HTC 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

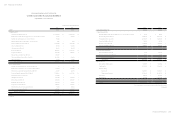

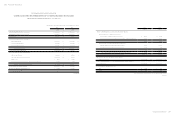

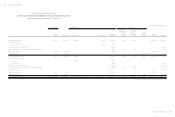

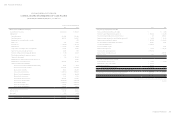

Financial information

Financial information

244

245

1. IFRS 9 “Financial Instruments”

Recognition and measurement of financial assets

With regards to financial assets, all recognized

financial assets that are within the scope of IAS

39 “Financial Instruments: Recognition and

Measurement” are subsequently measured at

amortized cost or fair value. Under IFRS 9, the

requirement for the classification of financial assets is

stated below.

For the Company's debt instruments that have

contractual cash flows that are solely payments

of principal and interest on the principal amount

outstanding, their classification and measurement are

as follows:

a. For debt instruments, if they are held within a

business model whose objective is to collect the

contractual cash flows, the financial assets are

measured at amortized cost and are assessed

for impairment continuously with impairment

loss recognized in profit or loss, if any. Interest

revenue is recognized in profit or loss by using the

effective interest method;

b. For debt instruments, if they are held within a

business model whose objective is achieved by

both the collecting of contractual cash flows

and the selling of financial assets, the financial

assets are measured at fair value through other

comprehensive income (FVTOCI) and are

assessed for impairment. Interest revenue is

recognized in profit or loss by using the effective

interest method, and other gain or loss shall be

recognized in other comprehensive income,

except for impairment gains or losses and foreign

exchange gains and losses. When the debt

instruments are derecognized or reclassified, the

cumulative gain or loss previously recognized in

other comprehensive income is reclassified from

equity to profit or loss.

Except for above, all other financial assets are

measured at fair value through profit or loss.

However, the Company may make an irrevocable

election to present subsequent changes in the fair

value of an equity investment (that is not held for

trading) in other comprehensive income, with only

dividend income generally recognized in profit or loss.

No subsequent impairment assessment is required,

and the cumulative gain or loss previously recognized

in other comprehensive income cannot be reclassified

When applying IFRS 15, an entity shall recognize

revenue by applying the following steps:

• Identify the contract with the customer;

• Identify the performance obligations in the

contract;

• Determine the transaction price;

• Allocate the transaction price to the performance

obligations in the contracts; and

• Recognize revenue when the entity satisfies a

performance obligation.

When IFRS 15 is effective, an entity may elect to apply

this Standard either retrospectively to each prior

reporting period presented or retrospectively with the

cumulative effect of initially applying this Standard

recognized at the date of initial application.

Except for the above impact, as of the date the consolidated

financial statements were authorized for issue, the Company

is continuously assessing the possible impact that the

application of other standards and interpretations will have on

the Company's financial position and financial performance,

and will disclose the relevant impact when the assessment is

completed.

4. SIGNIFICANT ACCOUNTING POLICIES

Statement of Compliance

These consolidated financial statements have been prepared

in accordance with the Regulations Governing the Preparation

of Financial Reports by Securities Issuers and IFRSs as

endorsed by FSC.

Basis of Preparation

These consolidated financial statements have been prepared

on the historical cost basis except for financial instruments

which are measured at fair value.

The fair value measurements are grouped into Levels 1 to

3 based on the degree to which the fair value measurement

inputs are observable and the significance of the inputs to the

fair value measurement in its entirety, which are described as

follows:

a. Level 1 inputs are quoted prices (unadjusted) in active

markets for identical assets or liabilities;

b. Level 2 inputs are inputs other than quoted prices

included within Level 1 that are observable for the asset

or liability, either directly (i.e. as prices) or indirectly (i.e.

derived from prices); and

c. Level 3 inputs are unobservable inputs for the asset or

liability.

For readers' convenience, the accompanying consolidated

financial statements have been translated into English

from the original Chinese version prepared and used in the

Republic of China. If inconsistencies arise between the

English version and the Chinese version or if differences arise

in the interpretations between the two versions, the Chinese

version of the consolidated financial statements shall prevail.

However, the accompanying consolidated financial statements

do not include the English translation of the additional

footnote disclosures that are not required under accounting

principles and practices generally applied in the Republic of

China but are required by the Securities and Futures Bureau

for their oversight purposes.

Classification of Current and Non-current Assets

and Liabilities

Current assets include:

a. Assets held primarily for trading purposes;

b. Assets to be realized within twelve months after the

reporting period; and

c. Cash and cash equivalents unless the asset is restricted

from being exchanged or used to settle a liability for at

least twelve months after the reporting period.

Current liabilities are:

a. Liabilities held primarily for the purpose of trading;

b. Liabilities due to be settled within twelve months after

the reporting period, even if an agreement to refinance, or

to reschedule payments, on a long-term basis is completed

after the reporting period and before the consolidated

financial statements are authorized for issue; and

c. Liabilities for which the Company does not have an

unconditional right to defer settlement for at least twelve

months after the reporting period. Terms of a liability

that could, at the option of the counterparty, result in its

settlement by the issue of equity instruments do not affect

its classification.

Aforementioned assets and liabilities that are not classified as

current are classified as non-current.

Basis of Consolidation

The consolidated financial statements incorporate the

financial statements of the HTC and the entities controlled

by the HTC (i.e. its subsidiaries). Income and expenses of

subsidiaries acquired or disposed of during the period are

included in the consolidated statement of profit or loss and

from equity to profit or loss.

The impairment of financial assets

IFRS 9 requires that impairment loss on financial

assets is recognized by using the “Expected Credit

Losses Model”. The credit loss allowance is required

for financial assets measured at amortized cost,

financial assets mandatorily measured at FVTOCI,

lease receivables, contract assets arising from IFRS 15

“Revenue from Contracts with Customers”, certain

written loan commitments and financial guarantee

contracts. A loss allowance for the 12-month

expected credit losses is required for a financial asset

if its credit risk has not increased significantly since

initial recognition. A loss allowance for full lifetime

expected credit losses is required for a financial asset

if its credit risk has increased significantly since initial

recognition and is not low. However, a loss allowance

for full lifetime expected credit losses is required for

trade receivables that do not constitute a financing

transaction.

For purchased or originated credit-impaired financial

assets, the Company takes into account the expected

credit losses on initial recognition in calculating the

credit-adjusted effective interest rate. Subsequently,

any changes in expected losses are recognized as

a loss allowance with a corresponding gain or loss

recognized in profit or loss.

Hedge accounting

The main changes in hedge accounting amended the

application requirements for hedge accounting to

better reflect the entity's risk management activities.

Compared with IAS 39, the main changes include: (1)

enhancing types of transactions eligible for hedge

accounting, specifically broadening the risk eligible

for hedge accounting of non-financial items; (2)

changing the way hedging derivative instruments are

accounted for to reduce profit or loss volatility; and (3)

replacing retrospective effectiveness assessment with

the principle of economic relationship between the

hedging instrument and the hedged item.

2. IFRS 15 “Revenue from Contracts with

Customers”

IFRS 15 establishes principles for recognizing revenue

that apply to all contracts with customers, and will

supersedes IAS 18 “Revenue”, IAS 11 “Construction

Contracts” and a number of revenue-related

interpretations from January 1, 2018.