GNC 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

and cash flow growth and (3) our financial condition. In addition, lenders that are adversely affected by franchisees who default on their indebtedness may be

less likely to provide current or prospective franchisees necessary financing on favorable terms or at all.

If we cannot open new company-owned stores on schedule and profitably, our planned future growth will be impeded, which would adversely affect sales

and profitability.

Our growth is dependent on both increases in sales in existing stores and the ability to open profitable new stores. Increases in sales in existing stores are

dependent on factors such as competition, store operations and other factors discussed in these Risk Factors. Our ability to timely open new stores and to

expand into additional market areas depends in part on the following factors: the availability of attractive store locations; the absence of occupancy delays; the

ability to negotiate acceptable lease terms; the ability to identify customer demand in different geographic areas; the hiring, training and retention of

competent sales personnel; the effective management of inventory to meet the needs of new and existing stores on a timely basis; general economic

conditions; and the availability of sufficient funds for expansion. Many of these factors are beyond our control. Delays or failures in opening new stores,

achieving lower than expected sales in new stores or drawing a greater than expected proportion of sales in new stores from our existing stores, could

materially adversely affect our growth and profitability. In addition, we may not anticipate all of the challenges imposed by the expansion of our operations

and, as a result, may not meet our targets for opening new stores, remodeling or relocating stores or expanding profitably.

Some of our new stores may be located in areas where we have little or no meaningful experience or brand recognition. Those markets may have

different competitive conditions, market conditions, consumer tastes and discretionary spending patterns than our existing markets, which may cause our new

stores to be less successful than stores in our existing markets. Alternatively, many of our new stores will be located in areas where we have existing stores.

Although we have experience in these markets, increasing the number of locations in these markets may result in inadvertent over-saturation of markets and

temporarily or permanently divert customers and sales from our existing stores, thereby adversely affecting our overall financial performance.

Our operating results and financial condition could be adversely affected by the financial and operational performance of Rite Aid.

As of December 31, 2011, Rite Aid operated 2,125 GNC franchise store-within-a-store locations and has committed to open additional franchise store-

within-a-store locations. Revenue from sales to Rite Aid (including license fee revenue for new store openings) represented approximately 2.9% of total

revenue for the year ended December 31, 2011. Any liquidity and operational issues that Rite Aid may experience could impair its ability to fulfill its

obligations and commitments to us, which would adversely affect our operating results and financial condition.

Economic, political and other risks associated with our international operations could adversely affect our revenues and international growth prospects.

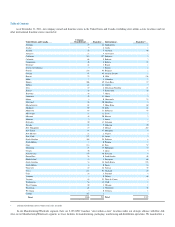

As of December 31, 2011, we had 167 company-owned Canadian stores and 1,590 international franchise stores in 53 international countries (including

distribution centers where retail sales are made). We derived 10.9% and 11.1% of our revenues for the years ended December 31, 2011 and 2010,

respectively, from our international operations. As part of our business strategy, we intend to expand our international franchise presence. Our international

operations are subject to a number of risks inherent to operating in foreign countries, and any expansion of our international operations will increase the

effects of these risks. These risks include, among others:

political and economic instability of foreign markets;

foreign governments' restrictive trade policies;

32

•

•