HTC 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital and shares

Capital and shares

122

123

(4) List of principal shareholders:

2016.04.26EachsharehasaparvalueofNT$10

Name of principal shareholders

Shares

Current Shareholding Percentage

Way-ChihInvestmentCo.,LTD. 43,819,290 5.29%

Way-LienTechnologyInc. 38,588,231 4.66%

Cher Wang 32,272,427 3.90%

Hon-MouInvestmentCo.,Ltd. 23,885,081 2.89%

Wen-Chi Chen 22,391,389 2.71%

StandardCharteredBankcustodyforFIDELITYFUND 12,094,000 1.46%

StandardCharteredBankincustodyforVANGUARDEMERGINGMARKETSSTOCK

INDEXFUND 11,283,925 1.36%

Kun-ChangInvestmentCo,Ltd. 9,322,824 1.13%

JPMorganChaseBankN.A.,TaipeiBranchincustodyforVanguardTotalInternational

StockIndexFund,aseriesofVanguardStarFunds 7,576,792 0.92%

CTBCBankincustodyforrestrictedstockwithvotingrightsforHTCCorp.employees 7,176,790 0.87%

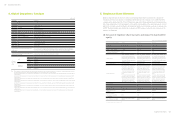

(5) Share prices for the past two fiscal years, the Company’s net

worth per share, earnings per share, dividends per share, and

related information:

Year

Item 2014 2015

2016.01.01~

2016.03.31

Marketprice

per share

Highest market price 180 161 136.5

Lowest market price 118 40.35 70.2

Average market price 140.01 96.52 75.71

Net worth per

share

(Note)

Beforedistribution 97.02 78.27 74.61

After distribution 96.64 78.27(Note) 74.61

Earnings

(loss) per

share

Weighted average shares (thousand shares) 824,816 826,784 827,667

Earnings (loss) per share 1.80 (18.79) (3.16)

Retroactivelyadjustedearnings(loss)per

share 1.80 (18.79)(Note) (3.16)

Dividends per

share

Cash dividends 0.38 0(Note)

Stock

dividends

Dividends from retained earnings 0 0(Note)

Dividends from capital surplus - -

Accumulated undistributed dividend - -

Return on

investment

Price/Earningsration 77.78 NA

Price/Dividendratio 368.45 NA

Cash dividend yield 0.03% 0%

Note:2016pendingontheapprovaloftheShareholdersMeeting.

(6) Dividend policy:

1. Dividend policy:

Since the Company is in the capital-intensive technology sector and growing, dividend policy is set with

consideration to factors such as current and future investment climate, demand for working capital,

competitive environment, capital budget, and interests of the shareholders, balancing dividends with

long-termnancialplanningoftheCompany.DividendsareproposedbytheBoardofDirectorstothe

Shareholders’Meetingonayearlybasis.Earningsmaybeallocatedincashorstockdividends,provided

thattheratioofcashdividendsmaynotbelessthan50%oftotaldividends.

AccordingtotheCompany’sArticlesofIncorporation,earningsshallbeallocatedinthefollowingorder:

1. To pay taxes.

2. To cover accumulated losses, if any.

3.Toappropriate10%legalreserveunlessthetotallegalreserveaccumulatedhasalreadyreachedthe

amount of the Company’s authorized capital.

4. To recognize or reverse special reserve return earnings.

5. The board of directors shall propose allocation ratios for any remainder profit after withholding

the amounts under subparagraphs 1 to 4 above plus any unappropriated retained earnings of previ-

ous years based on the dividend policy above and propose such allocatioin ratio at the shareholders’

meeting.

Note: ThedividendpolicyabovewasamendedincompliancewiththeCompanyActofTaiwan.ItwasadoptedbytheBoardonFebruary29,2016and

willbesubmittedforapprovalattheShareholders’MeetingonJune24,2016.

2. Dividend distribution proposed at the most recent shareholder’s meet-

ing: (Proposal adopted by the Board pending approval by the Share-

holders’ Meeting.)

HTCwillnotdistributestockdividendsatthe2016AnnualShareholders’Meeting.

3. There is no material change in dividend policy.

(7) Impact of the stock dividend proposal on operational perfor-

mance and earnings per share:

HTCwillnotdistributestockdividendsatthe2016AnnualShareholders’Meeting;thereforeitisnot

applicable.