GNC 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

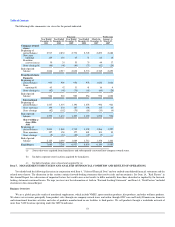

Other SG&A. Other SG&A expenses, including amortization expense, increased $12.8 million, or 12.9%, to $113.5 million for the year ended

December 31, 2011 compared to $100.7 million in 2010. This increase was due to increases in credit card fees, third-party sales commissions, bad debt

expense, legal expenses, settlement expenses and other SG&A expenses.

Transaction and strategic alternative related costs. For the year ended December 31, 2011, we incurred $13.5 million of expenses principally related to

the IPO and the Secondary Offering. These primarily consisted of a payment of $11.1 million for the termination of Sponsor-related obligations and other

costs of $2.4 million. In 2010, we incurred $4.0 million of expenses principally related to the exploration of strategic alternatives.

Foreign Currency (Gain) Loss

Foreign currency (gain) loss for the years ended December 31, 2011 and 2010 resulted primarily from accounts payable activity with our Canadian

subsidiary.

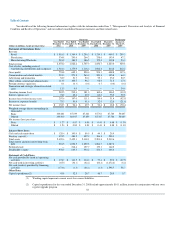

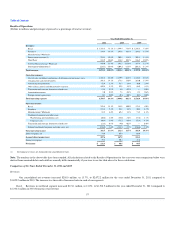

Operating Income

As a result of the foregoing, consolidated operating income increased $70.1 million, or 33.0%, to $282.5 million for the year ended December 31, 2011

compared to $212.4 million in 2010. Operating income, as a percentage of net revenue, was 13.6% and 11.7% for the years ended December 31, 2011 and

2010, respectively. Excluding transaction related expenses and executive severance expense, operating income was $299.5 million, or 14.5% of revenue, for

the year ended December 31, 2011.

Retail. Operating income increased $61.6 million, or 33.9%, to $243.5 million for the year ended December 31, 2011 compared to $181.9 million in

2010. The increase was due to higher margin on increased sales, partially offset by increases in wages and other selling expenses.

Franchise. Operating income increased $17.5 million, or 18.6%, to $111.3 million for the year ended December 31, 2011 compared to $93.8 million in

2010. The increase was due to increased wholesale product sales and royalty income.

Manufacturing/Wholesale. Operating income increased $12.8 million, or 18.4%, to $82.2 million for the year ended December 31, 2011 compared to

$69.4 million in 2010. This was primarily due to higher revenue from third party manufacturing contracts and contributions from new wholesale customers.

Warehousing and distribution costs. Unallocated warehousing and distribution costs increased $5.6 million, or 10.1%, to $60.6 million for the year

ended December 31, 2011 compared to $55.0 million in 2010. This increase was primarily due to higher fuel costs and increased wages to support higher

sales volumes.

Corporate costs. Corporate overhead costs increased $6.7 million, or 9.1%, to $80.4 million for the year ended December 31, 2011 compared to

$73.7 million in 2010. This increase was due to increases in executive severance expense of $3.5 million and other SG&A expenses.

Transaction and strategic alternative related costs. Transaction and strategic alternative related costs were $13.5 million for the year ended

December 31, 2011. These primarily consisted of a payment of $11.1 million for termination of Sponsor-related obligations and other costs of $2.4 million. In

2010, we incurred $4.0 million of expenses principally related to the exploration of strategic alternatives.

Interest Expense

Interest expense increased $9.5 million, or 14.6%, to $74.9 million for the year ended December 31, 2011 compared to $65.4 million in 2010. This

increase included $23.2 million related to the Refinancing: $5.8 million related to the termination of interest rate swaps, $13.4 million of deferred financing

fees

59