HTC 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

276

277

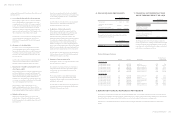

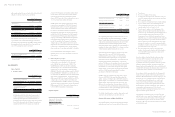

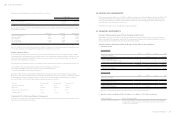

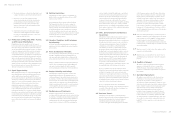

g. Gain or loss on foreign currency exchange

For the Year Ended December 31

2015 2014

Foreign exchange gains

Foreign exchange losses

$ 9,191,220

(8,562,146)

$ 8,647,918

(7,792,506)

$ 629,074 $ 855,412

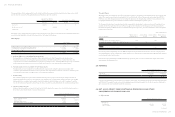

27. INCOME TAXES RELATING TO CONTINUING OPERATIONS

a. Income tax (benefit) expense recognized in profit or loss

For the Year Ended December 31

2015 2014

Current tax

In respect of the current period

Adjustments for prior periods

$ 336,419

( 26,242)

$ 219,434

( 95,001)

310,177 124,433

Deferred tax

In respect of the current period (358,649) 375,947

Income tax (benefit) expense recognized in profit or loss $( 48,472) $ 500,380

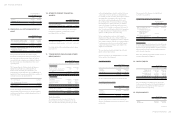

The income tax (benefit) expense for the years ended December 31, 2015 and 2014 can be reconciled to the accounting (loss) profit

as follows:

For the Year Ended December 31

2015 2014

(Loss) profit before income tax $(15,581,540) $ 1,983,426

Income tax calculated at 17%

Effect of expenses that were not deductible in determining taxable profit

Effect of temporary differences

Effect of loss carryforward

Effect of income that is exempt from taxation

Effect of different tax rates of subsidiaries operating in other jurisdictions

Adjustments for prior years' tax

( 2,648,862)

68,650

772,747

1,260,570

( 56)

524,721

( 26,242)

337,182

74,289

( 352,494)

( 4,803)

( 61,983)

603,190

( 95,001)

Income tax (benefit) expense recognized in profit or loss $( 48,472) $ 500,380

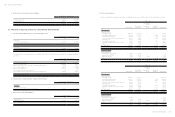

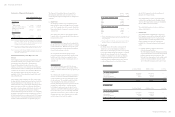

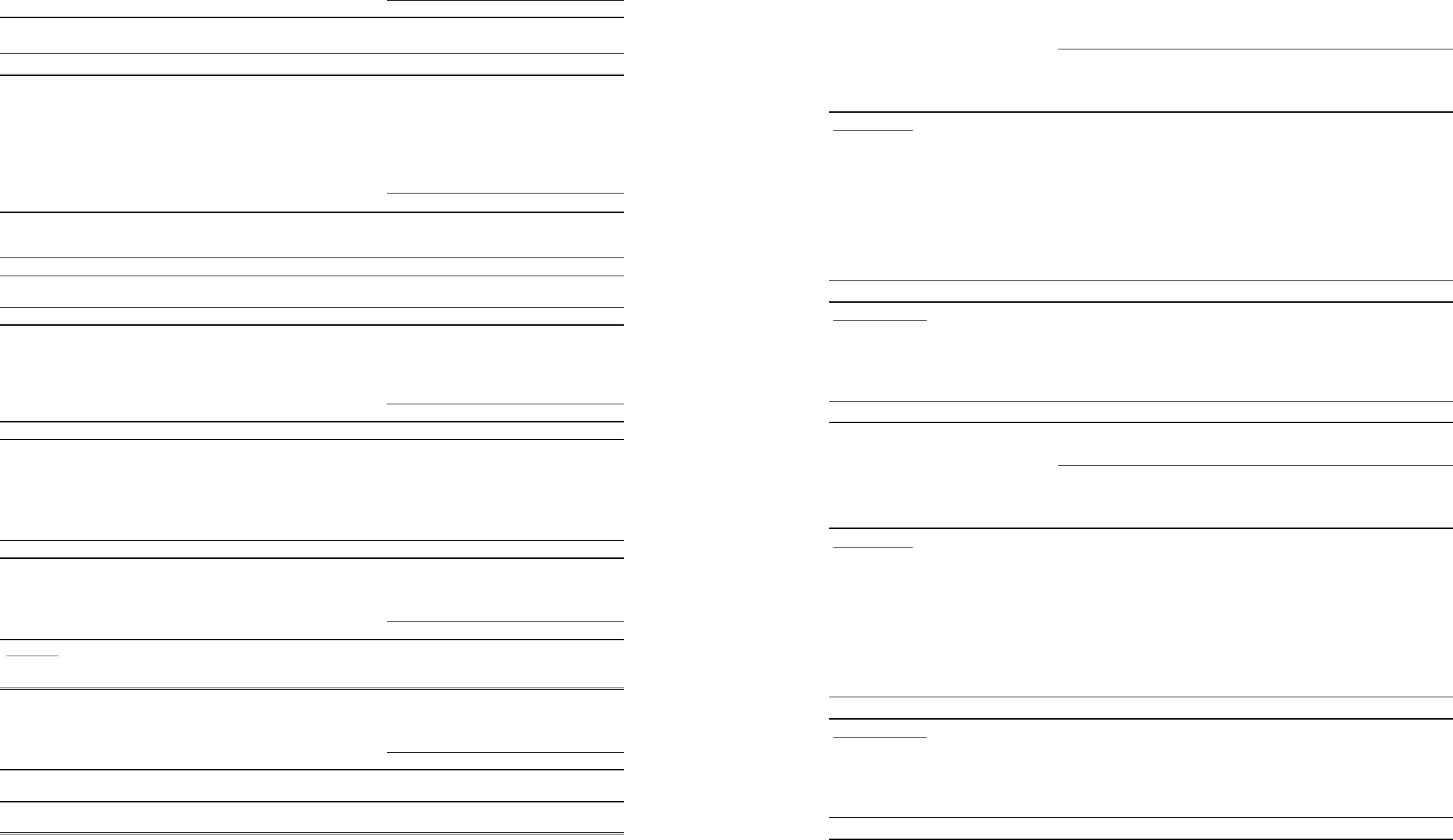

b. Income tax recognized in other comprehensive income

For the Year Ended December 31

2015 2014

Deferred tax

Recognized in current year

Remeasurement on defined benefit plan (tax benefit) $( 5,813) $(4,010)

c. Current tax assets and liabilities

December 31

2015 2014

Current tax assets

Tax refund receivable $212,033 $274,321

Current tax liabilities

Income tax payable $163,252 $ 210,714

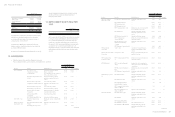

d. Deferred tax balances

The movements of deferred tax assets and deferred tax liabilities for the years ended December 31, 2015 and 2014 were as follows:

2015

Opening Balance

Recognized in

Profit or Loss

Recognized

in Other

Comprehensive

Income

Translation

Adjustment Closing Balance

Deferred tax assets

Temporary differences

Unrealized royalties

Unrealized marketing expenses

Unrealized warranty expense

Allowance for loss on decline in value of inventory

Unrealized profit

Unrealized salary and welfare

Unrealized contingent losses on purchase orders

Others

Loss carryforwards

$1,613,333

1,920,664

630,968

483,557

209,953

223,172

75,971

488,589

2,806,500

$( 937,569)

( 589,877)

( 4,373)

( 70,224)

49,023

( 92,959)

5,379

66,749

1,836,841

$ -

-

-

-

-

-

-

-

-

$ -

( 7,494)

( 676)

( 2,297)

-

2,878

-

( 775)

( 8,011)

$ 675,764

1,323,293

625,919

411,036

258,976

133,091

81,350

554,563

4,635,330

$8,452,707 $ 262,990 $ - $(16,375) $8,699,322

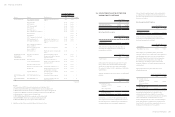

Deferred tax liabilities

Temporary differences

Unrealized gain on investments

Financial assets at FVTPL

Defined benefit plans

Others

$ 79,450

28,815

13,089

81,578

$( 79,450)

( 21,741)

2,164

3,368

$ -

-

(5,813)

-

$ -

-

-

( 4,109)

$-

7,074

9,440

80,837

$ 202,932 $( 95,659) $(5,813) $( 4,109) $ 97,351

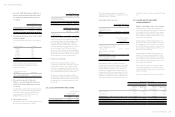

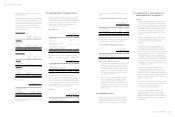

2014

Opening Balance

Recognized in

Profit or Loss

Recognized

in Other

Comprehensive

Income

Translation

Adjustment Closing Balance

Deferred tax assets

Temporary differences

Unrealized royalties

Unrealized marketing expenses

Unrealized warranty expense

Allowance for loss on decline in value of inventory

Unrealized profit

Unrealized salary and welfare

Unrealized contingent losses on purchase orders

Others

Loss carryforwards

$2,429,433

2,338,903

712,434

552,036

302,267

374,925

99,945

405,674

1,449,618

$( 816,100)

( 419,257)

( 108,938)

( 77,656)

( 92,314)

( 174,811)

( 23,974)

37,861

1,360,072

$ -

-

-

-

-

-

-

-

-

$ -

1,018

27,472

9,177

-

23,058

-

45,054

( 3,190)

$ 1,613,333

1,920,664

630,968

483,557

209,953

223,172

75,971

488,589

2,806,500

$8,665,235 $( 315,117) $ - $ 102,589 $ 8,452,707

Deferred tax liabilities

Temporary differences

Unrealized gain on investments

Financial assets at FVTPL

Defined benefit plans

Others

$ 79,450

19,476

15,098

37,098

$ -

9,339

2,001

49,490

$ -

-

(4,010)

-

$ -

-

-

( 5,010)

$ 79,450

28,815

13,089

81,578

$ 151,122 $ 60,830 $(4,010) $( 5,010) $ 202,932