GNC 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

stock at an exercise price of $5.00 per share plus accrued and unpaid dividends through September 7, 2010 for an aggregate purchase price of

$143,240.

From January 1, 2009 through July 14, 2010, we granted to certain of our directors and employees options to purchase up to an aggregate of

1,486,850 shares of Class A common stock under the 2007 Stock Plan, at exercise prices ranging from $7.70 to $16.63 per share.

On March 31, 2011, we granted to certain of our directors and our Chief Executive Officer options to purchase up to an aggregate of 570,000

shares of Class A common stock under the 2011 Stock Plan, at exercise prices ranging from $16.00 to $24.00 per share.

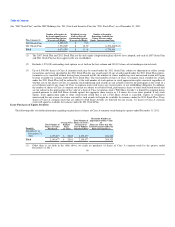

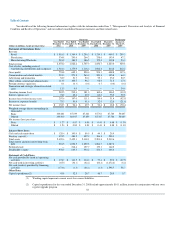

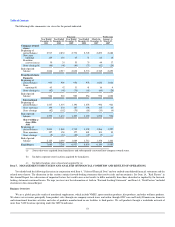

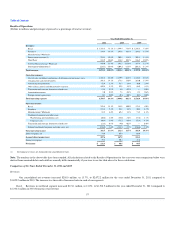

Item 6. SELECTED FINANCIAL DATA.

The selected consolidated financial data presented below as of December 31, 2011 and 2010 and for the years ended December 31, 2011, 2010 and 2009

are derived from our audited consolidated financial statements and footnotes included in this Annual Report. The selected consolidated financial data

presented below as of December 31, 2009, 2008 and for the periods from March 16, 2007 to December 31, 2007 (the "2007 Successor Period" and,

collectively with the years ended December 31, 2010, 2009 and 2008, the "Successor Periods") and from January 1, 2007 to March 15, 2007, are derived from

our audited consolidated financial statements and footnotes, which are not included in this Annual Report. The selected consolidated financial data for the

period January 1, 2007 to March 15, 2007 represent the period during which GNC Parent Corporation was owned by an investment fund managed by Apollo.

GNC Acquisition Inc., a wholly owned subsidiary of Holdings, completed the Merger with GNC Parent Corporation on March 16, 2007. As a result of

the Merger, the consolidated statement of operations for the 2007 Successor Period includes the following: interest and amortization expense resulting from

the incurrence of indebtedness under our Old Senior Credit Facility (as defined below), the Senior Notes (as defined below) and the Senior Subordinated

Notes (as defined below) in connection with the Merger; and amortization of intangible assets related to the Merger. Further, as a result of purchase

accounting, the fair values of our assets on the date of the Merger became their new cost basis.

51

•

•