GNC 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 14. STOCK-BASED COMPENSATION PLANS (Continued)

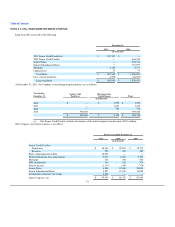

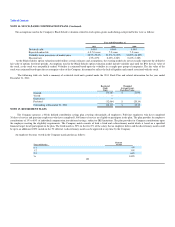

The assumptions used in the Company's Black Scholes valuation related to stock option grants made during each period below were as follows:

Year ended December 31,

2011 2010 2009

Dividend yield 0.00% 0.00% 0.00%

Expected option life 4.5-7.0 years 7.5 years 7.5 years

Volatility factor percentage of market price 38.5%-39.2% 31.5%-33.00% 34.20%-44.60%

Discount rate 1.5%-2.9% 2.49%-3.28% 0.43%-3.28%

As the Black-Scholes option valuation model utilizes certain estimates and assumptions, the existing models do not necessarily represent the definitive

fair value of options for future periods. Assumptions used in the Black-Scholes option valuation model include volatility and, until the IPO, the fair value of

the stock, as the stock was not publicly traded. Volatility is estimated based upon the volatility in a sample peer group of companies. The fair value of the

stock was estimated based upon the net enterprise value of the Company, discounted to reflect the lack of liquidity and control associated with the stock.

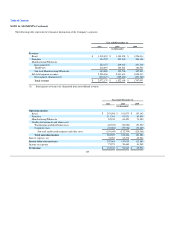

The following table sets forth a summary of restricted stock units granted under the 2011 Stock Plan and related information for the year ended

December 31, 2011:

Restricted

Stock

Units

Weighted

Average Grant-

Date Fair Value

Granted 170,183 $ 21.94

Vested —

Expirations —

Forfeited (32,064) $ (20.14)

Outstanding at December 31, 2011 138,119 $ 22.35

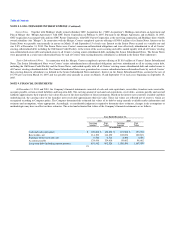

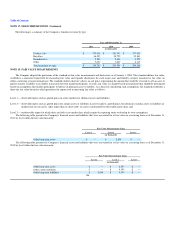

NOTE 15. RETIREMENT PLANS

The Company sponsors a 401(k) defined contribution savings plan covering substantially all employees. Full time employees who have completed

30 days of service and part time employees who have completed 1,000 hours of service are eligible to participate in the plan. The plan provides for employee

contributions of 1% to 80% of individual compensation into deferred savings, subject to IRS limitations. The plan provides for Company contributions upon

the employee meeting the eligibility requirements. The Company match consists of both a fixed and a discretionary match which is based on a specified

financial target for all participants in the plan. The fixed match is 50% on the first 3% of the salary that an employee defers and the discretionary match could

be up to an additional 100% match on the 3% deferral. A discretionary match can be approved at any time by the Company.

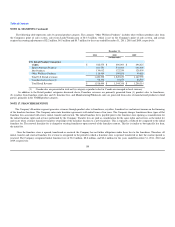

An employee becomes vested in the Company match portion as follows:

Years of Service Percent

Vested

0-1 0%

1-2 33%

2-3 66%

3+ 100%

101