GNC 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

completed the Secondary Offering pursuant to which certain of Holdings' stockholders sold 23.0 million shares of Class A common stock.

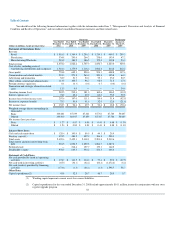

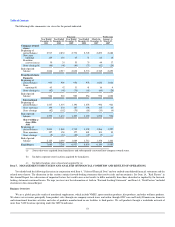

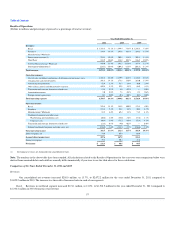

Revenues and Operating Performance from our Segments

We measure our operating performance primarily through revenues and operating income from our three segments, Retail, Franchise and Manufacturing/

Wholesale, and through the management of unallocated costs from our warehousing, distribution and corporate segments, as follows:

Retail: We generate retail revenues by sales at our company-owned stores and online through GNC.com and LuckyVitamin.com. Although we

believe that our retail and franchise businesses are not seasonal in nature, historically we have experienced, and expect to continue to experience,

a variation in our net sales and operating results from quarter to quarter, with the first half of the year being stronger than the second half of the

year. According to Nutrition Business Journal's Supplement Business Report 2011, our industry is expected to grow at an annual average rate of

approximately 3.7% through 2017. As a leader in our industry, we expect our organic retail revenue to grow faster than the projected industry

growth as a result of our disproportionate market share, scale economies in purchasing and advertising, strong brand awareness and vertical

integration.

Franchise: We generate franchise revenues primarily from:

product sales to our franchisees;

royalties on franchise retail sales; and

franchise fees, which we charge for initial franchise awards, renewals and transfers of franchises.

Although we do not anticipate the number of our domestic franchise stores to grow substantially, we expect to achieve domestic franchise store

revenue growth consistent with projected industry growth of approximately 3.7% through 2017, which we expect to generate from royalties on

franchise retail sales and product sales to our existing franchisees. As a result of our efforts to expand our international presence and provisions in

our international franchising agreements requiring franchisees to open additional stores, we have increased our international store base in recent

periods and expect to continue to increase the number of our international franchise stores over the next five years. We believe this will result in

additional franchise fees associated with new store openings and increased revenues from product sales to, and royalties from, new franchisees. As

our existing international franchisees continue to open additional stores, we also anticipate that franchise revenue from international operations

will be driven by increased product sales to, and royalties from, our franchisees. Since our international franchisees pay royalties to us in U.S.

dollars, any strengthening of the U.S. dollar relative to our franchisees' local currency may offset some of the growth in royalty revenue.

Manufacturing/Wholesale: We generate manufacturing/wholesale revenues through sales of manufactured products to third parties, generally for

third-party private label brands, the sale of our proprietary and third-party products to and through Rite Aid and www.drugstore.com and the sale

of our proprietary products to PetSmart and Sam's Club. We also record license fee revenue from the opening of franchise store-within-a-store

locations within Rite Aid stores. Our revenues generated by our manufacturing and wholesale operations are subject to our available

manufacturing capacity.

A significant portion of our business infrastructure is comprised of fixed operating costs. Our vertically-integrated distribution network and

manufacturing capacity can support higher sales volume without significant incremental costs. We therefore expect our operating expenses to grow at a lesser

rate than our revenues, resulting in positive operating leverage.

55

•

•

(1)

(2)

(3)

•