GNC 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Executive Overview

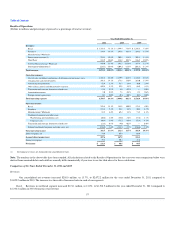

In 2011, we continued to focus on achieving our five principal corporate goals: growing company-owned domestic retail earnings, growing company-

owned domestic retail square footage, growing our international footprint, expanding our e-commerce business and further leveraging of the GNC brand.

These goals are designed to drive both short-term and long-term financial results. The following are some of the results in 2011 from these efforts:

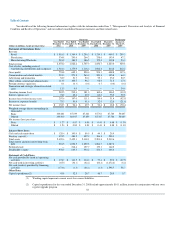

Our company-owned domestic same store sales increased by 10.1%, which includes a 37.3% increase from our GNC.com business.

We increased our company-owned domestic store count by 131 net new stores, or 4.8%.

Our retail segment sales increased by 13.0%, and operating income increased by 33.9%.

Total franchising revenue grew 14.0%, and operating income increased by 18.6%.

Domestic franchising revenue grew 11.5%, and we added 21 net new franchise stores.

International franchise revenue grew by 16.6%, as we added 153 net new franchise stores.

We began making wholesale sales in China through multiple retailers and other distribution channels.

We acquired LuckyVitamin.com in August 2011. LuckyVitamin.com generated $14.5 million of revenue in 2011 following the date of its

acquisition.

We increased our sales in our wholesale/manufacturing segment by 18.8% through our new wholesale distribution channels, including Sam's

Club and PetSmart, and increased third-party sales.

Consistent with our focus on communicating our core "Live Well" theme in both magazine and print, we expanded our marketing campaign to

include a "best in class" theme. The campaign's branding images reflect our core customer—youthful, athletic, aspirational and goal oriented.

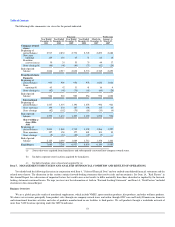

We generated 13.7% of total revenue growth which drove a 33.0% increase in total operating income. However, excluding certain expenses

associated with the IPO, the Secondary Offering, executive severance and other strategic alternative costs, total operating income increased by

37.6% in 2011 compared to 2010.

On March 4, 2011, Centers entered into a $1.2 billion term loan facility with a term of seven years (the "Term Loan Facility") and an $80.0 million

revolving credit facility with a term of five years (the "Revolving Credit Facility" and, together with the Term Loan Facility, the "Senior Credit Facility").

Centers used a portion of the proceeds from the Term Loan Facility to refinance its former indebtedness, including all outstanding indebtedness under its

former senior credit facility, consisting of a $675.0 million term loan facility (the "Old Term Loan Facility") and a $60.0 million senior revolving credit

facility (the "Old Revolving Credit Facility" and, together with the Old Term Loan Facility, the "Old Senior Credit Facility"), the Senior Floating Rate Toggle

Notes due 2014 (the "Senior Notes") and the Senior Subordinated Notes due 2015 (the "Senior Subordinated Notes"), and to pay related fees and expenses

(collectively, the "Refinancing"). As of the date hereof, the Revolving Credit Facility remains undrawn. After giving effect to the Refinancing and based on

the current LIBOR, we expect to incur approximately $42 million of interest expense per year.

On April 6, 2011, we completed the IPO. We used the net proceeds from the IPO, together with cash on hand (including additional funds from the

Refinancing), to redeem all of our outstanding Series A preferred stock, repay $300.0 million of outstanding borrowings under the Term Loan Facility and

pay Sponsor-related obligations of approximately $11.1 million. During the fourth quarter of 2011, we

54

•

•

•

•

•

•

•

•

•

•

•