HTC 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

228

229

The Company adopted a policy of only dealing with creditworthy counterparties and obtaining sufficient collateral, where

appropriate, as a means of mitigating the risk of financial loss from defaults.

The credit risk information of trade receivables are disclosed in the Note 10.

c. Liquidity risk

The Company manages liquidity risk to ensure that the Company possesses sufficient financial flexibility by maintaining adequate

reserves of cash and cash equivalents and reserve financing facilities, and also monitor liquidity risk of shortage of funds by the

maturity date of financial instruments and financial assets.

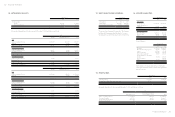

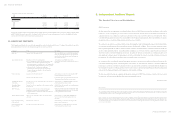

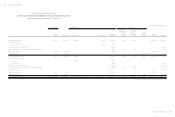

1) Liquidity and interest risk rate tables for non-derivative financial liabilities

The following table details the Company's remaining contractual maturity for its non-derivative financial liabilities with agreed

repayment periods. The tables had been drawn up based on the undiscounted cash flows of financial liabilities from the earliest

date on which the Company can be required to pay.

December 31, 2015

Less Than 3 Months 3 to 12 Months Over 1 Year

Non-derivative financial liabilities

Note and trade payables

Other payables

Other current liabilities

Guarantee deposits received

$ 11,642,922

11,279,562

111,498

-

$18,396,537

12,827,054

145,205

-

$ -

-

-

1,634

$23,033,982 $31,368,796 $1,634

December 31, 2014

Less Than 3 Months 3 to 12 Months Over 1 Year

Non-derivative financial liabilities

Note and trade payables

Other payables

Other current liabilities

Guarantee deposits received

$ 19,389,742

10,952,324

60,588

-

$27,934,589

18,293,729

72,984

-

$ -

-

-

1,160

$30,402,654 $46,301,302 $1,160

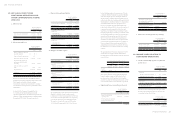

2) Liquidity and interest risk rate tables for derivative financial instruments

The following table detailed the Company's liquidity analysis for its derivative financial instruments. The table was based

on the undiscounted contractual net cash inflows and outflows on derivative instruments that settle on a net basis, and the

undiscounted gross inflows and outflows on those derivatives that require gross settlement.

December 31, 2015

Less Than3 Months 3 Months to 1 Year Over 1 Year

Gross settled

Foreign exchange contracts

Inflows

Outflows

$ 6,658,903

( 6,611,069)

$ 7,187,186

(7,158,069)

$ -

-

$ 47,834 $ 29,117 $ -

December 31, 2014

Less Than3 Months 3 Months to 1 Year Over 1 Year

Net settled

Foreign exchange contracts $ 15,600 $ - $ -

Gross settled

Foreign exchange contracts

Inflows

Outflows

$ 13,853,499

(13,630,802)

$ -

-

$ -

-

$ 222,697 $ - $ -

(Concluded)

3) Bank credit limit

December 31

2015 2014

Unsecured bank general credit limit

Amount used

Amount unused

$ 2,053,485

30,314,067

$ 1,638,476

43,623,999

$32,367,552 $45,262,475

Amount used includes guarantee for customs duties and for patent litigation.

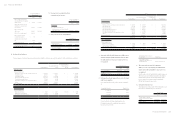

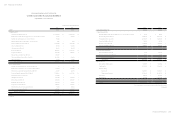

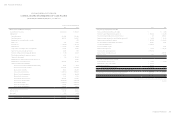

29. RELATED-PARTY TRANSACTIONS

Operating Sales

For the Year Ended December 31

2015 2014

Subsidiaries

Joint venture

Main management

Other related parties - Employees' Welfare Committee

Other related parties - other related parties' chairperson or its significant stockholder, is the

Company's chairperson

$35,572,044

9,971

-

20,920

6,302

$ 58,666,162

-

2,430

22,404

7,513

$35,609,237 $58,698,509

The following balances of trade receivables from related parties were outstanding at the end of the reporting period:

December 31

2015 2014

Subsidiaries

Joint venture

Other related parties - other related parties' chairperson or its significant stockholder, is the

Company's chairperson

$7,953,665

541

1,146

$16,249,309

-

925

$7,955,352 $16,250,234

The selling prices for products sold to related parties were lower than those sold to third parties, except some related parties have no

comparison with those sold to third parties. No guarantees had been given or received for trade receivables from related parties. No

(Continued)