GNC 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

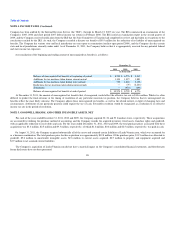

NOTE 11. COMMITMENTS AND CONTINGENCIES (Continued)

owned or operated properties, or for properties to which substances or wastes that were sent in connection with current or former operations at its facilities.

The presence of contamination from such substances or wastes could also adversely affect the Company's ability to sell or lease its properties, or to use them

as collateral for financing. From time to time, the Company has incurred costs and obligations for correcting environmental and health and safety

noncompliance matters and for remediation at or relating to certain of its properties or properties at which its waste has been disposed. The Company believes

it has complied with, and is currently complying with, its environmental obligations pursuant to environmental and health and safety laws and regulations and

that any liabilities for noncompliance will not have a material adverse effect on its business or financial performance. However, it is difficult to predict future

liabilities and obligations, which could be material.

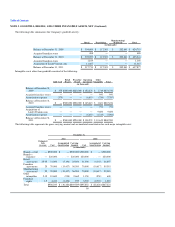

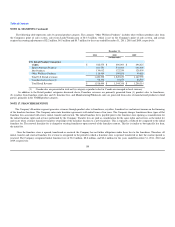

NOTE 12. PREFERRED STOCK

Holdings is authorized to issue up to 60.0 million shares of preferred stock, par value $0.001 per share, and had 29.9 million shares of Series A Preferred

Stock outstanding at December 31, 2010. Dividends were compounded quarterly on March 31, June 30, September 30 and December 31 of each year. Holders

of Series A Preferred Stock, upon a liquidation event, were required to be paid at 100% of the purchase price thereof, plus any unpaid accumulated dividends.

At December 31, 2010, $68.3 million in unpaid dividends had been accrued. In conjunction with the IPO, all outstanding shares of Series A Preferred Stock

were redeemed in full, and no shares of preferred stock were outstanding as of December 31, 2011.

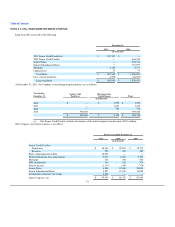

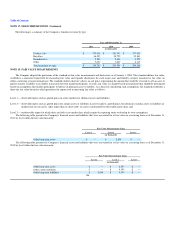

NOTE 13. STOCKHOLDERS' EQUITY

Common Stock

Holdings has authorized 300.0 million shares of common stock, which may be designated as Class A common stock or Class B common stock. The

shares are identical in all respects to rights and privileges except that shares of Class B common stock do not entitle their holders to vote for the election or

removal of directors. The shares of Class B common stock are convertible into Class A common stock, in whole or in part, at any time and from time to time

at the option of the holder, on the basis of one share of Class A common stock for each share of Class B common stock. A holder of Class B common stock

would have, upon conversion of its shares of Class B common stock into shares of Class A common stock, one vote per share of Class A common stock held

on all matters submitted to a vote of the Company's stockholders.

The shares of Class A common stock are convertible into Class B common stock, in whole or in part, at any time and from time to time at the option of

the holder, provided such holder is a holder of Class B common stock, on the basis of one share of Class B common stock for each share Class A common

stock.

At December 31, 2011, there were 103.1 million shares of Class A common stock outstanding and 2.1 million shares of Class B common stock

outstanding.

The Company periodically evaluates various options for the use of its capital, including the potential issuance of dividends.

In December 2011, the Company announced a share repurchase program, with the intent of mitigating dilution associated primarily with the exercise of

employee stock options pursuant to which it purchased 2.4 million shares of Class A common stock for $67.5 million.

98