HTC 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

210

211

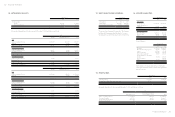

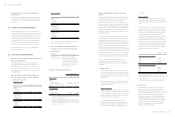

At the end of the reporting period, the proportion of

ownership and voting rights in subsidiaries held by the

Company were as follows:

December 31

2015 2014

H.T.C. (B.V.I.) Corp. 100.00% 100.00%

Communication Global Certification Inc. 100.00% 100.00%

High Tech Computer Asia Pacific Pte.

Ltd. 100.00% 100.00%

HTC Investment Corporation 100.00% 100.00%

PT. High Tech Computer Indonesia 1.00% 1.00%

HTC I Investment Corporation 100.00% 100.00%

HTC Holding Cooperatief U.A. 0.01% 0.01%

HTC Investment One (BVI) Corporation 100.00% 100.00%

HTC Investment (BVI) Corp. 100.00% -

HTC VIVE Holding (BVI) Corp. 100.00% -

Refer to Note 15 to the consolidated financial statements

for the year ended December 31, 2015 for the details of the

subsidiaries indirectly held by the Company.

The Company and its subsidiary, High Tech Computer Asia

Pacific Pte. Ltd., acquired equity interests of 1% and 99%,

respectively, in PT. High Tech Computer Indonesia and

acquired equity interests of 0.01% and 99.99%, respectively,

in HTC Holding Cooperatief U.A. As a result, PT. High Tech

Computer Indonesia and HTC Holding Cooperatief U.A. are

considered as subsidiaries of the Company.

The share of net income or loss and other comprehensive

income from subsidiaries under equity method were

accounted for based on the audited financial statements.

Investments in Joint Ventures

December 31

2015 2014

Unlisted equity investments

Huada Digital Corporation $208,312 $218,825

At the end of the reporting period, the proportion of

ownership and voting rights in joint ventures held by the

Company were as follows:

December 31

Name of Joint Venture 2015 2014

Huada Digital Corporation 50.00% 50.00%

The Company set up a subsidiary Huada, whose main

business is software services, in December 2009. In October

2011, Chunghwa Telecom Co., Ltd. invested in Huada. In

March 2012, Huada held a stockholders' meeting and re-

elected its directors and supervisors. As a result, the

investment type was changed to joint venture and the

Company continued to account for this investment by the

equity method.

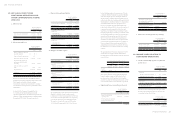

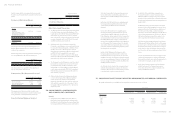

Aggregate information of joint ventures that are not

individually material:

For the Year Ended

December 31

2015 2014

The Company's share of:

Losses from continuing operations $(10,513) $(8,679)

Other comprehensive income - -

Total comprehensive losses for the

period $(10,513) $(8,679)

Investments in joint ventures accounted for by the

equity method and the share of profit or loss and other

comprehensive income of those investments were calculated

based on the financial statements that have not been

audited. Management believes there is no material impact

on the equity method accounting or the calculation of the

share of profit or loss and other comprehensive income, as

the financial statement have not been audited.

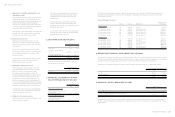

15. PROPERTY, PLANT AND EQUIPMENT

December 31

2015 2014

Carrying amounts

Land

Buildings

Machinery and equipment

Other equipment

$ 6,311,135

5,249,869

1,227,343

364,519

$ 7,462,489

8,096,521

2,641,228

459,870

$13,152,866 $18,660,108

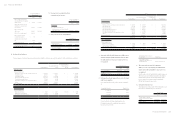

Movement of property, plant and equipment for the years

ended December 31, 2015 and 2014 were as follows:

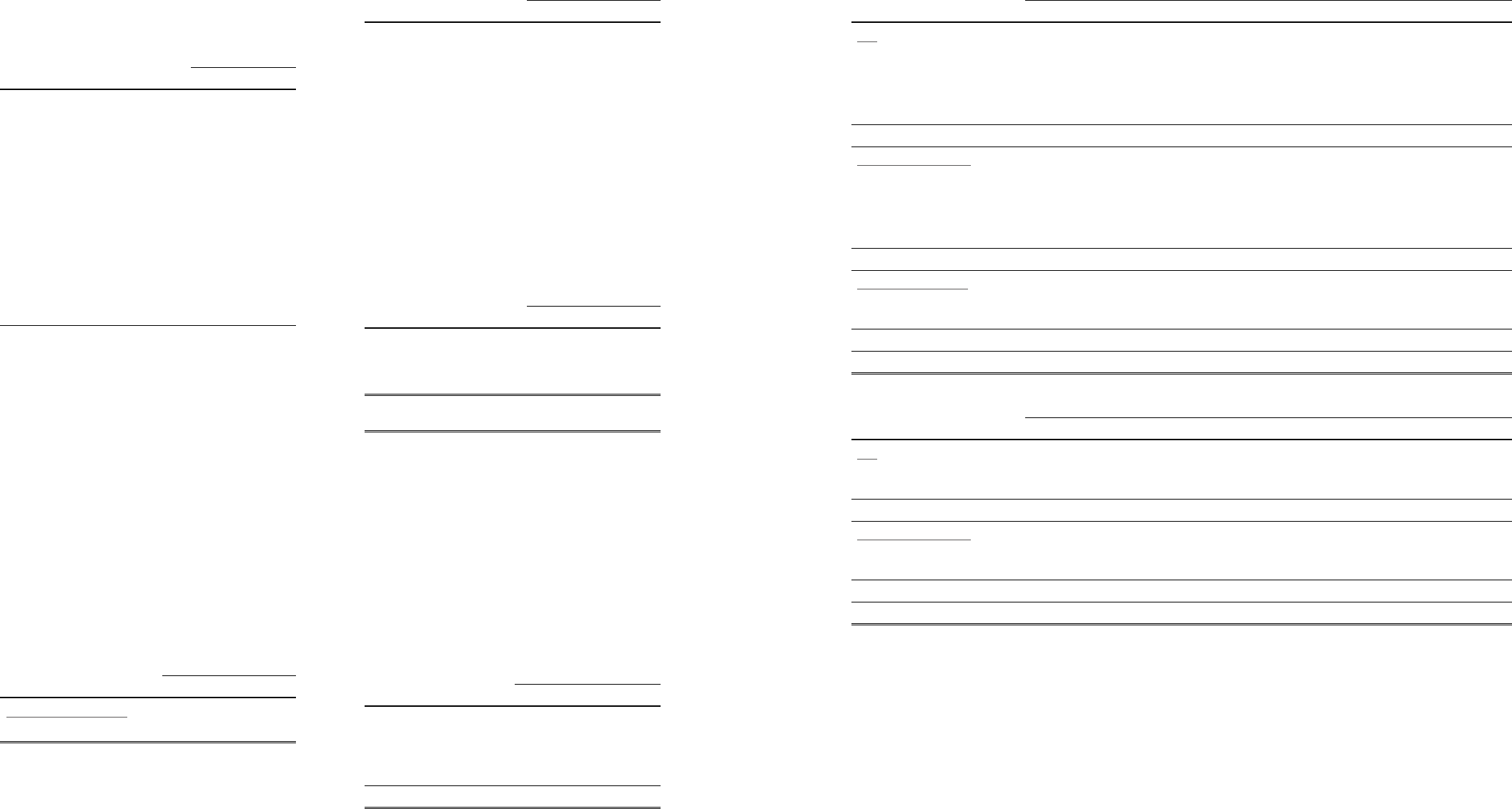

2015

Land Buildings Machinery and Equipment Other Equipment Total

Cost

Balance, beginning of the year

Additions

Disposals

Transfer to expense

Reclassification

$ 7,462,489

-

-

-

( 1,151,354)

$ 10,027,634

139,854

( 373,285)

-

( 3,011,581)

$ 10,095,828

163,046

( 547,015)

( 8,577)

-

$ 1,283,307

70,714

( 82,794)

-

-

$ 28,869,258

373,614

( 1,003,094)

( 8,577)

( 4,162,935)

Balance, end of the year 6,311,135 6,782,622 9,703,282 1,271,227 24,068,266

Accumulated depreciation

Balance, beginning of the year

Depreciation expenses

Disposals

Transfer to expense

Reclassification

-

-

-

-

-

1,931,113

369,583

( 373,285)

-

( 394,658)

7,454,600

1,047,596

( 546,982)

( 238)

-

823,437

162,781

( 82,794)

-

-

10,209,150

1,579,960

( 1,003,061)

( 238)

( 394,658)

Balance, end of the year - 1,532,753 7,954,976 903,424 10,391,153

Accumulated impairment

Balance, beginning of the year

Impairment losses

-

-

-

-

-

520,963

-

3,284

-

524,247

Balance, end of the year - - 520,963 3,284 524,247

Net book value, end of the year $ 6,311,135 $ 5,249,869 $ 1,227,343 $ 364,519 $ 13,152,866

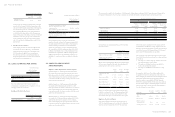

2014

Land Buildings Machinery and Equipment Other Equipment Total

Cost

Balance, beginning of the year

Additions

$7,462,489

-

$ 9,804,511

223,123

$ 9,743,475

352,353

$ 1,197,501

85,806

$28,207,976

661,282

Balance, end of the year 7,462,489 10,027,634 10,095,828 1,283,307 28,869,258

Accumulated depreciation

Balance, beginning of the year

Depreciation expenses

-

-

1,559,449

371,664

6,214,205

1,240,395

660,714

162,723

8,434,368

1,774,782

Balance, end of the year - 1,931,113 7,454,600 823,437 10,209,150

Net book value, end of the year $7,462,489 $ 8,096,521 $ 2,641,228 $ 459,870 $ 18,660,108

The above items of property, plant and equipment were depreciated on a straight-line basis over the estimated useful lives as follows:

Building 5-50 years

Machinery and equipment 3-6 years

Other equipment 3-5 years

The major component parts of the buildings held by the Company included plants, electro-powering machinery and engineering

systems, etc., which were depreciated over their estimated useful lives of 40 to 50 years, 20 years and 5 to 10 years, respectively.

There were no interests capitalized for the years ended December 31, 2015 and 2014.