GNC 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

franchise renewal or transfer, as applicable. Franchise royalties are earned based on a percentage of the franchisees' sales and recognized in the period in

which the franchisees' sales occur.

Accounts Receivable and Allowance for Doubtful Accounts

The majority of our retail revenues are received as cash or cash equivalents. The majority of our franchise revenues are billed to the franchisees with

varying terms for payment. We offer financing to qualified domestic franchisees with the initial purchase of a franchise location. The notes are demand notes,

payable monthly over periods of five to seven years. We generate a significant portion of our revenue from ongoing product sales to franchisees and third-

party customers. An allowance for doubtful accounts is established based on the financial condition of our franchisees and other third-party customers, the

current status of trade receivables and any historical write-off experience. We maintain both specific and general reserves for doubtful accounts. General

reserves are based upon our historical bad debt experience, overall review of our aging of accounts receivable balances, general economic conditions of our

industry or the geographical regions and regulatory environments of our third-party customers and franchisees. Management's estimates of the franchisees

financial health include forecasts of the customers' and franchisees' future operating results and the collectability of receivables from them. While we believe

that our business operations and communication with customers and franchisees allows us to make reasonable estimates of their financial health, actual results

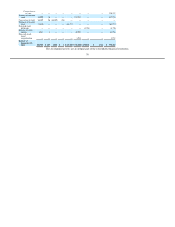

could differ from those predicted by management, and actual bad debt expense could differ from forecasted results. Our allowance for doubtful accounts was

$2.3 million and $1.6 million at December 31, 2011 and 2010, respectively. Changes in the allowance from period to period are primarily a result of the

composition of customers and their financial health. Bad debt expense was immaterial for each of the years ended December 31, 2011, 2010 and 2009.

Inventories

Where necessary, we adjust the carrying value of our inventory to estimated net realizable value. These estimates require us to make approximations

about the future demand for our products in order to categorize the status of such inventory items as slow moving, obsolete, or in excess of need. These future

estimates are subject to the ongoing accuracy of management's forecasts of market conditions, industry trends and competition. While we make estimates of

future demand based on historical experience, current expectations and assumptions that we believe are reasonable, if actual demand or market conditions

differ from these expectations and assumptions, actual results could differ from our estimates. We are also subject to volatile changes in specific product

demand as a result of unfavorable publicity, government regulation and rapid changes in demand for new and improved products or services. Our inventory

reduction for obsolescence and shrinkage was $11.4 million and $11.0 million at December 31, 2011 and 2010, respectively. This represented 2.6% and 2.8%

of our gross inventory value at each period, respectively. The change from period to period was primarily the result of inventory fluctuations and management

of inventory movement throughout our system. The impact on cost of goods sold as a result of these allowances was immaterial for each of the years ended

December 31, 2011, 2010 and 2009.

Impairment of Long-Lived Assets

Long-lived assets, including fixed assets and intangible assets with finite useful lives, are evaluated periodically by us for impairment whenever events or

changes in circumstances indicate that the carrying amount of an asset group may not be recoverable. If the sum of the undiscounted future cash flows is less

than the carrying value, we recognize an impairment loss, measured as the amount by which the carrying value exceeds the fair value of the asset. These

estimates of cash flow require significant management judgment and certain assumptions about future volume, revenue and expense growth rates and asset

disposal values. While we make estimates based on historical experience, current expectations and assumptions that we believe are reasonable, if actual

results, including future cash flows, differ from our

68