HTC 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information

Financial information

270

271

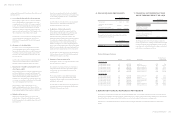

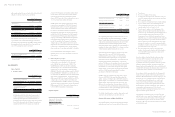

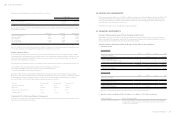

will remain constant, the present value of the defined benefit

obligation would (increase) decrease as follows:

December 31

2015 2014

Discount rates

0.25% increase $ 17,383 $ 15,513

0.25% decrease $(18,225) $(16,252)

Expected rates of salary increase

0.25% increase $( 17,573) $(15,703)

0.25% decrease $ 16,862 $ 15,077

The sensitivity analysis presented above may not be

representative of the actual change in the present value of

the defined benefit obligation as it is unlikely that the change

in assumptions would occur in isolation of one another as

some of the assumptions may be correlated.

December 31

2015 2014

The expected contributions to the

plan for the next year $35,185 $23,786

The average duration of the defined

benefit obligation 15.63 years 14.81 years

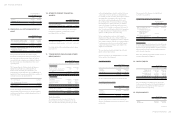

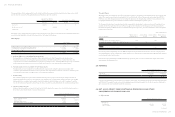

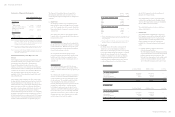

24. EQUITY

Share Capital

a. Ordinary shares

December 31

2015 2014

Numbers of shares authorized

(in thousands of shares) 1,000,000 1,000,000

Shares authorized $10,000,000 $10,000,000

Number of shares issued and

fully paid (in thousands of

shares) 831,870 834,952

Shares issued $ 8,318,695 $ 8,349,521

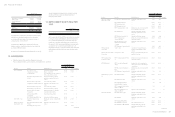

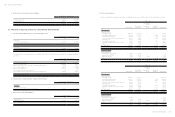

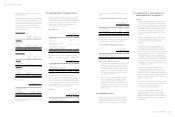

In February and October 2014, the Company retired

1,999 thousand and 10,000 thousand treasury shares

amounting to NT$19,984 thousand and NT$100,000

thousand, respectively. In November 2014, the Company

issued 4,600 thousand restricted shares for employees

amounting to NT$46,000 thousand. As a result, the

amount of the Company's outstanding ordinary shares

as of December 31, 2014 decreased to NT$8,349,521

thousand, divided into 834,952 thousand ordinary

shares at NT$10 par value. Every ordinary share carries

one vote per share and a right to dividends.

In March 2015, the Company retired 6,914 thousand

treasury shares amounting to NT$69,140 thousand.

In August and December 2015, the Company issued

400 thousand and 4,006 thousand restricted shares

for employees amounting to NT$4,000 thousand

and NT$40,060 thousand respectively. In April, July

and October 2015, the Company retired 49 thousand,

117 thousand and 409 thousand restricted shares for

employees amounting to NT$492 thousand, NT$1,167

thousand and NT$4,087 thousand, respectively. As

a result, the amount of the Company's outstanding

ordinary share as of December 31, 2015 decreased to

NT$8,318,695 thousand, divided into 831,870 thousand

ordinary shares at NT$10 par value. Every ordinary

share carries one vote per share and a right to dividends.

80,000 thousand shares of the Company's shares

authorized were reserved for the issuance of employee

share options.

b. Global depositary receipts

In November 2003, HTC issued 14,400 thousand

ordinary shares corresponding to 3,600 thousand

units of Global Depositary Receipts (“GDRs”). For

this GDR issuance, HTC's stockholders, including

Via Technologies, Inc., also issued 12,878.4 thousand

ordinary shares, corresponding to 3,219.6 thousand

GDR units. Thus, the entire offering consisted of 6,819.6

thousand GDR units. Taking into account the effect of

stock dividends, the GDRs increased to 8,782.1 thousand

units (36,060.5 thousand shares). The holders of these

GDRs requested HTC to redeem the GDRs to get HTC's

ordinary shares. As of December 31, 2015, there were

8,397.4 thousand units of GDRs redeemed, representing

33,589.4 thousand ordinary shares, and the outstanding

GDRs represented 2,471.1 thousand ordinary shares or

0.30% of HTC's outstanding ordinary shares.

Capital Surplus

December 31

2015 2014

May be used to offset a deficit,

distributed as cash dividends, or

transferred to share capital

Arising from issuance of ordinary

shares $14,312,926 $14,432,437

December 31

2015 2014

Arising from consolidation excess $ 23,604 $ 23,801

Arising from expired stock options 35,825 36,124

May not be used for any purpose

Arising from employee share options 544,087 250,470

Arising from employee restricted

shares 589,411 397,855

$15,505,853 $15,140,687

(Concluded)

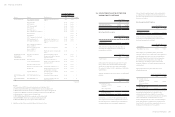

The capital surplus arising from shares issued in excess of

par (including share premium from issuance of ordinary

shares, treasury share transactions, consolidation excess and

expired stock options) and donations may be used to offset

a deficit; in addition, when the Company has no deficit,

such capital surplus may be distributed as cash dividends or

transferred to share capital (limited to a certain percentage

of the Company's capital surplus and once a year).

In February and October 2014, the retirement of treasury

shares caused decreases of NT$208,546 thousand in

additional paid-in capital - issuance of ordinary shares,

NT$1,499 thousand in capital surplus - treasury shares,

NT$344 thousand in capital surplus - consolidation excess

and NT$522 thousand in capital surplus - expired stock

options. The difference the carrying value of treasury shares

retired in excess of the sum of its par value and premium

from issuance of common share was firstly offset against

capital surplus - treasury shares by NT$630,292 thousand,

and the rest offset against unappropriated earnings

amounting to NT$8,208,915 thousand.

In March 2015, the retirement of treasury shares caused

decreases of NT$119,511 thousand in additional paid-in

capital - issuance of ordinary shares, NT$197 thousand in

capital surplus - consolidation excess, NT$299 thousand in

capital surplus - expired stock options, respectively. The

difference the carrying value of treasury shares retired in

excess of the sum of its par value and premium from issuance

of ordinary share was offset against unappropriated earnings

amounting to NT$3,560,909 thousand.

For details of capital surplus - employee share options and

employee restricted shares, please refer to Note 29.

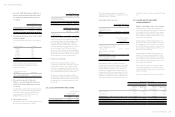

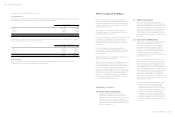

Retained Earnings and Dividend Policy

Under HTC's Articles of Incorporation, HTC should make

appropriations from its net income in the following order:

a. To pay taxes.

b. To cover accumulated losses, if any.

c. To appropriate 10% legal reserve unless the total legal

reserve accumulated has already reached the amount of

HTC's authorized capital.

d. To recognize or reverse special reserve return earnings.

e. To pay remuneration to directors and supervisors

at 0.3% maximum of the balance after deducting the

amounts under the above items (a) to (d).

f. To pay bonus to employees at 5% minimum of the

balance after deducting the amounts under the above

items (a) to (d), or such balance plus the unappropriated

retained earnings of previous years. However, the

bonus may not exceed the limits on employee bonus

distributions as set out in the Regulations Governing the

Offering and Issuance of Securities by Issuers. Where

bonus to employees is allocated by means of new share

issuance, the employees to receive bonus may include

the affiliates' employees who meet specific requirements

prescribed by the board of directors.

g. For any remainder, the board of directors should

propose allocation ratios based on the dividend policy

set forth in HTC's Articles and propose them at the

stockholders' meeting.

As part of a high-technology industry and as a growing

enterprise, HTC considers its operating environment,

industry developments, and long-term interests of

stockholders as well as its programs to maintain operating

efficiency and meet its capital expenditure budget and

financial goals in determining the stock or cash dividends to

be paid. HTC's dividend policy stipulates that at least 50% of

total dividends may be distributed as cash dividends.

In accordance with the amendments to the Company Act

in May 2015, the recipients of dividends and bonuses are

limited to shareholders and do not include employees. The

Company expects to modify the Articles of Incorporation

according to laws and regulations above on the board

of directors' meeting on February 29, 2016 and will be

subjected to the resolution of the shareholders' meeting.

For information about the accrual basis of the employees'

compensation and remuneration to directors and

supervisors and the actual appropriations, please refer to

employee benefits expense in Note 26.

Appropriation of earnings to legal reserve shall be made

until the legal reserve equals the Company's capital. Legal

reserve may be used to offset deficit. If the Company has

no deficit and the legal reserve has exceeded 25% of the

Company's capital, the excess may be transferred to capital

or distributed in cash.

(Continued)