GNC 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 13. STOCKHOLDERS' EQUITY (Continued)

Earnings Per Share

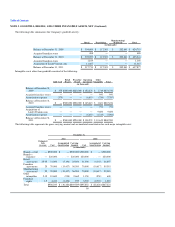

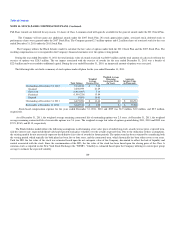

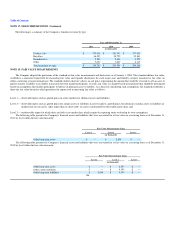

The following table represents the Company's basic and dilutive weighted average shares:

Year ended December 31,

2011 2010 2009

(in thousands)

Basic weighted average shares 100,261 87,339 87,421

Effect of dilutive employee stock-based compensation awards 2,749 1,578 438

Diluted weighted averages shares 103,010 88,917 87,859

Unexercised stock options of 2.0 million, 7.8 million, and 8.8 million shares for the years ended December 31, 2011, 2010 and 2009, respectively, were

not included in the computation of diluted earnings per share because the impact of applying the treasury stock method to these options was anti-dilutive.

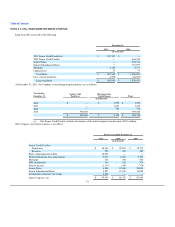

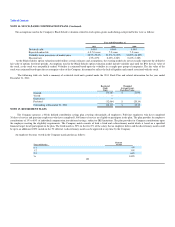

NOTE 14. STOCK-BASED COMPENSATION PLANS

The Company has outstanding stock-based compensation awards that were granted by the Compensation Committee (the "Compensation Committee") of

Holdings' Board of Directors (the "Board") under the following two stock-based employee compensation plans:

the GNC Holdings, Inc. 2011 Stock and Incentive Plan (the "2011 Stock Plan") adopted in March 2011; and

the GNC Acquisition Holdings Inc. 2007 Stock Incentive Plan adopted in March 2007 (as amended, the "2007 Stock Plan").

Both plans have provisions that allow for the granting of stock options, restricted stock and other stock based awards and are available to certain eligible

employees, directors, consultants or advisors as determined by the Compensation Committee. Stock options under the plans were granted with exercise prices

at or above fair market value on the date of grant, typically vest over a four- or five-year period and expire seven or ten years from the date of grant.

Up to 8.5 million shares of Class A common stock may be issued under the 2011 Stock Plan (subject to adjustment to reflect certain transactions and

events specified in the 2011 Stock Plan for any award grant). If any award granted under the 2011 Stock Plan expires, terminates or is cancelled without

having been exercised in full, the number of shares underlying such unexercised award will again become available for awards under the 2011 Stock Plan.

The total number of shares of Class A common stock available for awards under the 2011 Stock Plan will be reduced by (i) the total number of stock options

or stock appreciation rights exercised, regardless of whether any of the shares of Class A common stock underlying such awards are not actually issued to the

participant as the result of a net settlement, and (ii) any shares of Class A common stock used to pay any exercise price or tax withholding obligation. In

addition, the number of shares of Class A common stock that are subject to restricted stock, performance shares or other stock-based awards that are not

subject to the appreciation of the value of a share of Class A common stock ("Full Share Awards") that may be granted under the 2011 Stock Plan is limited

by counting shares granted pursuant to such awards against the aggregate share reserve as 1.8 shares for every share granted. If any stock option, stock

appreciation right or other stock-based award that is not a Full Share Award is cancelled, expires or terminates unexercised for any reason, the shares covered

by such awards will again be available for the grant of awards under the 2011 Stock Plan. If any shares of Class A common stock that are subject to restricted

stock, performance shares or other stock-based awards that are

99

•

•