GNC 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

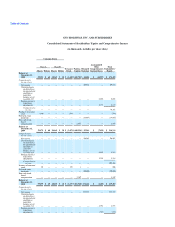

NOTE 2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying consolidated financial statements and footnotes have been prepared by the Company in accordance with accounting principles

generally accepted in the United States of America ("U.S. GAAP") and with the instructions to Form 10-K and Regulation S-X. The Company's normal

reporting period is based on a calendar year.

Summary of Significant Accounting Policies

Principles of Consolidation. The consolidated financial statements include the accounts of the Holdings and all of its subsidiaries. All material

intercompany transactions have been eliminated in consolidation.

The Company has no relationships with unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or special

purpose entities, which would have been established for the purpose of facilitating off balance sheet arrangements, or other contractually narrow or limited

purposes.

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions.

Accordingly, these estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates

of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. On a regular basis, management reviews its

estimates utilizing currently available information, changes in facts and circumstances, historical experience and reasonable assumptions. After such reviews

and if deemed appropriate, those estimates are adjusted accordingly. Actual results could differ from those estimates.

Cash and Cash Equivalents. The Company considers cash and cash equivalents to include all cash and liquid deposits and investments with an

original maturity of three months or less. The majority of payments due from banks for third-party credit and debit cards process within 24-72 hours, and are

classified as cash equivalents.

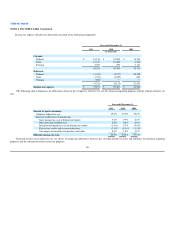

Receivables, net. The Company sells product to its franchisees and, to a lesser extent, various third-party customers. Receivables consist principally of

trade receivables of $111.5 million and $100.7 million at December 31, 2011 and 2010, respectively, and include unpaid invoices for product sales, franchisee

royalties and lease payments. The Company monitors the financial condition of the Company's franchisees and other third-party customers and establishes an

allowance for doubtful accounts for balances estimated to be uncollectible. In addition to considering the aging of receivable balances and assessing the

financial condition of the Company's franchisees, the Company considers each domestic franchisees' inventory and fixed assets, which the Company can use

as collateral in the event of a default by the franchisee. An allowance for international franchisees is calculated based on unpaid, non collateralized amounts

associated with their receivable balance. The allowance for doubtful accounts was $2.3 million and $1.6 million at December 31, 2011 and 2010, respectively.

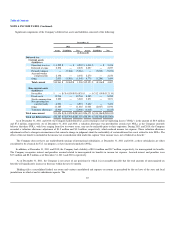

Inventories. Inventory components consist of raw materials, finished product and packaging supplies. Inventories are stated at the lower of cost or

market on a first in/first out basis ("FIFO"). The Company regularly reviews its inventory levels in order to identify slow moving and short dated products,

expected length of time for product sell through and future expiring product and adjusts the carrying value for such inventory to estimated net realizable value.

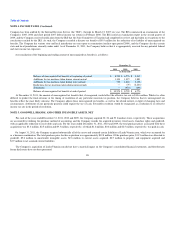

Property, Plant and Equipment. Property, plant and equipment expenditures are recorded at cost. The remaining useful lives ranged from one year to

sixteen years across all asset classes with the exception of

79