GNC 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

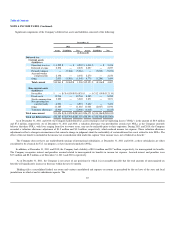

NOTE 8. LONG-TERM DEBT/INTEREST EXPENSE (Continued)

Senior Notes. Together with Holdings' wholly owned subsidiary GNC Acquisition Inc. ("GNC Acquisition"), Holdings entered into an Agreement and

Plan of Merger (the "Merger Agreement") with GNC Parent Corporation on February 8, 2007. Pursuant to the Merger Agreement, and on March 16, 2007,

GNC Acquisition was merged with and into GNC Parent Corporation, with GNC Parent Corporation as the surviving corporation and Holdings' direct wholly

owned subsidiary (the "Merger"). In connection with the Merger, Centers completed a private offering of $300.0 million of its Senior Notes. Interest on the

Senior Notes was payable semi-annually in arrears on March 15 and September 15 of each year. Interest on the Senior Notes accrued at a variable rate and

was 5.8% at December 31, 2010. The Senior Notes were Centers' senior non-collateralized obligations and were effectively subordinated to all of Centers'

existing collateralized debt, including the Old Senior Credit Facility, to the extent of the assets securing such debt, ranked equally with all of Centers' existing

non-collateralized senior debt and ranked senior to all Centers' existing senior subordinated debt, including the Senior Subordinated Notes. The Senior Notes

were guaranteed on a senior non-collateralized basis by each of Centers' then existing domestic subsidiaries (as defined in the Senior Notes indenture).

Senior Subordinated Notes. In connection with the Merger, Centers completed a private offering of $110.0 million of Centers' Senior Subordinated

Notes. The Senior Subordinated Notes were Centers' senior subordinated non-collateralized obligations and were subordinated to all its existing senior debt,

including the Old Senior Credit Facility and the Senior Notes, and ranked equally with all of Centers' existing senior subordinated debt and ranked senior to

all Centers' existing subordinated debt. The Senior Subordinated Notes were guaranteed on a senior subordinated non-collateralized basis by each of Centers'

then existing domestic subsidiaries (as defined in the Senior Subordinated Notes indenture). Interest on the Senior Subordinated Notes accrued at the rate of

10.75% per year from March 16, 2007 and was payable semi-annually in arrears on March 15 and September 15 of each year, beginning on September 15,

2007.

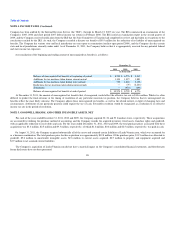

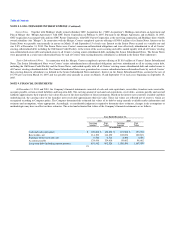

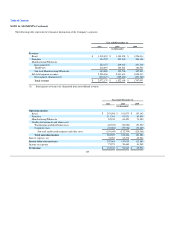

NOTE 9. FINANCIAL INSTRUMENTS

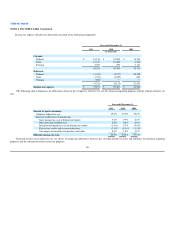

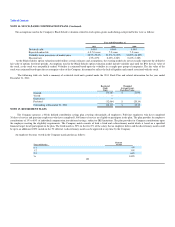

At December 31, 2011 and 2010, the Company's financial instruments consisted of cash and cash equivalents, receivables, franchise notes receivable,

accounts payable, certain accrued liabilities and long-term debt. The carrying amount of cash and cash equivalents, receivables, accounts payable and accrued

liabilities approximates their respective fair values because of the short maturities of these instruments. Based on the interest rates currently available and their

underlying risk, the carrying value of the franchise notes receivable approximates their fair value. These fair values are reflected net of reserves, which are

recognized according to Company policy. The Company determined the estimated fair values of its debt by using currently available market information and

estimates and assumptions, where appropriate. Accordingly, as considerable judgment is required to determine these estimates, changes in the assumptions or

methodologies may have an effect on these estimates. The actual and estimated fair values of the Company's financial instruments are as follows:

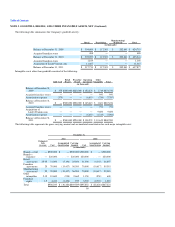

Year Ended December 31,

2011 2010

Carrying

Amount Fair

Value Carrying

Amount Fair

Value

(in thousands)

Cash and cash equivalents $ 128,438 $ 128,438 $ 193,902 $ 193,902

Receivables, net 114,190 114,190 102,874 102,874

Franchise notes receivable, net 6,510 6,510 4,496 4,496

Accounts payable 124,416 124,416 98,662 98,662

Long-term debt (including current portion) 901,542 892,526 1,058,499 1,007,070

93