GNC 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

through additions of franchise stores in existing markets, expansion into new high growth markets and the growth of product distribution in both

existing and new markets.

Expanding our e-commerce business. We believe GNC.com is well-positioned to continue capturing market share online, which represents one

of the fastest growing channels of distribution in the U.S. nutritional supplements industry. We intend to continue to capitalize on the growth of

GNC.com and may explore opportunities to acquire additional web banners to expand our online market share, as with our acquisition of

LuckyVitamin.com.

Further leveraging of the GNC brand. As with our Rite Aid, Sam's Club and PetSmart partnerships, we believe we have the opportunity to

create additional streams of revenue and grow our customer base by leveraging the GNC brand through corporate partnerships outside of our

existing distribution channels.

Competitive Strengths

We believe we are well-positioned to capitalize on favorable industry trends as a result of the following competitive strengths:

Highly-valued and iconic brand. We believe our broad portfolio of proprietary products, which are available in our locations or on GNC.com,

advances GNC's brand presence and our general reputation as a leading retailer of health and wellness products. We recently modernized the

GNC brand in an effort to further advance its positioning. We have launched enhanced advertising campaigns, in-store signage and product

packaging with a focus on engaging our customers, building the brand and reinforcing GNC's credibility with consumers.

Attractive, loyal customer base. Our large customer base includes approximately 4.9 million active Gold Card members in the United States and

Canada who account for over 50% of company-owned retail sales and spend on average two times more than other GNC customers. We believe

that our customer base is attractive as our shoppers tend to be gender balanced, relatively young, well-educated and affluent. Recent surveys,

commissioned by us, reflect a high satisfaction rate among our shoppers with respect to selection, product innovation, quality and overall

experience.

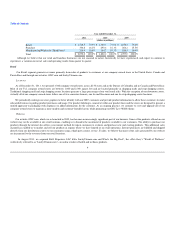

Commanding market position in an attractive and growing industry. Based on our broad global footprint of more than 7,600 locations in the

United States and 53 international countries (including distribution centers where retail sales are made), and on GNC.com, we believe we are the

leading global specialty retailer of health and wellness products within a fragmented industry. With a presence in all 50 states and the District of

Columbia, our domestic retail network is approximately eleven times larger than the next largest U.S. specialty retailer of nutritional

supplements, based on the information we compiled from the public securities filings of our primary competitors.

Unique product offerings and robust innovation capabilities. Product innovation is critical to our growth, brand image superiority and

competitive advantage. We have internal product development teams located in our corporate headquarters in Pittsburgh, Pennsylvania and our

manufacturing facility in Greenville, South Carolina, which collaborate on the development and formulation of proprietary nutritional

supplements with a focus on high growth categories. We seek to maintain the pace of GNC's proprietary product innovation to stay ahead of our

competitors and provide consumers with unique reasons to shop at our stores. Our in-house product development teams and vertically integrated

infrastructure enable us to quickly take a concept for a new product from the idea stage, to product development, to testing and trials and

ultimately to the shelf to be sold to our customers.

Diversified business model. Our multi-channel approach is unlike many other specialty retailers as we derive revenues across a number of

distribution channels in multiple geographies, including retail sales from company-owned retail stores (including 136 stores on U.S. military

bases), retail

6

•

•

•

•

•

•

•