HTC 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

272

273

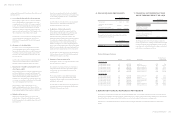

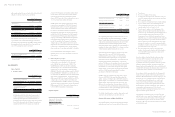

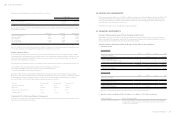

The appropriations of 2014 earnings and the loss off-setting for 2013 had been approved in the shareholders' meetings on June 2, 2015

and June 19, 2014, respectively. The appropriations and dividends per share were as follows:

Appropriation of Earnings

(The Loss Off-setting) Dividends Per Share (NT$)

For 2014 For 2013 For 2014 For 2013

Legal reserve $148,305 $ - $ - $ -

Special reserve reversal - (854,138) - -

Cash dividends 314,636 - 0.38 -

Information on the earnings appropriation proposed by the Company's board of directors and approved by the Company's shareholders

is available on the Market Observation Post System website of the Taiwan Stock Exchange.

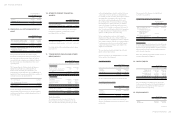

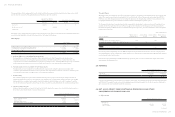

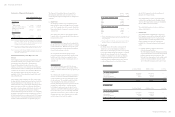

Other Equity

December 31

2015 2014

Exchange differences on translating foreign operations

Unrealized losses on available-for-sale financial assets

Unearned employee benefit

$ 1,473,417

( 13,633)

( 371,369)

$ 1,462,855

( 2,167)

( 398,570)

$ 1,088,415 $ 1,062,118

a. Exchange differences on translating foreign operations

Exchange differences relating to the translation of the results and net assets of the Company's foreign operations from

their functional currencies to the Company's presentation currency (New Taiwan dollars) were recognized directly in other

comprehensive income and accumulated in the foreign currency translation reserve. Exchange differences previously accumulated

in the foreign currency translation reserve were reclassified to profit or loss on the disposal of the foreign operation.

b. Unrealized gains or losses on available-for-sale financial assets

Unrealized gains or losses on available-for-sale financial assets represents the cumulative gains and losses arising on the

revaluation of AFS financial assets that have been recognized in other comprehensive income, net of amounts reclassified to profit

or loss when those assets have been disposed of or are determined to be impaired.

c. Cash flow hedge

The cash flow hedging reserve represents the cumulative effective portion of gains or losses arising on changes in fair value of

hedging instruments entered into for cash flow hedges. The cumulative gain or loss arising on changes in fair value of the hedging

instruments that are recognized and accumulated under the heading of cash flow hedging reserve will be transferred to profit or

loss only when the hedged transaction affects the profit or loss, or included as a basis adjustment to the non-financial hedged item.

d. Unearned employee benefit

In the meeting of shareholders on June 2, 2015 and June 19, 2014, the shareholders approved a restricted stock plan for employees.

Refer to Note 29 for the information of restricted shares issued.

For the Year Ended December 31

2015 2014

Balance, beginning of the year

Issuance of shares

Adjustment of turnover rate

Share-based payment expenses recognized

$(398,570)

(233,265)

3,395

257,071

$ -

(443,855)

-

45,285

Balance, end of the year $( 371,369) $(398,570)

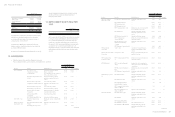

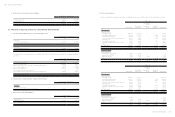

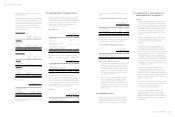

Treasury Shares

On August 24, 2015, the Company's board of directors passed a resolution to buy back 50,000 thousand Company shares from the open

market. The repurchase period was between August 25, 2015 and October 24, 2015, and the repurchase price ranged from NT$35 to

NT$60 per share. If the Company's share price i lower than this price range, the Company may continue to buy back its shares. The

Company had bought back 4,110 thousand shares for NT$200,955 thousand during the repurchase period.

The Company had repurchased company shares from the open market for transferring to employees and some of them had not been

transferred before the expiry time. The Board of Directors approved the retirement of 6,914 thousand, 10,000 thousand and 1,999

thousand treasury shares in March 2015, October 2014 and February 2014, respectively. The related information on the treasury share

transactions was as follows:

(In Thousands of Shares)

Reason to Reacquire

Number of Shares,

Beginning of Year

Addition During

the Year

Reduction During

the Year

Number of Shares,

End of Year

For 2015

To transfer shares to the Company's employees 6,914 - 6,914 -

To maintain the Company's credibility and stockholders' interest - 4,110 - 4,110

6,914 4,110 6,914 4,110

For 2014

To transfer shares to the Company's employees 18,913 - 11,999 6,914

Based on the Securities and Exchange Act of the ROC, the number of reacquired shares should not exceed 10% of a company's issued

and outstanding shares, and the total purchase amount should not exceed the sum of the retained earnings, additional paid-in capital in

excess of par and realized capital surplus.

Under the Securities and Exchange Act, HTC shall neither pledge treasury shares nor exercise shareholders' rights on these shares,

such as rights to dividends and to vote.

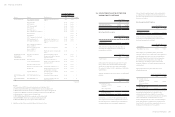

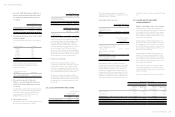

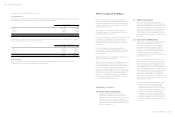

25. REVENUE

For the Year Ended December 31

2015 2014

Sale of goods

Other operating income

$120,087,853

1,596,378

$184,929,230

2,981,970

$121,684,231 $ 187,911,200

Some sales denominated in foreign currencies were hedged for cash flow risk. Accordingly, the Company transferred $22,604 thousand

and NT$102,057 thousand of the gain or loss on the hedging instrument that was determined to be the effective portion of the hedge to

sales of goods for the years ended in 2015 and 2014, respectively.

26. NET (LOSS) PROFIT FROM CONTINUING OPERATIONS AND OTHER

COMPREHENSIVE INCOME AND LOSS

a. Other income

For the Year Ended December 31

2015 2014

Interest income

Bank Deposits

Other receivables

$344,769

75,200

$307,005

96,150

(Continued)