GNC 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

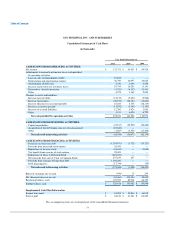

NOTE 4. INCOME TAXES (Continued)

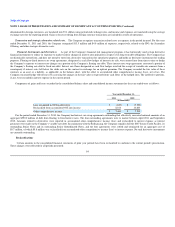

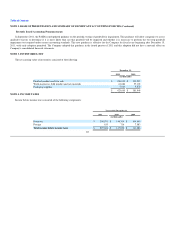

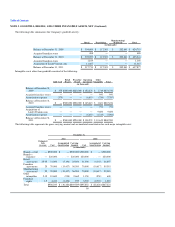

Income tax expense (benefit) for all periods consisted of the following components:

Year ended December 31,

2011 2010 2009

(in thousands)

Current:

Federal $ 63,130 $ 47,483 $ 10,320

State 13,371 10,422 6,700

Foreign 4,091 690 3,111

80,592 58,595 20,131

Deferred:

Federal (3,310) (3,747) 20,548

State (1,351) (4,385) 883

Foreign (660) — —

(5,321) (8,132) 21,431

Income tax expense $ 75,271 $ 50,463 $ 41,562

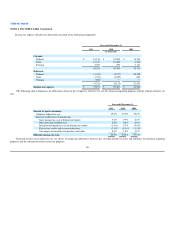

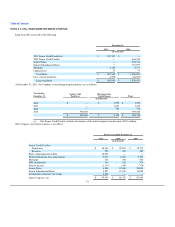

The following table summarizes the differences between the Company's effective tax rate for financial reporting purposes and the federal statutory tax

rate:

Year ended December 31,

2011 2010 2009

Percent of pretax earnings:

Statutory federal tax rate 35.0% 35.0% 35.0%

Increase (reduction) resulting from:

State income tax, net of federal tax benefit 3.0% 0.9% 2.6%

Other permanent differences 2.0% 0.8% 0.9%

International operations, net of foreign tax credits (1.6)% 0.1% (0.6)%

Federal tax credits and income deductions (2.4)% (4.1)% (1.4)%

Tax impact of uncertain tax positions and other 0.3% 1.6% 0.9%

Effective income tax rate 36.3% 34.3% 37.4%

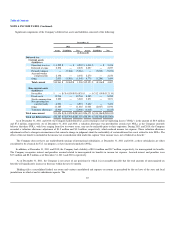

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amount of assets and liabilities for financial reporting

purposes and the amounts used for income tax purposes.

86