GNC 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

denominated in foreign currencies, are translated into U.S. dollars using period-end exchange rates, and income and expenses are translated using the average

exchange rates for the reporting period. Gains or losses resulting from foreign currency transactions are included in results of operations.

Transaction and strategic alternative related costs. The Company recognizes transaction related costs as expenses in the period incurred. For the years

ended December 31, 2011 and 2010, the Company recognized $13.5 million and $4.0 million of expenses, respectively, related to the IPO, the Secondary

Offering, and other strategic alternative costs.

Financial Instruments and Derivatives. As part of the Company's financial risk management program, it has historically used certain derivative

financial instruments to reduce its exposure to market risk for changes in interest rates primarily in respect of its long term debt obligations. The Company has

not historically entered into, and does not intend to enter into, derivative transactions for speculative purposes and holds no derivative instruments for trading

purposes. Floating-to-fixed interest rate swap agreements, designated as cash flow hedges of interest rate risk, were entered into from time to time to hedge

the Company's exposure to interest rate changes on a portion of the Company's floating rate debt. These interest rate swap agreements converted a portion of

the Company's floating rate debt to fixed rate debt. Interest rate floors designated as cash flow hedges involved the receipt of variable-rate amounts from a

counterparty if interest rates fell below the strike rate on the contract in exchange for an upfront premium. The Company recorded the fair value of these

contracts as an asset or a liability, as applicable, in the balance sheet, with the offset to accumulated other comprehensive income (loss), net of tax. The

Company measured hedge effectiveness by assessing the changes in the fair value or expected future cash flows of the hedged item. The ineffective portions,

if any, were recorded in interest expense in the current period.

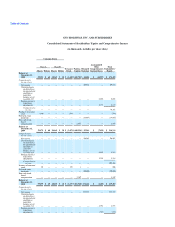

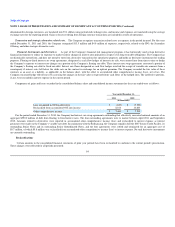

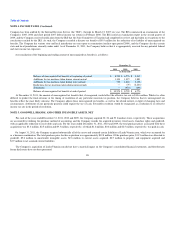

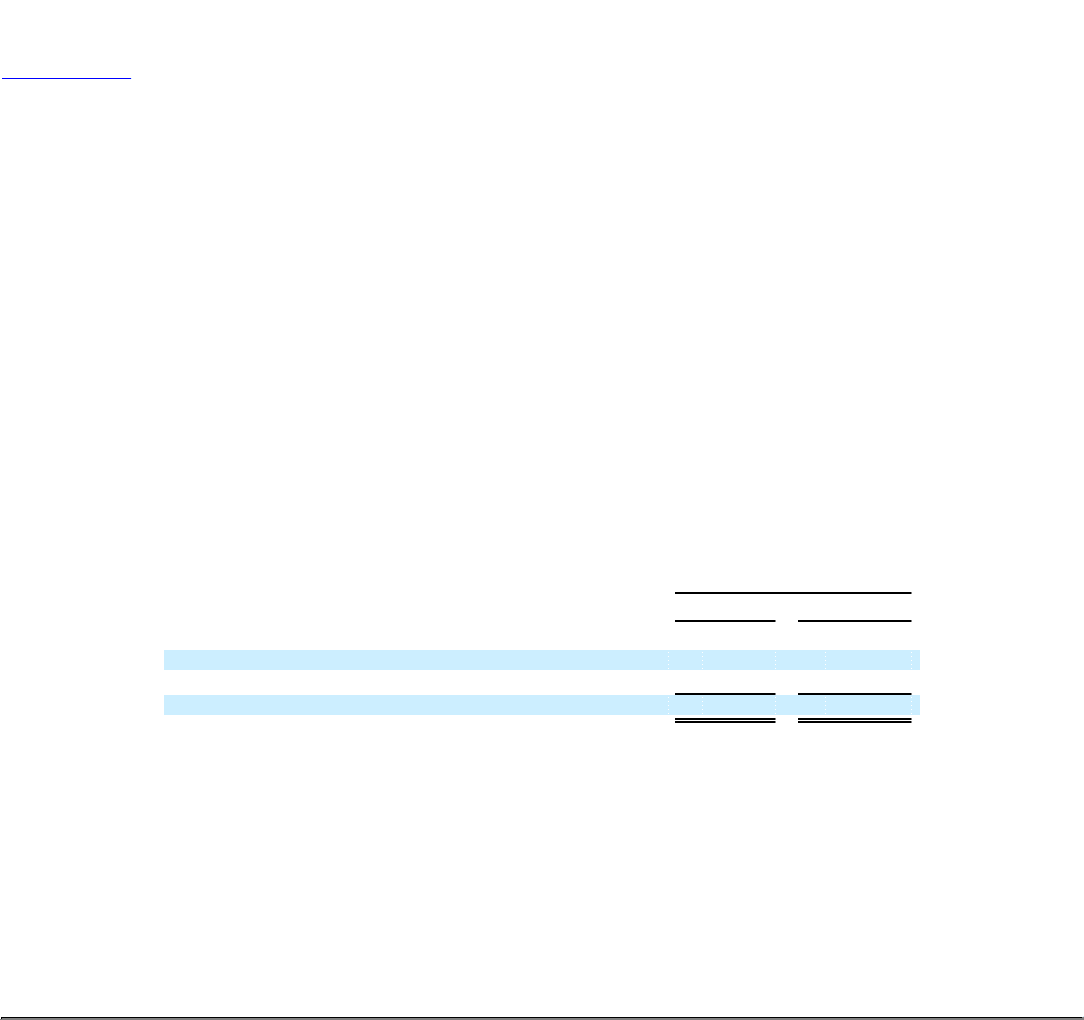

Components of gains and losses recorded in the consolidated balance sheet and consolidated income statements for the years ended were as follows:

Year ended December 31,

2011 2010

(in thousands)

Loss recognized in OCI on derivative $ (639) $ (7,393)

Reclassified from accumulated OCI into income 8,108 14,603

Other comprehensive income $ 7,469 $ 7,210

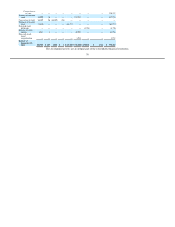

For the period ended December 31, 2010, the Company had interest rate swap agreements outstanding that effectively converted notional amounts of an

aggregate $550.0 million of debt from floating to fixed interest rates. The four outstanding agreements were to mature between April 2011 and September

2012. Amounts related to derivatives were reported in accumulated other comprehensive income (loss) and reclassified to interest expense as interest

payments were made on the Company's variable-rate debt. In conjunction with the Refinancing, the Company repaid in full the 2007 Senior Credit Facility, its

outstanding Senior Notes and its outstanding Senior Subordinated Notes, and the four agreements were settled and terminated for an aggregate cost of

$8.7 million, of which $5.8 million was reclassified from accumulated other comprehensive income (loss) to interest expense. No such derivative instruments

are currently outstanding.

Reclassifications

Certain amounts in the consolidated financial statements of prior year periods have been reclassified to conform to the current period's presentation.

These changes were reflected for all periods presented.

84