HTC 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

222

223

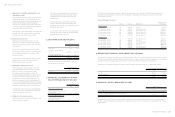

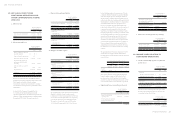

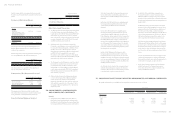

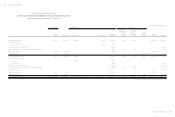

For the Year Ended

December 31

2015 2014

Effect of expenses that were

not deductible in determining

taxable profit $ 22,521 $ 54,623

Share of the profit or loss of

subsidiaries, associates and

joint ventures 232,740 ( 99,899)

Effect of temporary

differences 863,147 ( 211,439)

Effect of loss carryforward 488,274 -

Effect of income that is

exempt from taxation ( 56) -

Adjustments for prior years'

tax ( 2,451) -

Overseas income tax 211 44,578

Income tax (benefit) expense

recognized in profit or loss $( 1,248,476) $ 48,169

(Concluded)

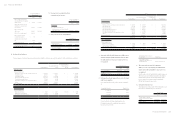

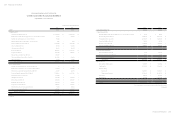

2014

Opening Balance

Recognized in Profit

or Loss

Recognized in Other

Comprehensive

Income Closing Balance

Deferred tax assets

Temporary differences

Allowance for loss on decline in value of inventory

Unrealized profit

Unrealized royalties

Unrealized marketing expenses

Unrealized warranty expense

Unrealized contingent losses on purchase orders

Others

Loss carryforward

$ 259,715

302,267

2,429,433

1,629,920

549,713

99,945

367,515

837,428

$( 46,107)

( 92,314)

( 816,101)

( 276,191)

27,419

( 23,975)

26,150

1,208,854

$ -

-

-

-

-

-

-

-

$ 213,608

209,953

1,613,332

1,353,729

577,132

75,970

393,665

2,046,282

$6,475,936 $ 7,735 $ - $6,483,671

Deferred tax liabilities

Temporary differences

Defined benefit plans

Financial assets at FVTPL

Unrealized gain on investments

$ 15,108

19,476

79,450

$ 1,987

9,339

-

$( 3,980)

-

-

$ 13,115

28,815

79,450

$ 114,034 $ 11,326 $(3,980) $ 121,380

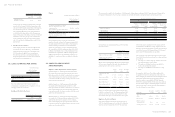

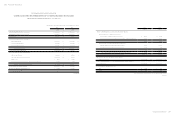

b. Income tax recognized in other

comprehensive income

For the Year Ended

December 31

2015 2014

Deferred tax

Recognized in current year

Remeasurement on defined benefit

plan (tax benefit)

$(5,720)

$(3,980)

c. Current tax assets and liabilities

December 31

2015 2014

Current tax assets

Tax refund receivable

$43,707

$45,994

Current tax liabilities

Income tax payable

$12,495

$ 11,982

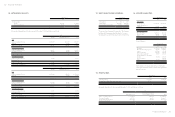

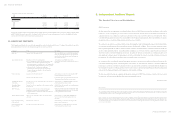

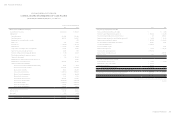

d. Deferred tax balances

The movements of deferred tax assets and deferred tax liabilities for the years ended December 31, 2015 and 2014 were as follows:

2015

Opening Balance

Recognized in Profit

or Loss

Recognized in Other

Comprehensive

Income Closing Balance

Deferred tax assets

Temporary differences

Allowance for loss on decline in value of inventory

Unrealized profit

Unrealized royalties

Unrealized marketing expenses

Unrealized warranty expense

Unrealized contingent losses on purchase orders

Others

Loss carryforward

$ 213,608

209,953

1,613,332

1,353,729

577,132

75,970

393,665

2,046,282

$ 122,586

49,023

( 937,568)

( 306,545)

(4,248)

5,379

109,238

2,109,383

$ -

-

-

-

-

-

-

-

$ 336,194

258,976

675,764

1,047,184

572,884

81,349

502,903

4,155,665

$6,483,671 $ 1,147,248 $ - $7,630,919

Deferred tax liabilities

Temporary differences

Defined benefit plans

Financial assets at FVTPL

Unrealized gain on investments

$ 13,115

28,815

79,450

$ 2,203

( 21,741)

( 79,450)

$(5,720)

-

-

$ 9,598

7,074

-

$ 121,380 $( 98,988) $(5,720) $ 16,672

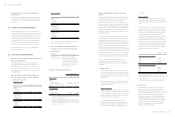

e. Amounts of deductible temporary differences,

unused carryforward and unused tax credits

for which deferred tax assets have not been

recognized

December 31

2015 2014

Loss carryforward $2,806,460 $ 1,045,579

Deductible temporary

differences $3,207,393 $3,466,830

f. Information about unused loss carry-forward

and tax-exemption

Loss carryforwards as of December 31, 2015 comprised

of:

Remaining Carrying Expiry Year

$ 7,662,140 2023

10,513,823 2024

22,777,716 2025

$ 40,953,679

Under the Statute for Upgrading Industries, the

Company was granted exemption from corporate

income tax for as follows:

Item Exempt from Corporate

Income Tax

Expiry Year

Sales of wireless and

smartphone which has 3.5G

and GPS function 2015.01.01-2018.09.30

g. The aggregate amount of temporary

difference associated with investments for

which deferred tax liabilities have not been

recognized

As of December 31, 2015 and 2014, the taxable temporary

differences associated with investment in subsidiaries

and branch for which no deferred tax liabilities have

been recognized were NT$705,923 thousand and

NT$897,465 thousand, respectively.

h. Integrated income tax

The imputation credit account (“ICA”) information as of

December 31, 2015 and 2014, were as follows:

December 31

2015 2014

Unappropriated earnings

generated on and after January

1, 1998 $21,782,432 $41,381,753

Balance of ICA $ 8,196,056 $ 8,164,935