GNC 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 4. INCOME TAXES (Continued)

Company has been audited by the Internal Revenue Service (the "IRS"), through its March 15, 2007 tax year. The IRS commenced an examination of the

Company's 2005, 2006 and short period 2007 federal income tax returns in February 2008. The IRS issued an examination report in the second quarter of

2009, and the Company received notification from the IRS that the Joint Committee of Taxation had completed its review and had taken no exceptions to the

conclusions reached by the IRS. As such, the Company recorded a discrete tax benefit of $0.9 million for the reduction of its liability of unrecognized tax

benefits. The Company has various state and local jurisdiction tax years open to examination (earliest open period 2004), and the Company also has certain

state and local jurisdictions currently under audit. As of December 31, 2011, the Company believes that it is appropriately reserved for any potential federal

and state income tax exposures.

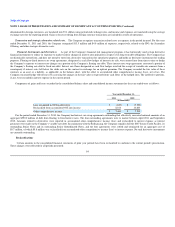

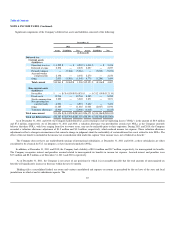

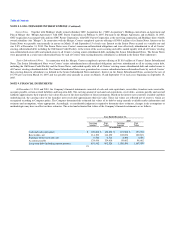

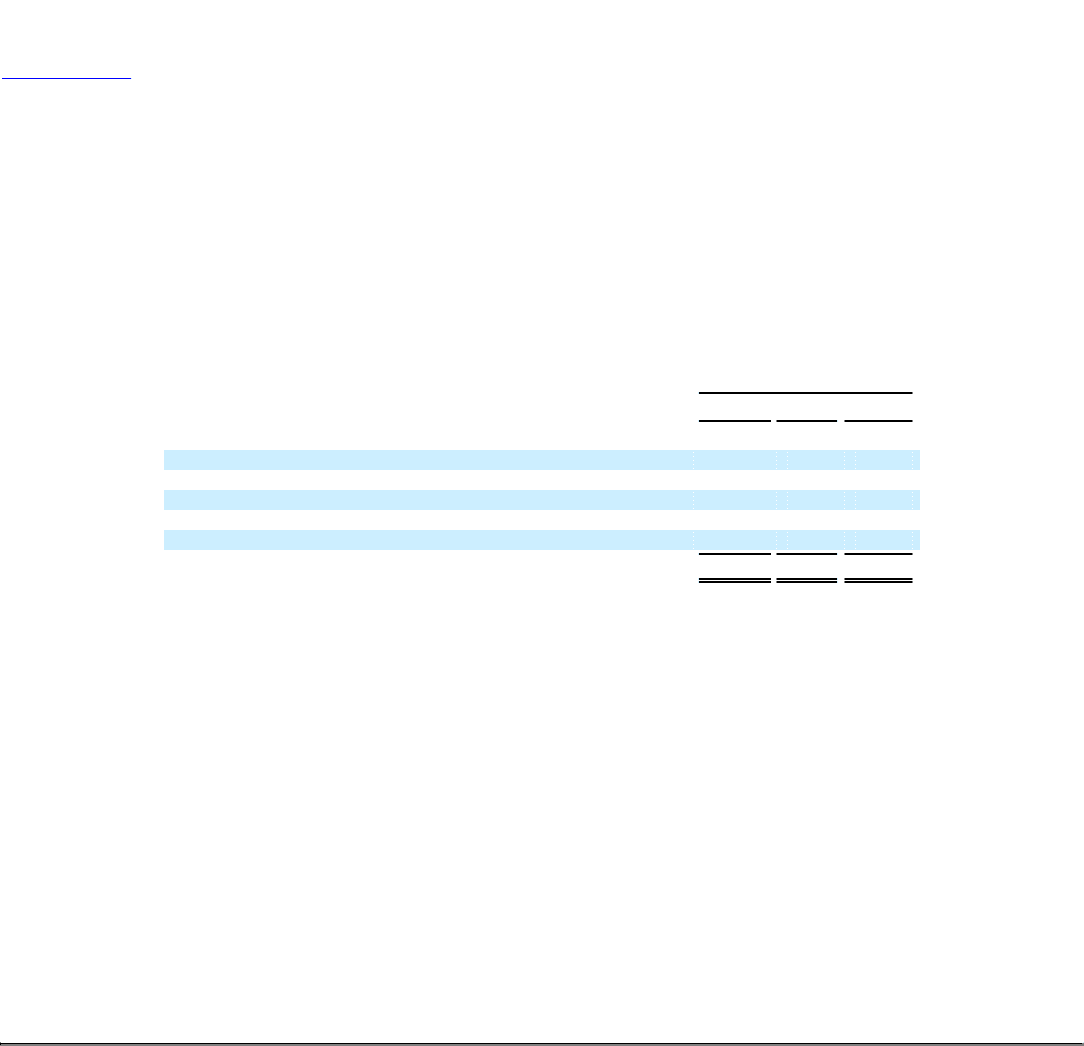

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

December 31,

2011 2010 2009

(in thousands)

Balance of unrecognized tax benefits at beginning of period $ 8,720 $ 6,776 $ 5,542

Additions for tax positions taken during current period 1,104 1,027 1,881

Additions for tax positions taken during prior periods 750 1,880 2,108

Reductions for tax positions taken during prior periods — (39) (2,264)

Settlements — (924) (491)

Balance of unrecognized tax benefits at end of period $ 10,574 $ 8,720 $ 6,776

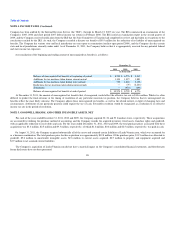

At December 31, 2011, the amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate is $10.6 million. While it is often

difficult to predict the final outcome or the timing of resolution of any particular uncertain tax position, the Company believes that its unrecognized tax

benefits reflect the most likely outcome. The Company adjusts these unrecognized tax benefits, as well as the related interest, in light of changing facts and

circumstances. Settlement of any particular position could require the use of cash. Favorable resolution would be recognized as a reduction to its effective

income tax rate in the period of resolution.

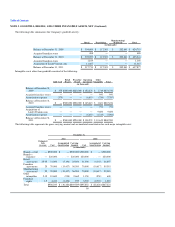

NOTE 5. GOODWILL, BRANDS, AND OTHER INTANGIBLE ASSETS, NET

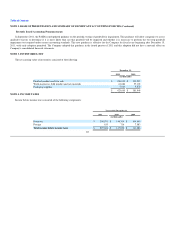

For each of the years ended December 31, 2011, 2010 and 2009, the Company acquired 30, 24 and 53 franchise stores, respectively. These acquisitions

are accounted for utilizing the purchase method of accounting, and the Company records the acquired inventory, fixed assets, franchise rights and goodwill,

with an applicable reduction to receivables and cash. For the years ended December 31, 2011, 2010 and 2009, the total purchase prices associated with these

acquisitions was $3.4 million, $2.5 million and $9.3 million, respectively, of which $1.6 million, $0.6 million and $2.5 million, respectively, was paid in cash.

On August 31, 2011, the Company acquired substantially all of the assets and assumed certain liabilities of LuckyVitamin.com, which was accounted for

as a business combination. The total purchase price for this acquisition was approximately $19.8 million. Of the purchase price, $11.5 million was allocated to

goodwill, $9.6 million to amortizable intangible assets, $2.6 million to current assets acquired, $0.7 million to property and equipment acquired and

$3.9 million to net assumed current liabilities.

The Company's acquisition of LuckyVitamin.com did not have a material impact on the Company's consolidated financial statements, and therefore pro

forma disclosures have not been presented.

88