HTC 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

280

281

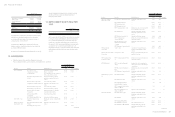

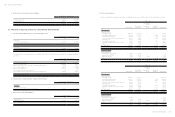

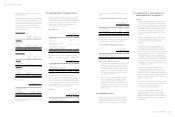

Information about outstanding options as of the reporting date was as follows:

December 31

2015 2014

Range of exercise price (NT$) $54.5-$149 $134.5-149

Weighted-average remaining contractual life (years) 7.30 years 8.22 years

Options granted in August 2015, October 2014 and November 2013 were priced using the trinomial option pricing model and the inputs

to the model were as follows:

August 2015 October 2014 November 2013

Grant-date share price (NT$)

Exercise price (NT$)

Expected volatility

Expected life (years)

Expected dividend yield

Risk-free interest rate

$54.50

$54.50

39.26%

10 years

4.04%

1.3965%

$134.5

$134.5

33.46%

10 years

4.40%

1.7021%

$149.00

$149.00

45.83%

7years

5.00%

1.63%

Expected volatility was based on the historical share price volatility over the past 1 year. The Company assumed that employees would

exercise their options after the vesting date when the share price was 1.63 times the exercise price.

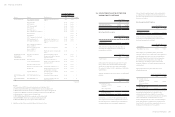

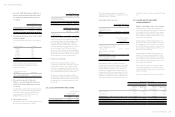

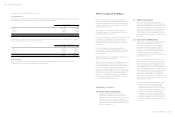

Employee Restricted Shares

In the shareholder meeting on June 19, 2014 and June 2, 2015, the shareholders approved a restricted stock plan for employees with a

total amount of $50,000 thousand and $75,000 thousand, consisting of 5,000 thousand and 7,500 thousand shares. On October 31, 2014,

August 6, 2015, and September 16, 2015, HTC's board of directors passed a resolution to issue 4,600 thousand shares, 400 thousand

shares, and 4,006 thousand shares respectively.

The restrictions on the rights of the employees who acquire the restricted shares but have not met the vesting conditions are as follows:

a. The employees cannot sell, pledge, transfer, donate or in any other way dispose of these shares.

b. The employees holding these shares are entitled to receive cash and dividends in share.

c. The employees holding these shares have no voting rights.

If an employee fails to meet the vesting conditions, HTC will recall or buy back and cancel the restricted shares. In April, July and

October 2015, the Company retired 49 thousand, 117 thousand and 409 thousand restricted shares for employees amounting to NT$492

thousand, NT$1,167 thousand and NT$4,087 thousand. As a result, the amount of the Company's outstanding employee restricted

shares as of December 31, 2015 was 7,243 thousand shares, the other information was as follows:

Grant-date December 23, 2015 August 10, 2015 November 2, 2014

Grant-date fair value (NT$) $76.20 $57.50 $134.50

Exercise price Gratuitous Gratuitous Gratuitous

Numbers of shares (thousand shares) 4,006 400 4,600

Vesting period (years) 1-3 years 1-3 years 1-3 years

Compensation Cost of Share-based Payment Arrangements

Compensation cost of share-based payment arrangement recognized was NT$550,688 thousand and NT$269,013 thousand for the years

ended December 31, 2015 and 2014, respectively.

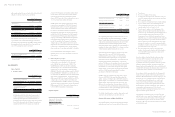

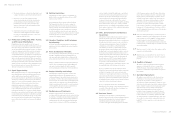

30. CAPITAL RISK MANAGEMENT

The Company manages its capital to ensure its ability to continue as a going concern while maximizing the returns to shareholders. The

Company periodically reviews its capital structure by taking into consideration macroeconomic conditions, prevailing interest rate,

and adequacy of cash flows generated from operations; as the situation would allow, the Company pays dividends, issues new shares,

repurchases shares, issues new debt, and redeems debt.

The Company is not subject to any externally imposed capital requirements.

31. FINANCIAL INSTRUMENTS

Fair Value of Financial Instruments That Are Not Measured at Fair Value

Financial instruments not carried at fair value held by the Company include financial assets measured at cost and debt investments

with no active market. The management considers that the carrying amounts of financial assets and financial liabilities not carried at

fair value approximate their fair value or the fair value are not measured reliably.

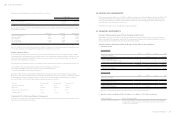

Fair Value of Financial Instruments That Are Measured at Fair Value on a Recurring Basis

a. Fair value hierarchy

December 31, 2015

Level 1 Level 2 Level 3 Total

Financial assets at FVTPL

Derivative financial instruments $ - $95,493 $ - $ 95,493

Available-for-sale financial assets

Domestic listed stocks - equity investments

Overseas listed stocks - equity investments

$ 75

303,289

$ -

-

$ -

-

$ 75

303,289

$ 303,364 $ - $ - $303,364

Financial liabilities at FVTPL

Derivative financial instruments $ - $36,544 $ - $ 36,544

December 31, 2014

Level 1 Level 2 Level 3 Total

Financial assets at FVTPL

Derivative financial instruments $ - $262,544 $ - $262,544

Available-for-sale financial assets

Domestic listed stocks - equity investments $ 93 $ - $ - $ 93

Financial liabilities at FVTPL

Derivative financial instruments $ - $ 22,424 $ - $ 22,424

There were no transfers between Levels 1 and 2 for the years ended December 31, 2015 and 2014.

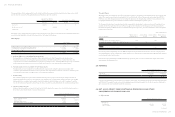

b. Valuation techniques and inputs applied for the purpose of measuring Level 2 fair value measurement

Financial Instruments Valuation Techniques and Inputs

Derivatives - foreign currency contracts Discounted cash flow: Future cash flows are estimated based on observable forward exchange rates

at the end of the reporting period and contract forward rates, discounted at a rate that reflects the

credit risk of various counterparties.