GNC 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 4. INCOME TAXES (Continued)

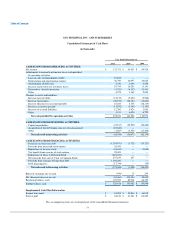

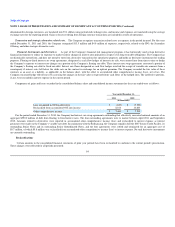

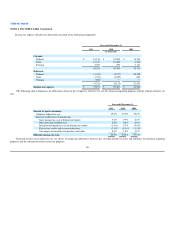

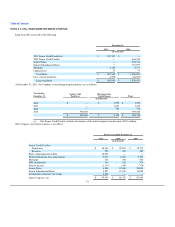

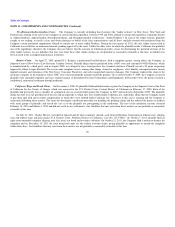

Significant components of the Company's deferred tax assets and liabilities consisted of the following:

December 31,

2011 2010

Assets Liabilities Net Assets Liabilities Net

(in thousands)

Deferred tax:

Current assets

(liabilities):

Operating reserves $ 4,292 $ — $ 4,292 $ 3,018 $ — $ 3,018

Deferred revenue 2,278 — 2,278 2,257 — 2,257

Prepaid expenses — (5,384) (5,384) — (7,032) (7,032)

Accrued worker

compensation 2,358 — 2,358 2,270 — 2,270

Other 2,033 (3,581) (1,548) 4,778 (1,284) 3,494

Total current $10,961 $ (8,965)$ 1,996 $12,323 $ (8,316)$ 4,007

Non-current assets

(liabilities):

Intangibles $ — $(314,829)$(314,829)$ — $(312,119)$(312,119)

Fixed assets 12,744 — 12,744 8,285 — 8,285

Stock compensation 3,222 — 3,222 3,871 — 3,871

Net operating loss

carryforwards 6,921 — 6,921 7,432 — 7,432

Other 11,485 — 11,485 11,001 (2,067) 8,934

Valuation allowance (2,946) — (2,946) (4,418) — (4,418)

Total non-current $31,426 $(314,829)$(283,403)$26,171 $(314,186)$(288,015)

Total net deferred taxes $42,387 $(323,794)$(281,407)$38,494 $(322,502)$(284,008)

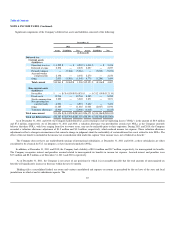

As of December 31, 2011 and 2010, the Company had deferred tax assets relating to state net operating losses ("NOLs") in the amount of $6.9 million

and $7.4 million, respectively. As of December 31, 2011 and 2010, a valuation allowance was provided for certain state NOLs, as the Company currently

believes that these NOLs, with lives ranging from five to twenty years, may not be realizable prior to their expiration. During 2011 and 2010, the Company

recorded a valuation allowance adjustment of $1.5 million and $3.1 million, respectively, which reduced income tax expense. These valuation allowance

adjustments reflect a change in circumstances that caused a change in judgment about the realizability of certain deferred tax assets related to state NOLs. The

effect of this tax benefit is included in the income tax reconciliation table under the caption "State income taxes, net of federal tax benefit."

The Company does not have any undistributed earnings of international subsidiaries, at December 31, 2011 and 2010, as these subsidiaries are either

considered to be a branch for U.S. tax purposes, or have incurred cumulative NOLs.

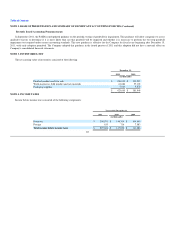

In addition, at December 31, 2011 and 2010, the Company had a liability of $10.6 million and $8.7 million, respectively, for unrecognized tax benefits.

The Company recognizes interest and penalties accrued related to unrecognized tax benefits in income tax expense. Accrued interest and penalties were

$3.5 million and $2.9 million as of December 31, 2011 and 2010, respectively.

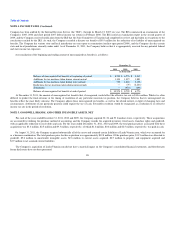

As of December 31, 2011, the Company is not aware of any positions for which it is reasonably possible that the total amounts of unrecognized tax

benefits will significantly increase or decrease within the next 12 months.

Holdings files a consolidated federal tax return and various consolidated and separate tax returns as prescribed by the tax laws of the state and local

jurisdictions in which it and its subsidiaries operate. The

87