GNC 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

On December 8, 2011, we announced the approval of a share repurchase program pursuant to which we were authorized to purchase

2.4 million shares of Class A common stock. We concluded such share repurchase program in January 2012.

(2)

In February 2012, the Board authorized a new share repurchase program pursuant to which Holdings may purchase up to 1.0 million shares of Class A

common stock over the forthcoming year.

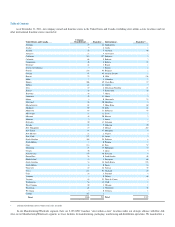

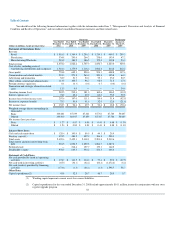

Stock Performance Graph

The line graph below compares the cumulative total stockholder return on the Class A common stock with the S&P Retail Index ("RLX") and the

S&P 500 Index ("SPI") for the period from the completion of our IPO on April 6, 2011 through December 31, 2011. The graph assumes an investment of

$100 made at the closing of trading on April 6, 2011 in (i) the Class A common stock, (ii) the stocks comprising the RLX and (iii) the stocks comprising the

SPI. All values assume reinvestment of the full amount of all dividends, if any, into additional shares of the same class of equity securities at the frequency

with which dividends were paid on such securities during the applicable time period. The stock price performance included in the line graph below is not

necessarily indicative of future stock price performance.

Recent Sales of Unregistered Securities

During the past three years, we sold unregistered securities to a limited number of persons, as described below. None of these transactions involved

underwriters, underwriting discounts or commissions, or any public offering, and we believe that each transaction was exempt from the registration

requirements of the Securities Act by virtue of Section 4(2) thereof or Rule 701 of the Securities Exchange Act of 1934, as amended (the "Exchange Act")

pursuant to compensatory benefit plans and contracts relating to compensation as provided under such Rule 701.

On March 29, 2010, Richard D. Innes, in connection with his resignation as one of our directors, purchased 14,470 shares of Class A common

stock at a price of $6.25 per share for an aggregate purchase price of $90,438.

On September 8, 2010, David Berg exercised options to purchase (i) 13,876 shares of Class A common stock at an exercise price of $7.91 per

share and (ii) 4,749 shares of Series A preferred

50

•

•