GNC 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

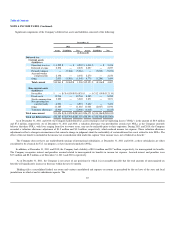

NOTE 2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

buildings, that have useful lives ranging from fifteen to thirty-six years. Depreciation and amortization are recognized using the straight-line method over the

estimated useful life of the property. Fixtures are depreciated over three to fifteen years, and equipment is generally depreciated over ten years. Computer

equipment and software costs are generally depreciated over three to five years. Amortization of improvements to retail leased premises is recognized using

the straight-line method over the estimated useful life of the improvements, or over the life of the related leases including renewals that are reasonably

assured, whichever period is shorter. Buildings are depreciated over thirty-six years and building improvements are depreciated over the remaining useful life

of the building.

Expenditures that materially increase the value or clearly extend the useful life of property, plant and equipment are capitalized in accordance with the

policies outlined above. Repair and maintenance costs incurred in the normal operations of business are expensed as incurred. Gains/losses from the sale of

property, plant and equipment are recognized in current operations.

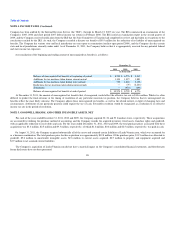

Goodwill and Intangible Assets. Goodwill represents the excess of purchase price over the fair value of identifiable net assets of businesses, including

franchisees, acquired by the Company. Goodwill and intangible assets with indefinite useful lives are not amortized, but instead are tested for impairment at

least annually. The Company completes its annual impairment test in the fourth quarter. For intangible assets with indefinite lives, the Company performs the

impairment test by estimating the fair value of the intangible asset and if the fair value is less than the asset carrying value, an impairment provision is

recorded. In performing the annual impairment test for goodwill, the Company performs a qualitative assessment to determine whether it is "more likely than

not" that the fair value of the reporting unit is less than its carrying value. If it is concluded that it is "more likely than not" that the fair value of a reporting

unit is less than its carrying value, the Company is required to perform a two-step goodwill impairment test. See Note 5, "Goodwill, Brands, and Other

Intangible Assets, Net."

Long-lived Assets. The Company reviews the carrying value of property and equipment and amortizable intangible assets for impairment whenever

events or changes in circumstances indicate that the carrying amounts may not be recoverable. Factors the Company considers important that may trigger an

impairment review include significant changes in the manner of its use of assets, significant negative industry or economic trends, underperforming stores and

store closings. These reviews may include an analysis of the current operations and capacity utilization, in conjunction with an analysis of the markets in

which the businesses are operating. When an impairment review is considered necessary, a comparison is performed of the undiscounted projected cash flows

from the use and eventual disposition of the asset group to the net book value of the related asset group. If it is determined that the carrying value of the asset

group may not be recoverable, a charge to adjust the carrying value of the long-lived assets to estimated fair value may be required.

Other Long-Term Assets. Other long-term assets consist primarily of deferred financing fees. In conjunction with the 2007 Senior Credit Facility,

$29.3 million in costs related to the financing of debt were capitalized and were amortized over the life of the debt. During 2011, in conjunction with the

Refinancing, the Company wrote-off deferred financing costs of $13.4 million related to the 2007 Senior Credit Facility and capitalized $17.3 million in

deferred financing costs, which are being amortized over the life of the debt. Also in 2011, the Company expensed $4.0 million related to the early

extinguishment of debt. Accumulated amortization as of December 31, 2011 and 2010 was $5.7 million and $15.2 million, respectively.

80