HTC 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

178

179

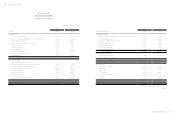

3. Financial Analysis for the Past Five Fiscal Years

(1) Financial Analysis for the Past Five Fiscal Years

Item

Year

2015 2014 2013 2012 2011

Capital

Structure

Analysis

DebtRatio(%) 49 51 54 59

Financial

analysis was

based on ROC

GAAP

Long-termFundtoFixedAssetsRatio(%) 493 431 393 407

Liquidity

Analysis

CurrentRatio(%) 93 103 97 103

QuickRatio(%) 62 80 72 82

DebtServicesCoverageRatio(%) ( 2,145 ) 94 ( 195 ) 52,916

Operating

Performance

Analysis

Average Collection Turnover(Times) 4.81 5.65 5.43 5.02

Days Sales Outstanding 76 65 67 73

AverageInventoryTurnover(Times) 5.68 7.66 7.12 7.85

AveragePaymentTurnover(Times) 2.61 3.65 2.62 2.84

AverageInventoryTurnoverDays 64 48 51 46

Fixed Assets Turnover (Times) 7.36 9.10 9.84 15.45

Total Assets Turnover (Times) 0.81 1.06 1.07 1.22

Profitability

Analysis

ReturnonTotalAssets(%) (10.69) 0.90 ( 0.72 ) 7.57

ReturnonEquity(%) ( 21.41 ) 1.88 (1.68) 18.52

Ratioofincomebeforetaxtopaid-incapital(%) ( 202 ) 18.34 (15.26) 198.73

NetMargin(%) (13.27) 0.85 (0.68) 6.21

BasicEarningsPerShare(NT$) ( 18.79 ) 1.80 (1.60) 20.21

Cash Flow

CashFlowRatio(%) ( 20.87 ) 0.72 (14.76) 19.50

CashFlowAdequacyRatio(%) 94.56 110.33 113.13 128.67

CashFlowReinvestmentRatio(%) ( 17.81 ) 0.65 ( 17.28 ) ( 12.04 )

Leverage

Operating Leverage ( 0.71 ) 37.00 ( 5.87 ) 2.37

Financial Leverage 1 1 1 1

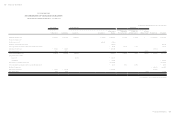

1. Capital Structure & Liquidity Analyses

Owing to net cash outflow for operating activities in 2015, the decrease in current and quick asset has

resulted in decline in current ratio and quick ratio. Debt ratio was lower compared to previous year due

to decrease in purchase and payables for royalty and operating expenses. Long-term funds to fixed asset

ratio was higher compared to previous year given lowered book value for fixed asset after impairment

assessment and strict capex control.

2. Operating Performance Analysis

Due to decline in revenue as a result of intensified competition and weak global economics, our fixed

asset turnover and total asset turnover were all lower compared to previous year, while days sales

outstanding and inventory turnover days were higher compared to the previous year.

3. Profitability Analysis

Profitabilitydeclinedcomparedtothepreviousyearduetoproducttransitionandintensifiedcompetitionin

smartphone market.

4. Cash Flow Analysis

As we recorded a loss in 2015, our net cash outflow from operating activities saw an increase from the

previous year, resulting in negative cash flow ratio and lower cash flow adequacy ratio.

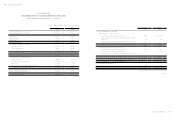

(2) Financial Analysis – ROC GAAP

Item

Year

2015 2014 2013 2012 2011

Capital

Structure

Analysis

DebtRatio(%)

FinancialanalysiswasbasedonIFRS

60 59

Long-termFundtoFixedAssetsRatio(%) 403 658

Liquidity

Analysis

CurrentRatio(%) 103 123

QuickRatio(%) 80 100

DebtServicesCoverageRatio(%) 52,892 6,806

Operating

Performance

Analysis

Average Collection Turnover (Times) 5.02 6.95

Days Sales Outstanding 73 53

AverageInventoryTurnover(Times) 7.85 12.11

AveragePaymentTurnover(Times) 2.78 4.85

AverageInventoryTurnoverDays 46 30

Fixed Assets Turnover (Times) 15.31 34.52

Total Assets Turnover (Times) 1.12 1.94

Profitability

Analysis

ReturnonTotalAssets(%) 8 29

ReturnonEquity(%) 18 70

Paid-inCapitalRatio(%)

Operating

Income 173 761

Pre-tax

Income 199 820

NetMargin(%) 6 14

BasicEarningsPerShare(NT$) 20.17 73.32

Cash Flow

CashFlowRatio(%) 19 58

CashFlowAdequacyRatio(%) 129 163

CashFlowReinvestmentRatio(%) (12) 52

Leverage

Operating Leverage 2.37 1.35

Financial Leverage 1 1