GNC 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

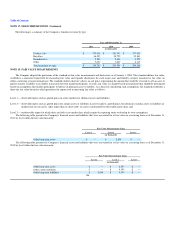

NOTE 15. RETIREMENT PLANS (Continued)

The Company made cash contributions of $1.3 million, $1.3 million and $1.2 million for the years ended December 31, 2011, 2010 and 2009,

respectively. In addition, the Company made a discretionary match for the 2009 plan year of $0.6 million in February 2010, for the 2010 plan year of

$0.9 million in March 2011, and for the 2011 plan year will make a cash contribution of $1.3 million in February 2012.

The Company has a Non-qualified Executive Retirement Arrangement Plan that covers key employees. Under the provisions of this plan, certain eligible

key employees are granted cash compensation, which in the aggregate was not significant for any year presented.

The Company has a Non-qualified Deferred Compensation Plan that provides benefits payable to certain qualified key employees upon their retirement

or their designated beneficiaries upon death. This plan allows participants the opportunity to defer pretax amounts ranging from 2% to 100% of their base

compensation plus bonuses. The plan is funded entirely by elective contributions made by the participants. The Company has elected to finance any potential

plan benefit obligations using corporate owned life insurance policies. All assets relating to the non-qualified deferred compensation plan are held in a rabbi

trust.

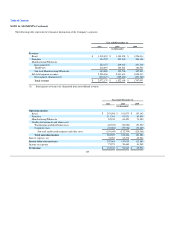

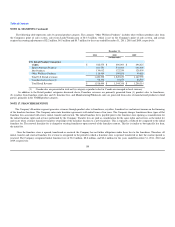

NOTE 16. SEGMENTS

The Company has three reportable segments, each of which represents an identifiable component of the Company for which separate financial

information is available. This information is utilized by management to assess performance and allocate assets accordingly. The Company's management

evaluates segment operating results based on several indicators. The primary key performance indicators are sales and operating income or loss for each

segment. Operating income or loss, as evaluated by management, excludes certain items that are managed at the consolidated level, such as distribution and

warehousing, impairments and other corporate costs. The following table represents key financial information for each of the Company's reportable segments,

identifiable by the distinct operations and management of each: Retail, Franchising, and Manufacturing/Wholesale. The Retail reportable segment includes the

Company's corporate store operations in the United States, Canada, Puerto Rico and its GNC.com and LuckyVitamin.com businesses. The Franchise

reportable segment represents the Company's franchise operations, both domestically and internationally. The Manufacturing/Wholesale reportable segment

represents the Company's manufacturing operations in South Carolina and the Wholesale sales business. This segment supplies the Retail and Franchise

segments, along with various third parties, with finished products for sale. The Warehousing and Distribution and Corporate costs represent the Company's

administrative expenses. The accounting policies of the segments are the same as those described in the "Basis of Presentation and Summary of Significant

Accounting Policies."

102