GNC 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

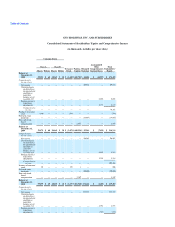

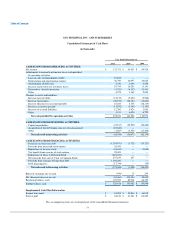

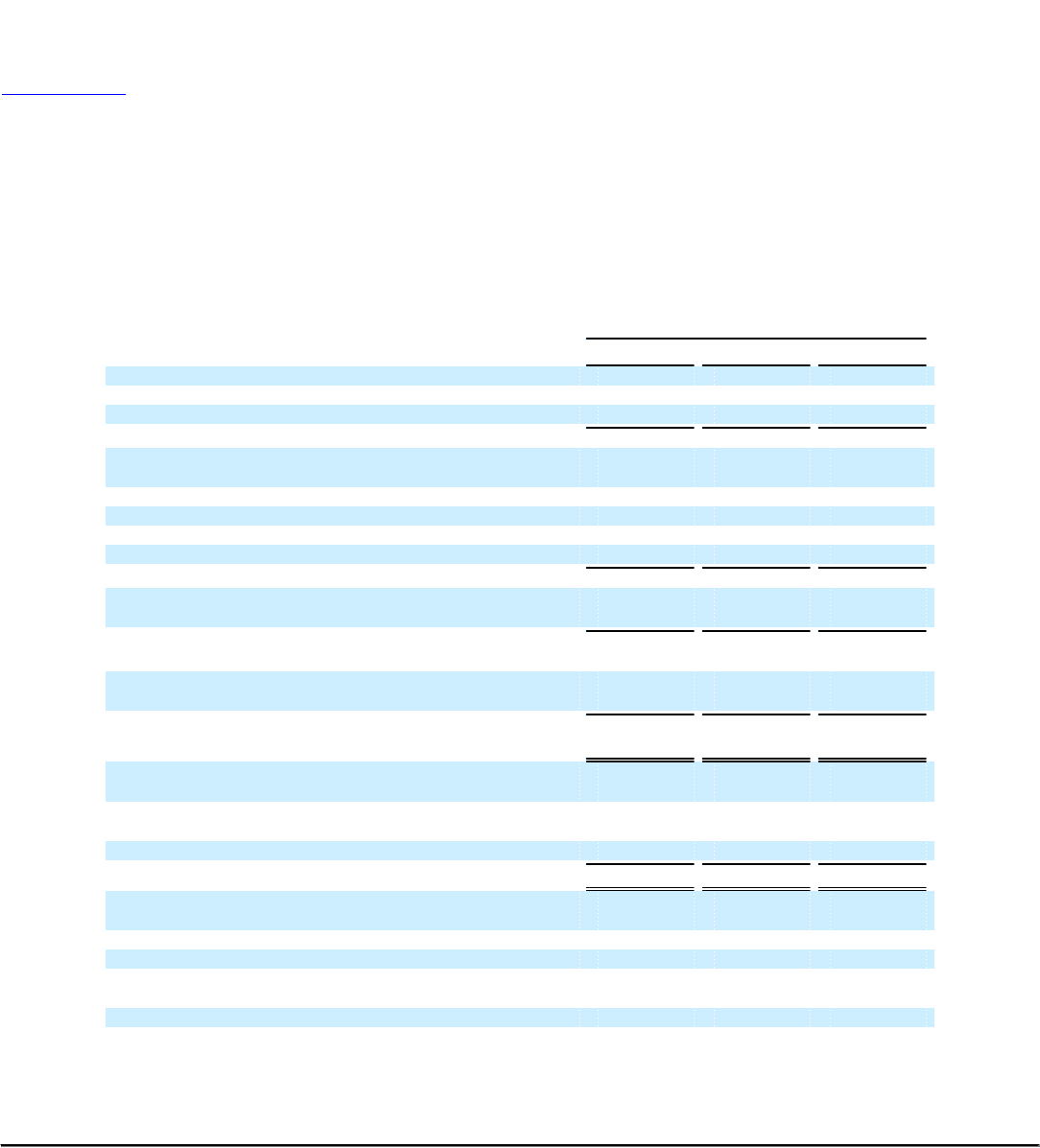

GNC HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Income

(in thousands, except per share data)

Year ended December 31,

2011 2010 2009

Revenue $ 2,072,179 $ 1,822,168 $ 1,707,007

Cost of sales, including cost of warehousing,

distribution and occupancy 1,318,346 1,179,886 1,116,437

Gross profit 753,833 642,282 590,570

Compensation and related benefits 291,268 273,797 263,046

Advertising and promotion 52,924 51,707 50,034

Other selling, general and administrative 113,477 100,687 96,619

Foreign currency loss (gain) 121 (296) (155)

Transaction and strategic alternative related costs 13,536 3,981 —

Operating income 282,507 212,406 181,026

Interest expense, net (Note 8) 74,903 65,376 69,940

Income before income taxes 207,604 147,030 111,086

Income tax expense (Note 4) 75,271 50,463 41,562

Net income $ 132,333 $ 96,567 $ 69,524

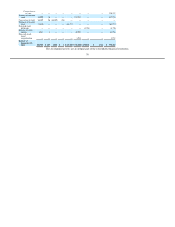

Income per share—Basic and Diluted:

Net income $ 132,333 $ 96,567 $ 69,524

Preferred stock dividends (4,726) (20,606) (18,667)

Net income available to common shareholders $ 127,607 $ 75,961 $ 50,857

Earnings per share:

Basic $ 1.27 $ 0.87 $ 0.58

Diluted $ 1.24 $ 0.85 $ 0.58

Weighted average common shares outstanding:

Basic 100,261 87,339 87,421

Diluted 103,010 88,917 87,859

The accompanying notes are an integral part of the consolidated financial statements.

75