HTC 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital and shares

Capital and shares

126

127

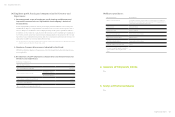

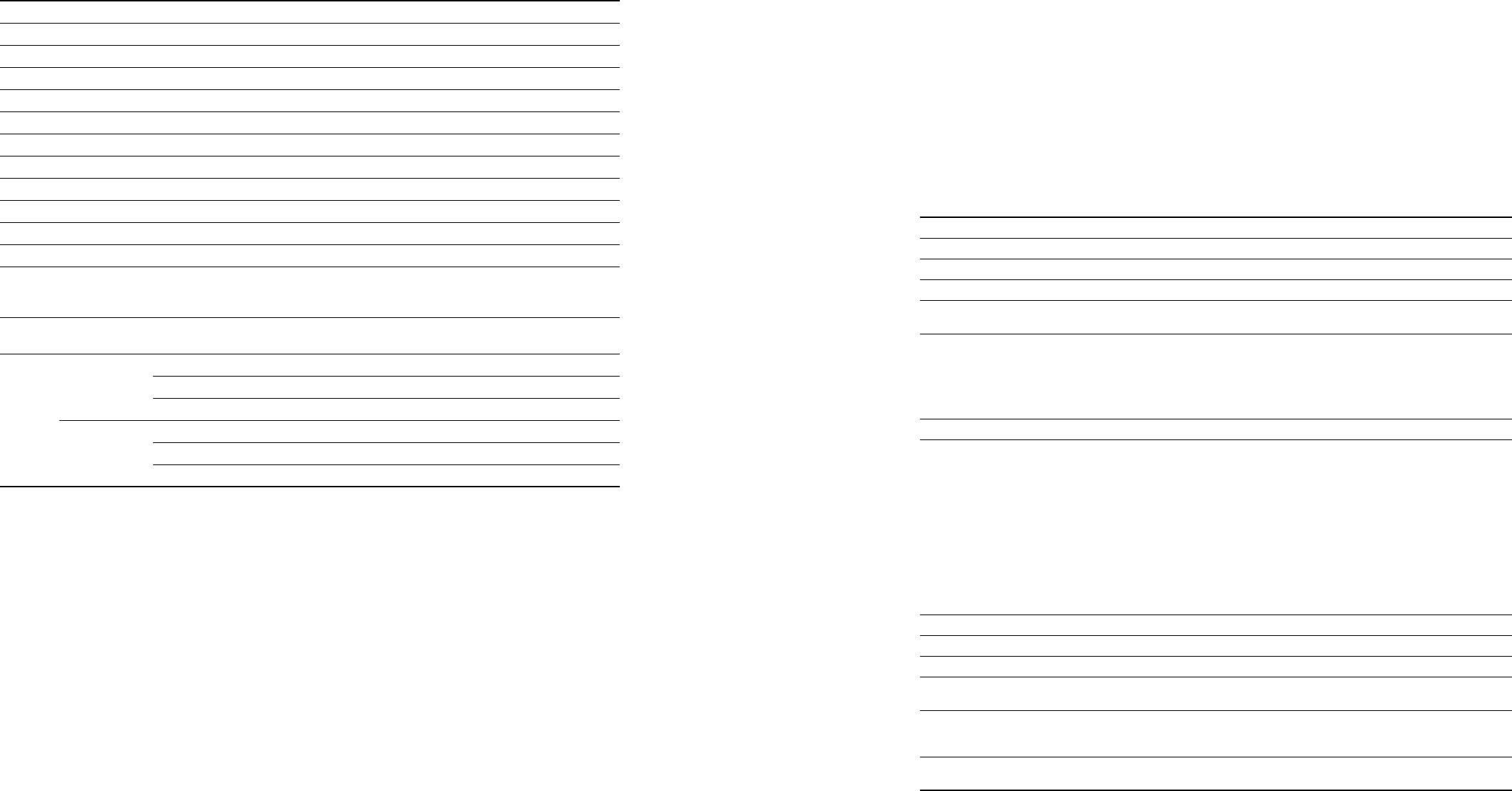

4. Global Depository Receipts

2016.04.15

IssueDate 2003.11.19

IssuanceandListing Luxembourg

Total amount USD105,182,100.60

Oering price per GDR USD15.4235

Units issued 9,015,121 units (note)

Underlying securities Cash oering and common shares from selling shareholders

Common shares represented 36,060,497shares(note)

Rights and obligations of GDR holders Same as that of common share holders

Trustee Not applicable

Depositary bank Citibank, N.A.–New York

Custodian bank Citibank Taiwan Limited

GDRS outstanding 682,620units

Apportionment of expenses for issuance and

maintenance

All fees and expenses such as underwriting fees, legal fees, listing fees and other expenses

related to issuance of GDRS were borne by HTC and the selling shareholders, while mainte-

nance expenses such as annual listing fees and accounting fees were borne by HTC.

Terms and conditions in the deposit agreement

and custody agreement See deposit agreement and custody agreement for details

Closing

price per

GDR

2015

High USD20.32

Low USD 4.92

Average USD 12.40

2016.01.01~

2016.04.15

High USD15.32

Low USD 8.45

Average USD 10.29

Note: Thetotalnumberofunitsissuedincludesthe6,819,600unitsoriginallyissued(representing27,278,400sharesofcommonstock)plusadditionalunitsissuedin

stock dividends in past years on common shares underlying the overseas depositary receipts, as itemized below.

18August2004:dividendsissuedoncommonsharesunderlyingtheoverseasdepositaryreceiptsintheamountof216,088additionalunits(representing864,352

common shares)

12August2005:dividendsissuedoncommonsharesunderlyingtheoverseasdepositaryreceiptsintheamountof70,290additionalunits(representing281,161

common shares)

1August2006:dividendsissuedoncommonsharesunderlyingtheoverseasdepositaryreceiptsintheamountof218,776additionalunits(representing875,107

common shares)

20August2007:dividendsissuedoncommonsharesunderlyingtheoverseasdepositaryreceiptsintheamountof508,556additionalunits(representing2,034,224

common shares)

21July2008:dividendsissuedoncommonsharesunderlyingtheoverseasdepositaryreceiptsintheamountof488,656additionalunits(representing1,954,626

common shares)

9August2009:dividendsissuedoncommonsharesunderlyingtheoverseasdepositaryreceiptsintheamountof170,996additionalunits(representing683,985

common shares)

3August2010:dividendsissuedoncommonsharesunderlyingtheoverseasdepositaryreceiptsintheamountof311,805additionalunits(representing1,247,223

common shares)

26July2011:dividendsissuedoncommonsharesunderlyingtheoverseasdepositaryreceiptsintheamountof210,354additionalunits(representing841,419

common shares)

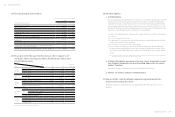

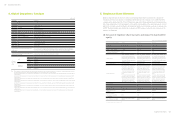

5. Employee Share Warrants

Employee share warrants are adopted to attract and retain important talent necessary for the company’s de-

velopment,andtoincreaseemployees’commitmentanddedicationtothecompany,soastojointlybenetthe

company and its shareholders. The 2nd and3rd Grants were approved by Financial Supervisory Commission, Exec-

utiveYuanonSeptember9,2013andAugust19,2014,andthetotalquantitiesofthecurrentissueare15,000,000

and 20,000,000 units, respectively. Each stock warrant unit may be used to purchase one share of common stock

of HTC. The share purchase price shall be the closing price of HTC common stock on the date of issuance of the

employee stock warrants.

(1) Issuance of employee share warrants and impact to shareholders’

equity

2016.04.30/Unit:shareandNT$

Employee Stock Options Granted 2nd Grant 3rd Grant 4th Grant

Approval Date September9,2013 August 19, 2014 August 19, 2014

Issue(Grant)Date November11,2013 October31,2014 August 11, 2015

Number of Options Granted 15,000,000 19,000,000 1,000,000

PercentageofSharesExercisableto

Outstanding Common Shares 1.81% 2.30% 0.12%

Option Duration

The duration of the stock warrants

is 7 years. The stock warrants and

rights and interests therein may not

be transferred, pledged, given to oth-

ers, or disposed in any other manner,

except by succession.

The duration of the stock warrants

is 10 years. The stock warrants and

rights and interests therein may not

be transferred, pledged, given to oth-

ers, or disposed in any other manner,

except by succession.

The duration of the stock warrants

is 10 years. The stock warrants and

rights and interests therein may not

be transferred, pledged, given to oth-

ers, or disposed in any other manner,

except by succession.

Source of Option Shares New Common Share New Common Share New Common Share

VestingSchedule(%)

After 2 full years have elapsed from

the time the stock warrant holder

is allocated the employee stock

warrants, the warrant holder may

exercise the share purchase rights

according to the schedule set out

below.

Percentageofsharepurchaserights

that may be exercised according to

the time elapsed since the allocation

of the stock warrants (cumulative)

Twofullyearshaveelapsed:60%

Threefullyearshaveelapsed:100%

After 2 full years have elapsed from

the time the stock warrant holder

is allocated the employee stock

warrants, the warrant holder may

exercise the share purchase rights

according to the schedule set out

below.

Percentageofsharepurchaserights

that may be exercised according to

the time elapsed since the allocation

of the stock warrants (cumulative)

Twofullyearshaveelapsed:60%

Threefullyearshaveelapsed:100%

After 2 full years have elapsed from

the time the stock warrant holder

is allocated the employee stock

warrants, the warrant holder may

exercise the share purchase rights

according to the schedule set out

below.

Percentageofsharepurchaserights

that may be exercised according to

the time elapsed since the allocation

of the stock warrants (cumulative)

Twofullyearshaveelapsed:60%

Threefullyearshaveelapsed:100%

Shares Exercised 0 0 0

Value of Shares Exercised NTD 0 NTD 0 NTD 0

Shares Unexercised 9,650,000shares 13,084,400shares 950,000 shares

AdjustedExercisePrice

PerShare NTD149 NTD134.5 NTD54.50

PercentageofShares

Unexercised to Outstanding

Common Shares

1.17% 1.58% 0.11%

ImpacttoShareholders’Equity Dilution to shareholder’s equity is

limited

Dilution to shareholder’s equity is

limited

Dilution to shareholder’s equity is

limited

Note:Theinformationiscalculatedbasedontheissuedshares,827,641,465.