GNC 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

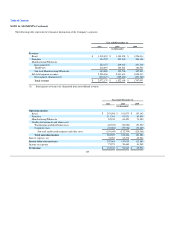

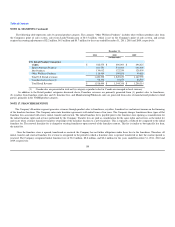

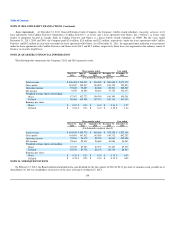

NOTE 18. FAIR VALUE MEASUREMENTS (Continued)

Other long-term assets classified as Level 2 consist of assets related to the Company's non-qualified deferred compensation plan. The assets related to

these plans are adjusted based on changes in the fair value of the underlying investments. Since the fair value of the investments is based on quoted prices of

similar items in active markets, the assets are classified within Level 2 on the fair value hierarchy. Other current liabilities and long-term liabilities classified

as Level 2 consist of the Company's interest rate swaps. The derivatives are a pay-variable, receive-fixed interest rate swaps based on LIBOR. Fair value is

based on a model-derived valuation using LIBOR, which is an observable input in an active market. Therefore, the Company's derivative is classified as

Level 2 on the fair value hierarchy as part of the Refinancing derivatives that were settled during 2011.

In addition to the above table, the Company's financial instruments also consist of cash and cash equivalents, accounts receivable, accounts payable and

long-term debt. The Company did not elect to value its long-term debt with the fair value option in accordance with the standard on Financial Instruments.

The Company believes that the recorded values of all of its other financial instruments approximate their fair values because of their nature and respective

durations.

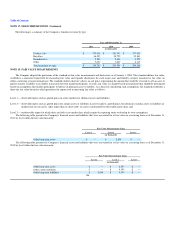

NOTE 19. RELATED PARTY TRANSACTIONS

ACOF Management Services Agreement In connection with the Merger, on March 16, 2007, we entered into a Management Services Agreement (the

"Management Services Agreement") with ACOF Operating Manager II, L.P. ("ACOF Operating Manager"), an affiliate of Ares Corporate Opportunities

Fund II, L.P. ("Ares"), which was terminated upon the consummation of the IPO. The Management Services Agreement provided for an annual management

fee of $0.8 million, payable quarterly and in advance to ACOF Operating Manager, on a pro rata basis, until the tenth anniversary from March 16, 2007 plus

any one-year extensions (which extensions occurred automatically on each anniversary date of March 16, 2007), as well as reimbursements for ACOF

Operating Manager's, and its affiliates', out-of-pocket expenses in connection with the management services provided under the Management Services

Agreement. For our fiscal year ended December 31, 2011, $0.2 million was paid to ACOF Operating Manager in accordance with the terms of the

Management Services Agreement.

Upon the consummation of the IPO, the Management Services Agreement was terminated and ACOF Operating Manager received, in lieu of quarterly

payments of the annual management fee, an automatic fee equal to the net present value of the aggregate annual management fee that would have been

payable to ACOF Operating Manager during the remainder of the term of the fee agreement. The amount of such payment was $5.6 million. No further

payments will be made pursuant to the Management Services Agreement.

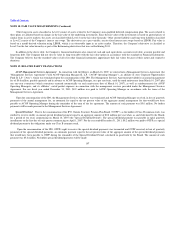

Special Dividend Prior to the consummation of the IPO, Ontario Teachers' Pension Plan Board ("OTPP"), as the holder of Class B common stock, was

entitled to receive ratably an annual special dividend payment equal to an aggregate amount of $0.8 million per year when, as and if declared by the Board,

for a period of ten years commencing on March 16, 2007 (the "Special Dividend Period"). The special dividend payment was payable in equal quarterly

installments on the first day of each quarter commencing on April 1, 2007. For the year ended December 31, 2011, $0.2 million was paid to OTPP as a special

dividend pursuant to the obligations under our Class B common stock.

Upon the consummation of the IPO, OTPP's right to receive the special dividend payments was terminated and OTPP received, in lieu of quarterly

payments of the special dividend payments, an automatic payment equal to the net present value of the aggregate amount of the special dividend payments

that would have been payable to OTPP during the remainder of the Special Dividend Period, calculated in good faith by the Board. The amount of such

payment was $5.6 million. No further special dividend payments will be made.

107