HTC 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

258

259

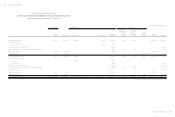

For the Year Ended

December 31

2015 2014

Revenues

Other gains and losses

$22,604

1,258

$102,057

1,939

$ 23,862 $103,996

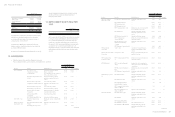

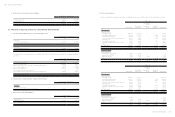

9. FINANCIAL ASSETS MEASURED AT

COST

December 31

2015 2014

Domestic unlisted equity investment

Overseas unlisted equity investment

Overseas unlisted mutual funds

$ 643,961

2,054,310

697,880

$ 643,961

1,423,818

518,699

$ 3,396,151 $2,586,478

Classified according to financial asset

measurement categories

Available-for-sale financial assets $ 3,396,151 $2,586,478

Management believed that the above unlisted equity

investments and mutual funds held by the Company, whose

fair value cannot be reliably measured due to the range of

reasonable fair value estimates was so significant; therefore,

they were measured at cost less impairment at the end of

reporting period.

The Company disposed of the investments in Primavera

Capital (Cayman) Fund L.L.P. and Shanghai F-road

Commercial Co., Ltd. in May 2014. Furthermore, the

Company made a partial disposal of shares of KKBOX Inc. in

August 2014. These transactions resulted in the recognition of

a gain in profit or loss, calculated as follows:

Proceeds of disposal $ 2,358,135

Less: Carrying amount of investment

on the date of disposal (2,200,140)

Gain recognized $ 157,995

In 2014, the Company determined that the recoverable

amount of financial assets measured at cost was less than its

carrying amount and thus recognized an impairment loss of

$373,257 thousand.

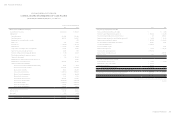

10. OTHER CURRENT FINANCIAL

ASSETS

December 31

2015 2014

Time deposits with original

maturities more than three months $4,100,290 $334,954

The market rate intervals of time deposits with original

maturities more than three months at the end of the

reporting period were as follows:

December 31

2015 2014

Time deposits with original

maturities more than three months 0.51%-1.95% 0.30%-3.08%

For details of pledged other current financial assets, please

refer to Note 33.

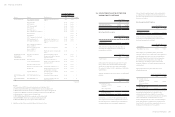

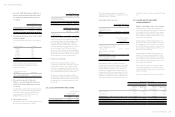

11. TRADE RECEIVABLES AND OTHER

RECEIVABLES

December 31

2015 2014

Trade receivables

Trade receivables

Trade receivables - related parties

Less: Allowances for impairment

loss

$ 21,534,175

1,687

( 3,016,914)

$ 32,194,141

925

( 3,054,782)

$ 18,518,948 $ 29,140,284

Other receivables

Receivables from disposal of

investments

VAT refund receivables

Interest receivables

Others

$ 1,305,943

273,024

188,431

188,168

$ 1,251,073

246,900

102,771

327,005

$ 1,955,566 $ 1,927,749

Current - other receivables $ 466,791 $ 584,936

Non-current - other receivables 1,488,775 1,342,813

$ 1,955,566 $ 1,927,749

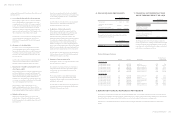

Trade Receivables

The credit period on sales of goods is 30-75 days. No

interest is charged on trade receivables before the due

date. Thereafter, interest is charged at 1-18% per annum

The movements of the allowance for doubtful trade

receivables were as follows:

Movement in the allowances for impairment loss

For the Year Ended

December 31

2015 2014

Balance, beginning of the year

Add: Impairment losses

recognized on receivables

Less: Amounts written off

during the year as

uncollectible

Add: Effect of foreign currency

exchange differences

$ 3,054,782

-

( 38,038)

170

$3,050,907

3,875

-

-

Balance, end of the year $ 3,016,914 $3,054,782

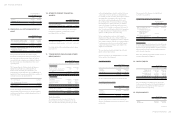

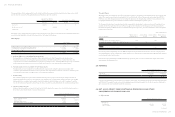

Other Receivables

Receivable from disposal of investments is derived from sale

of shares of Saffron Media Group Ltd. in 2013. According to

the agreement, the principle and interest will be received in

full in September 2018 and could be repaid by the buyer in

whole or in part, at any time.

Others were primarily prepayments on behalf of vendors or

customers and grants from suppliers.

12. INVENTORIES

December 31

2015 2014

Finished goods

Work-in-process

Semi-finished goods

Raw materials

Inventory in transit

$ 4,060,279

460,282

3,073,114

10,930,317

599,645

$ 2,925,203

686,398

3,692,029

9,491,854

417,576

$19,123,637 $17,213,060

The cost of inventories recognized as cost of goods sold

for the year ended December 31, 2015 and 2014 included

inventory write-downs of NT$1,939,446 thousand and

NT$521,692 thousand, respectively.

13. PREPAYMENTS

December 31

2015 2014

Royalty

Net input VAT

$6,978,900

1,082,836

$12,068,674

1,848,355

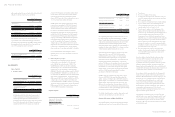

on the outstanding balance, which is considered to be non-

controversial, to some of customers. In determining the

recoverability of a trade receivable, the Company considered

any change in the credit quality of the trade receivable

since the date credit was initially granted to the end of

the reporting period. For customers with low credit risk,

the Company has recognized an allowance for doubtful

debts of 1-5% against receivables past due beyond 31-90

days and of 5-100% against receivables past due beyond 91

days. For customers with high credit risk, the Company has

recognized an allowance for impairment loss of 10-100%

against receivables past due more than 31 days.

Before accepting any new customer, the Company's

Department of Financial and Accounting evaluates the

potential customer's credit quality and defines credit limits

and scorings by customer. The factor of overdue attributed

to customers are reviewed once a week and the Company

evaluates the financial performance periodically for the

adjustment of credit limits.

The concentration of credit risk is limited due to the fact

that the customer base is diverse.

As of the reporting date, the Company had no receivables

that are past due but not impaired.

Age of trade receivables

December 31

2015 2014

1-90 days

91-180 days

Over 181 days

$ 1,129,769

95,996

2,840,451

$3,322,048

36,184

2,642,973

$4,066,216 $6,001,205

The above aging schedule was based on the past due date.

Age of impaired trade receivables

December 31

2015 2014

1-90 days

91-180 days

Over 181 days

$1,049,302

-

-

$2,946,423

-

-

$1,049,302 $2,946,423

The above aging of trade receivables after deducting the

allowance for impairment loss were presented based on the

past due date.

(Continued)