GNC 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

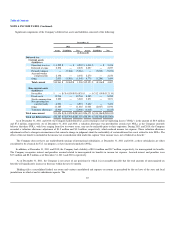

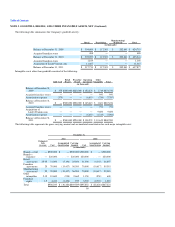

NOTE 5. GOODWILL, BRANDS, AND OTHER INTANGIBLE ASSETS, NET (Continued)

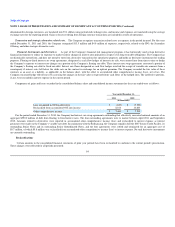

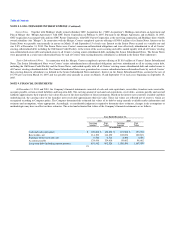

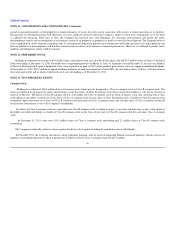

The following table represents future estimated amortization expense of intangible assets with finite lives:

Year ending December 31,

Estimated

amortization

expense

(in thousands)

2012 $ 10,493

2013 10,525

2014 10,395

2015 10,473

2016 10,301

Thereafter 97,402

Total $ 149,589

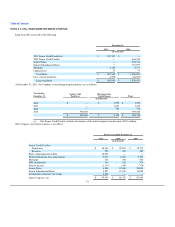

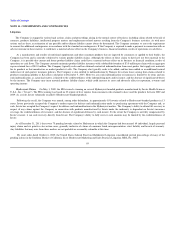

NOTE 6. PROPERTY, PLANT AND EQUIPMENT, NET

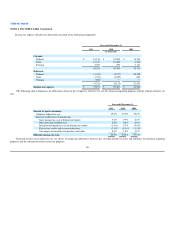

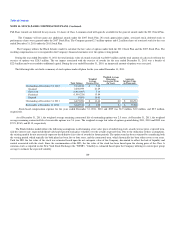

Property, plant and equipment consisted of the following:

December 31,

2011 2010

(in thousands)

Land, buildings and improvements $ 63,615 $ 63,400

Machinery and equipment 97,907 89,977

Leasehold improvements 92,649 82,594

Furniture and fixtures 68,481 55,247

Software 25,093 20,393

Construction in progress 3,252 549

Total property, plant and equipment $ 350,997 $ 312,160

Less: accumulated depreciation (152,826) (118,732)

Net property, plant and equipment $ 198,171 $ 193,428

The Company recognized depreciation expense of property, plant and equipment of $38.8 million, $39.2 million and $36.9 million for the years ended

December 31, 2011, 2010 and 2009, respectively.

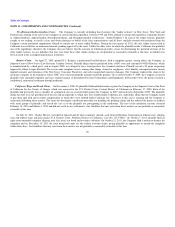

NOTE 7. DEFERRED REVENUE AND OTHER CURRENT LIABILITIES

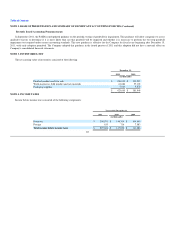

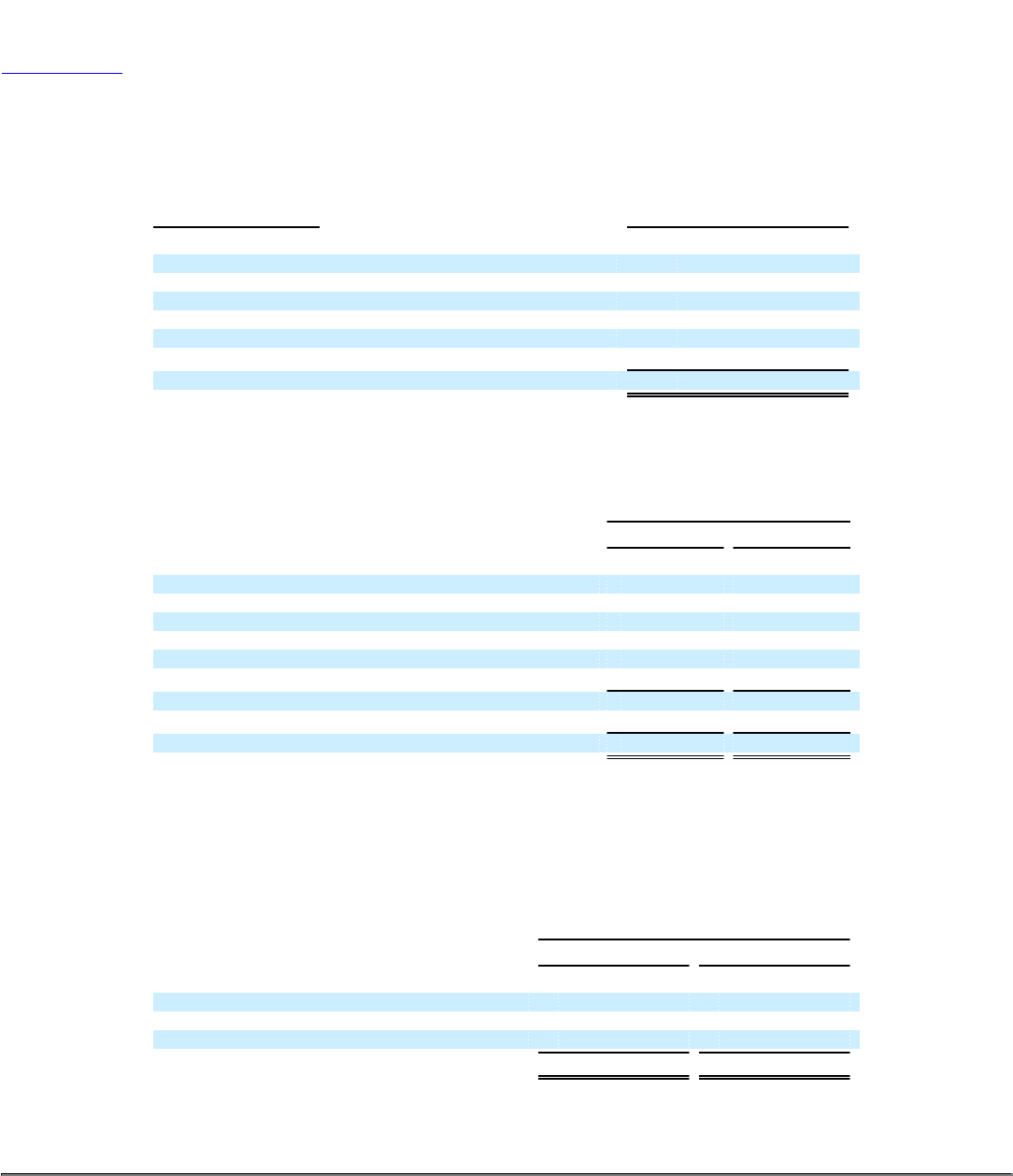

Other current liabilities consisted of the following:

December 31,

2011 2010

(in thousands)

Deferred revenue $ 37,790 $ 35,467

Accrued payroll 28,063 25,656

Other current liabilities 38,672 46,970

Total $ 104,525 $ 108,093

Deferred revenue consists primarily of Gold Card membership fees and gift card deferrals. Other current liabilities consist of the liabilities related to

accrued taxes, benefits, workers compensation, accrued interest and other occupancy.

90