GNC 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

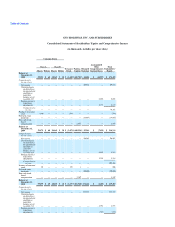

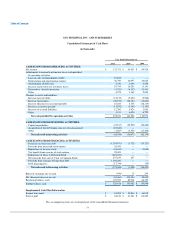

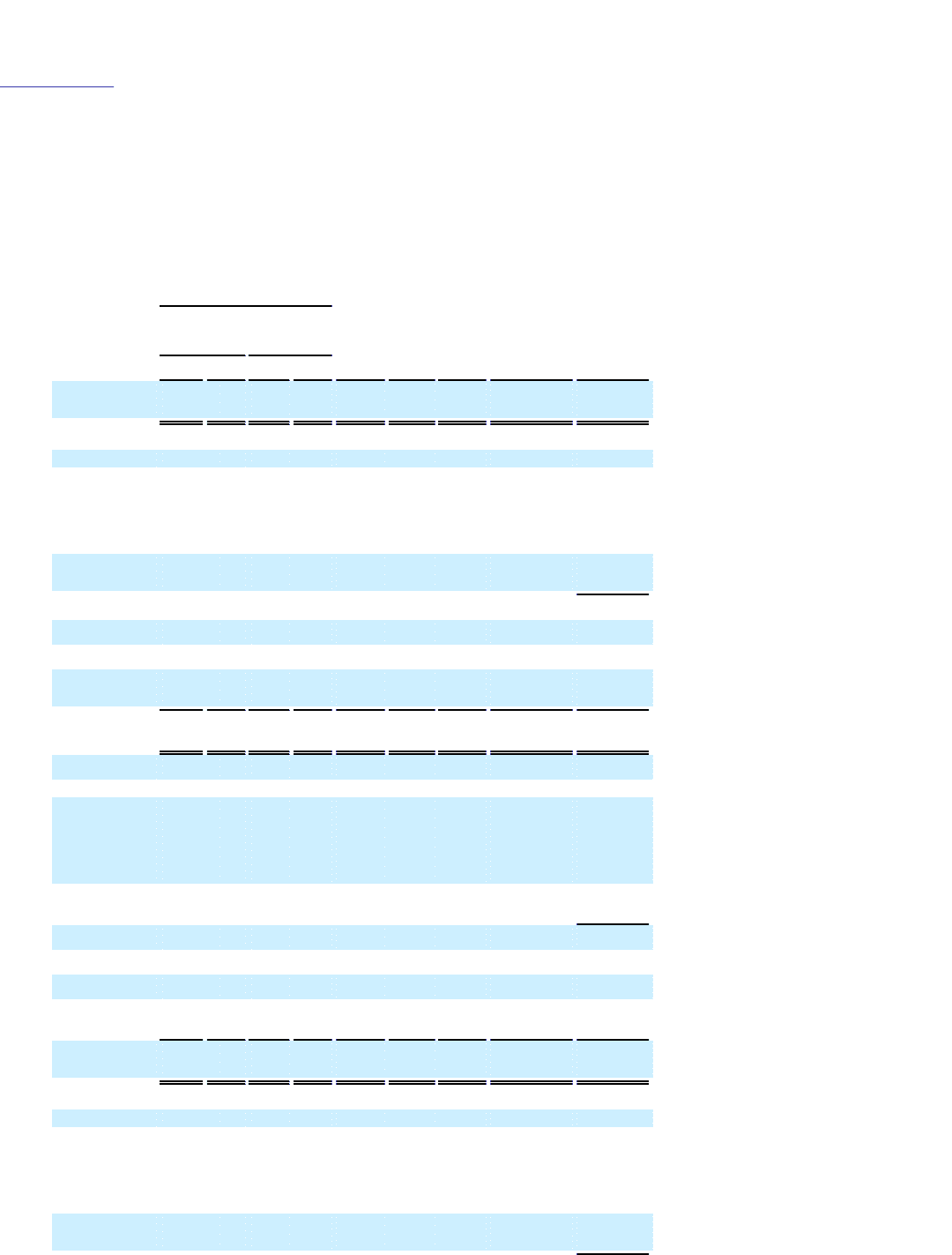

GNC HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Stockholders' Equity and Comprehensive Income

(in thousands, includes per share data)

Common Stock

Class A Class B

Accumulated

Other

Comprehensive

Income/(Loss)

Treasury

Stock Paid-in-

Capital Retained

Earnings

Total

Stockholders'

Equity

Shares Dollars Shares Dollars

Balance at

December 31,

2008 59,510 $ 60 28,169 $ 28 $ (1,680)$445,701 $ 44,406 $ (14,057) $ 474,458

Comprehensive

income (loss):

Net income — — — — — — 69,524 — 69,524

Unrealized gain

on derivatives

designated and

qualified as

cash flow

hedges, net of

tax of $1,537 — — — — — — — 2,686 2,686

Foreign currency

translation

adjustments — — — — — — — 4,172 4,172

Comprehensive

income — — — — — — — 76,382

Purchase of treasury

stock (340) — — — (794) — — — (794)

Preferred stock

dividends — — — — — — (18,667) — (18,667)

Non-cash stock-

based

compensation — — — — — 2,855 — — 2,855

Balance at

December 31,

2009 59,170 $ 60 28,169 $ 28 $ (2,474)$448,556 $ 95,263 $ (7,199) $ 534,234

Comprehensive

income (loss):

Net income — — — — — — 96,567 — 96,567

Unrealized gain

on derivatives

designated and

qualified as

cash flow

hedges, net of

tax of $2,625 — — — — — — — 4,585 4,585

Foreign currency

translation

adjustments — — — — — — — 1,334 1,334

Comprehensive

income — — — — — — — 102,486

Issuance of common

stock 29 — — — 197 3 — — 200

Preferred stock

dividends — — — — — — (20,606) — (20,606)

Non-cash stock-

based

compensation — — — — — 3,169 — — 3,169

Balance at

December 31,

2010 59,199 $ 60 28,169 $ 28 $ (2,277)$451,728 $171,224 $ (1,280) $ 619,483

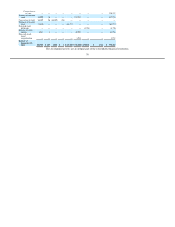

Comprehensive

income (loss):

Net income — — — — — — 132,333 — 132,333

Unrealized gain

on derivatives

designated and

qualified as

cash flow

hedges, net of

tax of $2,718 — — — — — — — 4,751 4,751

Foreign currency

translation

adjustments — — — — — — — (747) (747)