GNC 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

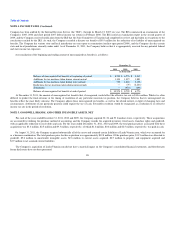

NOTE 2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Distribution and Shipping Costs. The Company bills franchisees and third-party customers shipping and transportation costs and reflects these charges

in revenue. The unreimbursed costs that are associated with these costs are included in cost of sales.

Research and Development. Research and development costs arising from internally generated projects are expensed by the Company as incurred. The

Company recognized $0.6 million, $0.5 million and $0.4 million for the years ended December 31, 2011, 2010 and 2009, respectively. These costs are

included in Other Selling, General, and Administrative costs in the accompanying audited consolidated financial statements.

Advertising Expenditures. The Company recognizes advertising, promotion and marketing program costs the first time the advertising takes place with

exception to the costs of producing advertising, which are expensed as incurred during production. The Company administers national advertising funds on

behalf of its franchisees. In accordance with the franchisee contracts, the Company collects advertising fees from the franchisees and utilizes the proceeds to

coordinate various advertising and marketing campaigns. The Company recognized $52.9 million, $51.7 million and $50.0 million for the years ended

December 31, 2011, 2010 and 2009, respectively, net of approximately $12.2 million in 2011 and $11.0 million in each of 2010 and 2009 from the national

advertising fund.

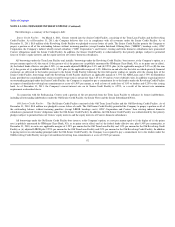

Leases. The Company has various operating leases for company-owned and franchise store locations, distribution centers, and equipment. Leases

generally include amounts relating to base rental, percent rent and other charges such as common area maintenance fees and real estate taxes. Periodically, the

Company receives varying amounts of reimbursements from landlords to compensate the Company for costs incurred in the construction of stores. These

reimbursements are amortized by the Company as an offset to rent expense over the life of the related lease. The Company determines the period used for the

straight-line rent expense for leases with option periods and conforms it to the term used for amortizing improvements.

The Company leases an approximately 300,000 square-foot-facility in Greenville, South Carolina where the majority of its proprietary products are

manufactured. The Company also leases a 630,000 square foot complex located in Anderson, South Carolina, for packaging, materials receipt, lab testing,

warehousing, and distribution. Both the Greenville and Anderson facilities are leased on a long-term basis pursuant to "fee-in-lieu-of-taxes" arrangements

with the counties in which the facilities are located, but the Company retains the right to purchase each of the facilities at any time during the lease for $1.00,

subject to a loss of tax benefits. As part of a tax incentive arrangement, the Company assigned the facilities to the counties and leases them back under

operating leases. The Company leases the facilities from the counties where located, in lieu of paying local property taxes. Upon exercising its right to

purchase the facilities back from the counties, the Company will be subject to the applicable taxes levied by the counties. In accordance with the standards on

the accounting for leases, the purchase option in the lease agreements prevent sale-leaseback accounting treatment. As a result, the original cost basis of the

facilities remains on the balance sheet and continues to be depreciated.

Contingencies. In accordance with the standards on contingencies the Company accrues a loss contingency if it is probable and can be reasonably

estimated or a liability had been incurred at the date of the financial statements if those financial statements have not been issued. If both of the conditions

above are not met, disclosure of the contingency shall be made when there is at least a reasonable possibility that a loss or an additional loss may have been

incurred.

82