HTC 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

208

209

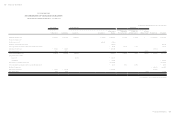

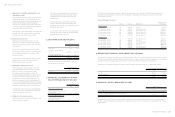

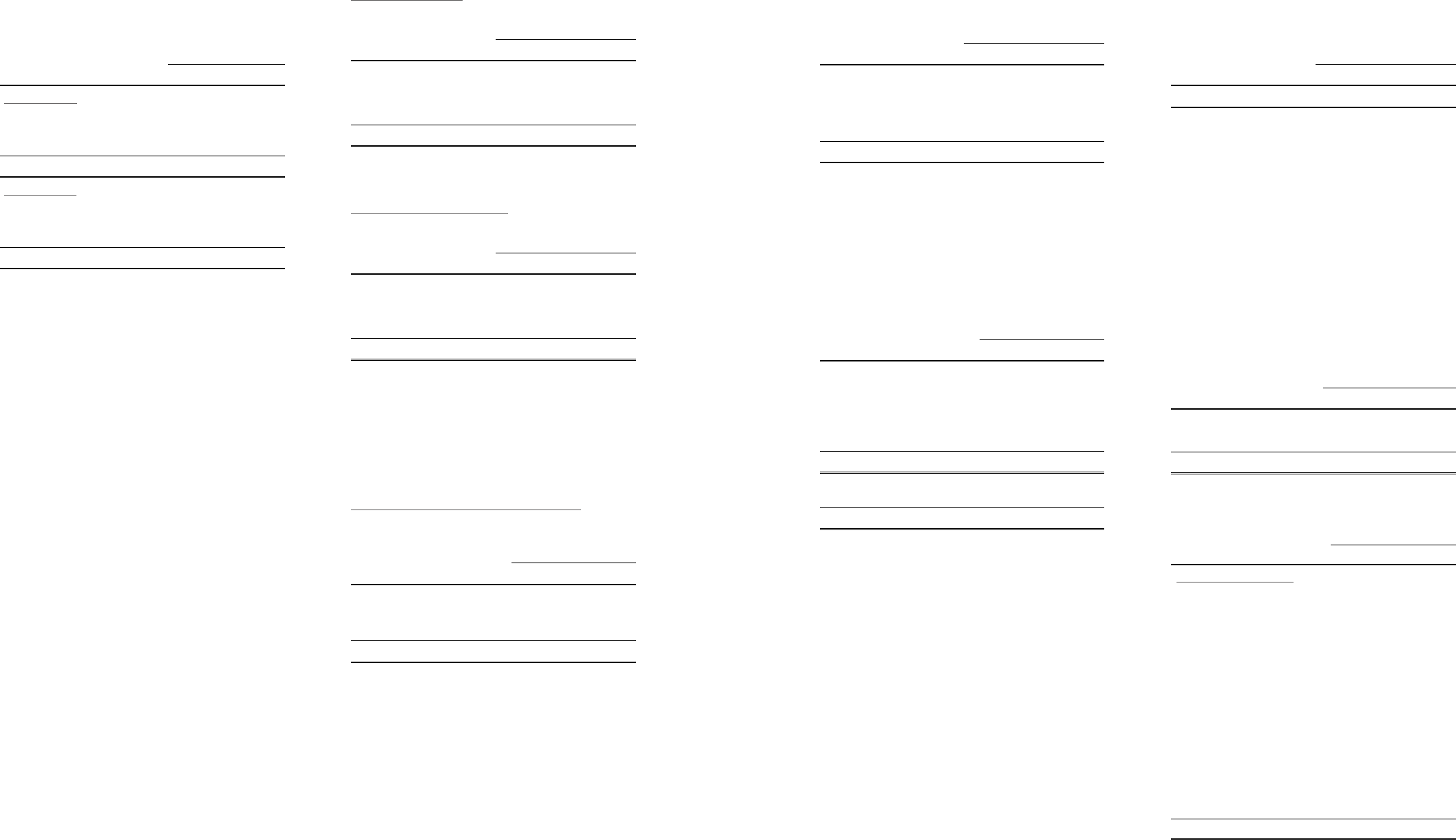

10. TRADE RECEIVABLES AND OTHER

RECEIVABLES

December 31

2015 2014

Trade receivables

Trade receivables

Trade receivables - related parties

Less: Allowances for impairment loss

$ 9,023,892

7,955,352

( 3,012,869)

$ 15,455,951

16,250,234

( 3,050,907)

$ 13,966,375 $ 28,655,278

Other receivables

VAT refund receivables

Interest receivables

Others

$ 132,110

1,013

124,377

$ 58,468

8,592

257,367

$ 257,500 $ 324,427

Trade Receivables

The credit period on sales of goods is 30-75 days. No

interest is charged on trade receivables before the due

date. Thereafter, interest is charged at 1-18% per annum

on the outstanding balance, which is considered to be non-

controversial, to some of customers. In determining the

recoverability of a trade receivable, the Company considered

any change in the credit quality of the trade receivable

since the date credit was initially granted to the end of

the reporting period. For customers with low credit risk,

the Company has recognized an allowance for doubtful

debts of 1-5% against receivables past due beyond 31-90

days and of 5-100% against receivables past due beyond 91

days. For customers with high credit risk, the Company has

recognized an allowance for impairment loss of 10-100%

against receivables past due more than 31 days.

Before accepting any new customer, the Company's

Department of Financial and Accounting evaluates the

potential customer's credit quality and defines credit limits

and scorings by customer. The factor of overdue attributed

to customers are reviewed once a week and the Company

evaluates the financial performance periodically for the

adjustment of credit limits.

The concentration of credit risk is limited due to the fact

that the customer base is diverse.

As of the reporting date, the Company had no receivables

that are past due but not impaired.

Age of trade receivables

December 31

2015 2014

1-90 days $6,050,058 $ 8,460,909

91-180 days 674,498 281,674

Over 181 days 1,540,635 6,491,590

$ 8,265,191 $15,234,173

The above aging schedule was based on the past due date.

Age of impaired trade receivables

December 31

2015 2014

1-90 days $5,252,322 $ 8,233,369

91-180 days - 3,949,897

Over 181 days - -

$5,252,322 $12,183,266

The above aging of trade receivables after deducting the

allowance for impairment loss were presented based on the

past due date.

The movements of the allowance for doubtful trade

receivables were as follows:

Movement in the allowances for impairment loss

For the Year Ended

December 31

2015 2014

Balance, beginning of the year $ 3,050,907 $3,050,907

Less: Amounts written off as

uncollectible ( 38,038) -

Balance, end of the year $ 3,012,869 $3,050,907

Other Receivables

Others were primarily prepayments on behalf of vendors or

customers and grants from suppliers.

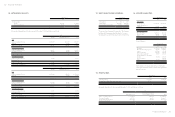

11. INVENTORIES

December 31

2015 2014

Finished goods

Work-in-process

Semi-finished goods

Raw materials

Inventory in transit

$ 1,740,629

447,708

2,615,846

10,425,440

604,543

$ 1,009,421

697,801

3,188,532

9,096,247

438,308

$15,834,166 $14,430,309

The cost of inventories recognized as cost of goods sold

for the years ended December 31, 2015 and 2014 included

inventory write-downs of NT$2,150,302 thousand and

NT$557,580 thousand, respectively.

12. PREPAYMENTS

December 31

2015 2014

Royalty

Prepayments to suppliers

Software and hardware maintenance

Service

Prepaid equipment

Others

$7,033,244

251,338

176,955

159,781

78,888

195,547

$10,796,985

1,575,529

202,835

197,702

126,878

136,313

$7,895,753 $13,036,242

Current

Non-current

$3,377,222

4,518,531

$ 4,630,779

8,405,463

$7,895,753 $13,036,242

Prepayments for royalty were primarily for getting royalty

right and were classified as current or non-current in

accordance with their nature. For details of content of

contracts, please refer to Note 32.

Prepayments to suppliers were primarily for discount

purposes and were classified as current or non-current in

accordance with their nature.

In June 2015, the Company determined that the recoverable

amount of partial prepayments was less than its carrying

amount, and thus recognized an impairment loss of

NT$1,268,643 thousand.

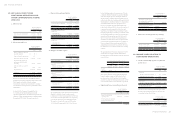

13. NON-CURRENT ASSETS HELD FOR

SALE

December 31

2015 2014

Land and buildings held for sale $3,768,277 $ -

On December 29, 2015, the Company's board of directors

resolved to sell a plot of land and buildings to Inventec

Corporation for a total amount of NT$6,060,000 thousand.

Since the transfer process of this transaction was not

completed on December 31, 2015, the land and building were

temporarily accounted for as “non-current assets held for

sale”. No impairment loss was recognized on classification

of the land and buildings as held for sale for the year ended

December 31, 2015.

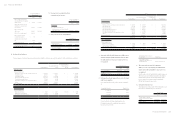

14. INVESTMENTS ACCOUNTED FOR

USING EQUITY METHOD

December 31

2015 2014

Investment in subsidiaries $41,272,544 $42,276,929

Investment in joint ventures 208,312 218,825

$ 41,480,856 $42,495,754

Investments in Subsidiaries

December 31

2015 2014

Unlisted equity investments

H.T.C. (B.V.I.) Corp. $ 3,311,970 $ 2,915,646

Communication Global

Certification Inc. 400,897 434,336

High Tech Computer Asia Pacific

Pte. Ltd. 31,366,465 32,416,366

HTC Investment Corporation 287,186 284,774

PT. High Tech Computer Indonesia 62 62

HTC I Investment Corporation 261,996 260,949

HTC Holding Cooperatief U.A. 13 13

HTC Investment One (BVI)

Corporation 5,003,823 5,964,783

HTC Investment (BVI) Corp. 638,990 -

HTC VIVE Holding (BVI) Corp. 1,142 -

$41,272,544 $42,276,929