HTC 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

220

221

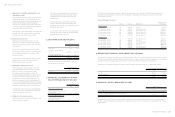

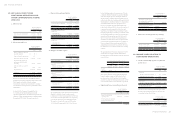

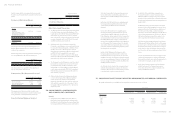

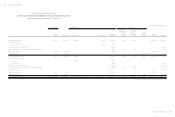

23. NET (LOSS) PROFIT FROM

CONTINUING OPERATIONS AND

OTHER COMPREHENSIVE INCOME

AND LOSS

a. Other income

For the Year Ended

December 31

2015 2014

Interest income - bank deposits $ 179,328 $214,092

Others 108,172 178,669

$287,500 $392,761

b. Other gains and losses

For the Year Ended

December 31

2015 2014

Net loss on disposal of property,

plant and equipment $( 33) $ -

Gains on disposal of investments 327 -

Net foreign exchange (loss) gain ( 291,550) 50,904

Net gains arising on financial

instruments classified as held

for trading 58,949 240,120

Ineffective portion of cash flow

hedge 1,258 1,939

Impairment losses ( 1,792,890) (174,253)

Other losses ( 42,415) ( 32,901)

$(2,066,354) $ 85,809

Gain or loss on financial assets and liabilities held for

trading was derived from forward exchange transactions.

The Company entered into forward exchange

transactions to manage exposures related to exchange

rate fluctuations of foreign currency denominated assets

and liabilities.

In June 2015, the Company determined that the

recoverable amount of partial prepayments and

operation equipment were less than its carrying amount,

and thus recognized an impairment loss of NT$1,268,643

thousand and NT$524,247 thousand, respectively.

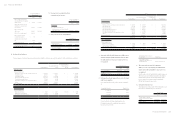

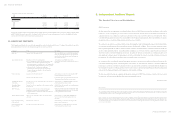

c. Depreciation and amortization

For the Year Ended

December 31

2015 2014

Property, plant and equipment $ 1,579,960 $ 1,774,782

Intangible assets 682,553 649,887

$2,262,513 $ 2,424,669

Classification of depreciation -

by function

Operating costs

Operating expenses

$ 805,766

774,194

$ 967,355

807,427

$ 1,579,960 $ 1,774,782

Classification of amortization -

by function

Operating costs

Operating expenses

$ -

682,553

$ -

649,887

$ 682,553 $ 649,887

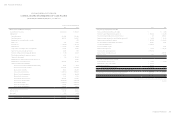

d. Employee benefits expense

For the Year Ended

December 31

2015 2014

Short-term benefits $ 9,261,843 $10,493,645

Post-employment benefits

(Note 20)

Defined contribution plans

Defined benefit plans

353,469

5,595

$ 381,930

6,595

359,064 388,525

Share-based payments

(Note 26)

Equity-settled share-based

payments 513,002 244,346

Total employee benefits

expense $ 10,133,909 $ 11,126,516

Classification - by function

Operating costs $ 3,270,958 $ 4,413,610

Operating expenses 6,862,951 6,712,906

$ 10,133,909 $ 11,126,516

The existing Articles of Incorporation of the Company

stipulate to distribute bonus to employees and

remuneration to directors and supervisors at the rates

no less than 5% and no higher than 0.3%, respectively,

of net income (net of the bonus and remuneration).

The employee bonus for the year ended December

31, 2014 should be appropriated at 5% of net income

before deducting employee bonus expenses. To be in

compliance with the Company Act as amended in May

2015, the Company expects to modify the Articles of

Incorporation according to laws and regulations above

on the board of directors' meeting on February 29, 2016,

which stipulate to distribute employees' compensation

and remuneration to directors and supervisors at

the rates no less than 4% and no higher than 0.25%,

respectively, of net profit before income tax, employees'

compensation, and remuneration to directors and

supervisors. No employee bonus was estimated as the

Company reported net loss for the year ended December

31, 2015. Material differences between such estimated

amounts and the amounts proposed by the board of

directors on or before the date the annual financial

statements are authorized for issue are adjusted in the

year the bonus and remuneration were recognized. If

there is a change in the proposed amounts after the

annual financial statements were authorized for issue,

the differences are recorded as a change in accounting

estimate.

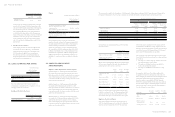

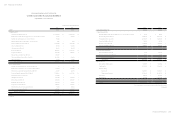

The appropriations of bonuses to employees for 2014

and 2013 have been approved in the shareholders'

meetings on June 2, 2015 and June 19, 2014, respectively,

were as follows:

For the Year Ended December 31

2014 2013

Cash

Dividends

Share

Dividends

Cash

Dividends

Share

Dividends

Bonus to

employees $88,334 $ - $ - $ -

There was no difference between the amounts of the

bonus to employees approved in the shareholders'

meetings on June 2, 2015 and June 19, 2014 and the

amounts recognized in the financial statements for the

years ended December 31, 2014 and 2013, respectively.

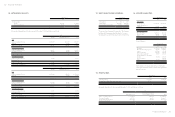

e. Impairment losses on non-financial assets

For the Year Ended

December 31

2015 2014

Inventories (included in

operating costs) $2,150,302 $557,580

Property, plant and equipment

(included in other gains and

losses) 524,247 -

For the Year Ended

December 31

2015 2014

Investments accounted for by

the equity method (included in

other gains and losses) $ - $174,253

Prepaid expenses (including in

other gains and losses) 1,268,643 -

$3,943,192 $731,833

(Concluded)

f. Gain or loss on foreign currency exchange

For the Year Ended

December 31

2015 2014

Foreign exchange gains $ 7,445,466 $7,201,630

Foreign exchange losses (7,737,016) (7,150,726)

$( 291,550) $ 50,904

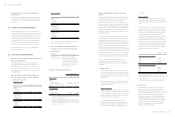

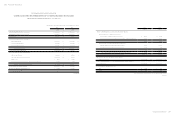

24. INCOME TAXES RELATING TO

CONTINUING OPERATIONS

a. Income tax (benefit) expense recognized in

profit or loss

For the Year Ended

December 31

2015 2014

Current tax

In respect of the current period $ 211 $44,578

Adjustments for prior periods ( 2,451) -

( 2,240) 44,578

Deferred tax

In respect of the current period ( 1,246,236) 3,591

Income tax (benefit) expense

recognized in profit or loss $( 1,248,476) $ 48,169

The income tax (benefit) expense for the years ended

December 31, 2015 and 2014 can be reconciled to the

accounting (loss) profit as follows:

For the Year Ended

December 31

2015 2014

(Loss) profit before income tax $(16,781,544) $ 1,531,215

Income tax calculated at 17% ( 2,852,862) 260,306

(Continued)

(Continued)