2,320,672 $ 869,738 $ 15,432,130

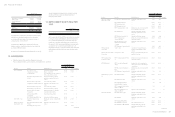

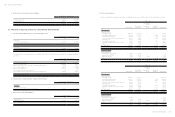

2014

Land Buildings

Property in

Construction

Machinery and

Equipment

Other

Equipment Total

Cost

Balance, beginning of the year

Additions

Disposal

Reclassification

Effect of foreign currency exchange

differences

$ 7,623,287

-

-

-

( 604)

$ 12,229,591

223,122

-

-

55,602

$ 145

1,053

-

( 147)

38

$ 14,480,912

570,963

( 274)

-

129,938

$ 3,564,884

87,266

( 1,039,424)

147

44,117

$ 37,898,819

882,404

( 1,039,698)

-

229,091

2014

Land Buildings

Property in

Construction

Machinery and

Equipment

Other

Equipment Total

Balance, end of the year $ 7,622,683 $ 12,508,315 $ 1,089 $ 15,181,539 $ 2,656,990 $ 37,970,616

Accumulated depreciation

Balance, beginning of the year

Depreciation expenses

Disposal

Effect of foreign currency exchange

differences

-

-

-

-

1,722,043

416,707

-

4,836

-

-

-

-

8,718,986

1,940,537

( 192)

84,483

1,896,391

595,648

( 869,996)

25,617

12,337,420

2,952,892

( 870,188)

114,936

Balance, end of the year - 2,143,586 - 10,743,814 1,647,660 14,535,060

Net book value, end of the year $ 7,622,683 $ 10,364,729 $ 1,089 $ 4,437,725 $ 1,009,330 $ 23,435,556

(Concluded)

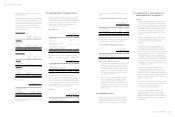

The above items of property, plant and equipment were

depreciated on a straight-line basis over the estimated useful

lives as follows:

Building 5-50 years

Machinery and equipment 3-6 years

Other equipment 3-5 years

The major component parts of the buildings held by the

Company included plants, electro-powering machinery and

engineering systems, etc., which were depreciated over their

estimated useful lives of 40 to 50 years, 20 years and 5 to 10

years, respectively.

There were no interests capitalized for the years ended

December 31, 2015 and 2014.

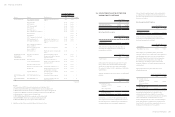

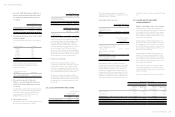

18. INVESTMENT PROPERTIES, NET

Movement of investment properties, net for the year ended

December 31, 2015 was as follows:

2015

Completed Investment

Property

Cost

Balance, beginning of the year

Transferred from property, plant and

equipment

Effect of foreign currency exchange

differences

$ -

1,997,596

( 4,798)

Balance, end of the year 1,992,798

Accumulated depreciation

Balance, beginning of the year

Transferred from property, plant and

equipment

Depreciation expense

-

271,184

13,855

2015

Completed Investment

Property

Effect of foreign currency exchange

differences $ ( 730)

Balance, end of the year 284,309

Net book value, end of the year $ 1,708,489

(Concluded)

The investment properties were depreciated using the

straight-line method over their estimated useful lives as

follows:

Main buildings 50 years

Air-conditioning 5-10 years

Others 3-5 years

In October, 2015, the determination of fair value was

performed by qualified professional valuers, and the fair

value was measured by using Level 3 inputs. The valuation

was arrived at by reference to cost method. The significant

unobservable inputs used include residue ratio. The

evaluated fair value was NT$1,949,221 thousand with an

assessment by qualified professional valuers as no significant

changes so as to the date of the balance sheet.

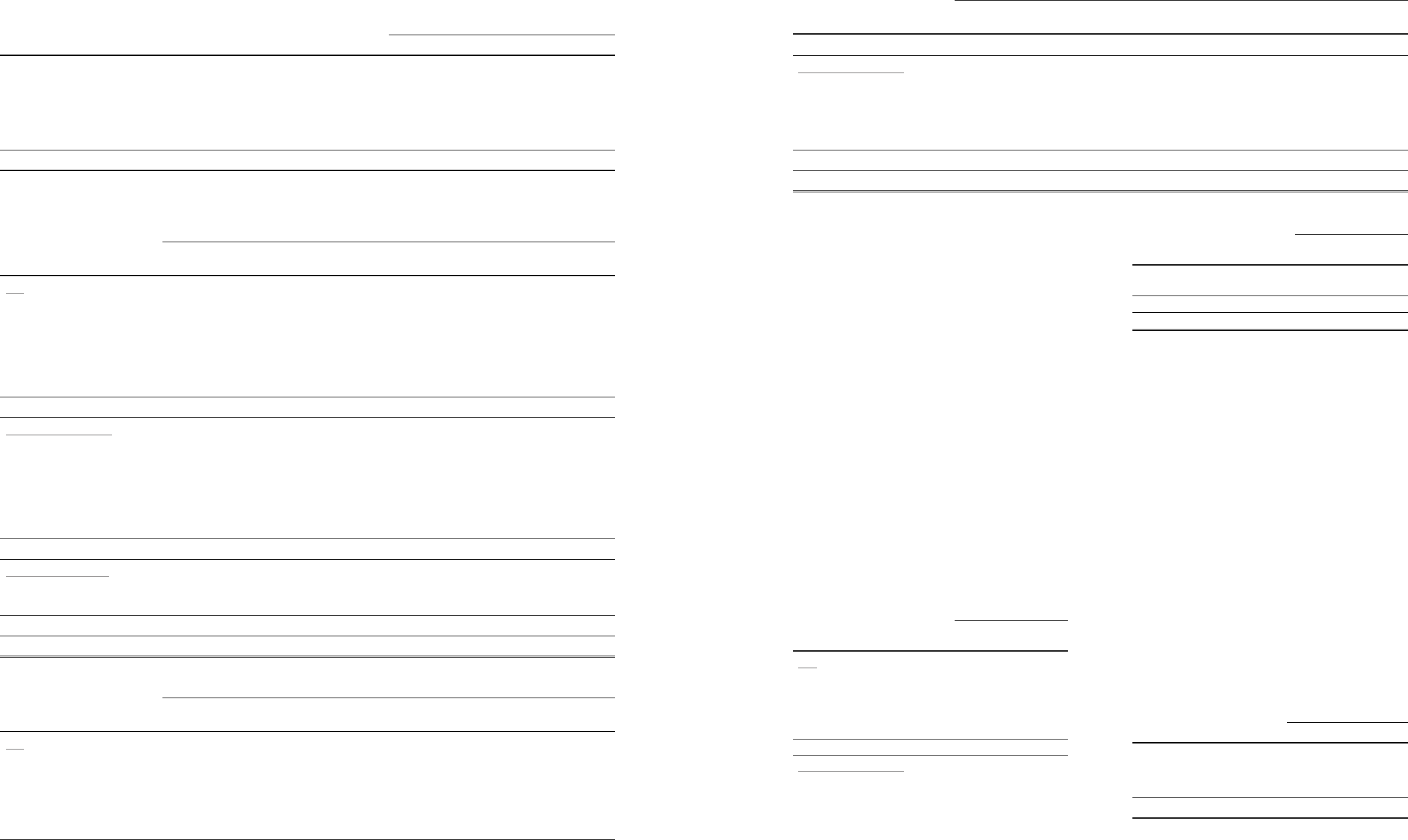

19. INTANGIBLE ASSETS

December 31

2015 2014

Carrying amounts

Patents

Other intangible assets

$4,986,922

574,522

$6,418,735

790,556

$ 5,561,444 $7,209,291

(Continued)

(Continued)